Howard Marks, a renowned investor and one of Warren Buffett’s most trusted advisors, recently published an article in the Financial Times. Marks stresses the importance of market outlook and fundamental analysis for investment decisions, warning that overlooking other investors’ perspectives despite understanding a company may lead to losses. Marks suggests that the best opportunities arise from a disparity between a company’s expected performance and actual potential, signaling a time to seize such dislocations. In today’s FA Alpha Daily, we’ll explore Howard Marks’ understanding of market outlook and how it can identify dislocations for increased success.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Marks suggested the following framework to identify these types of situations.

First, you need to learn to recognize market patterns. Marks has worked in investments for over 50 years, and the more market history he learned, the easier it was for him to recognize similarities in the market today.

One pattern that repeats time and time again is that markets will often correct due to excessive investor sentiment in both directions. That means the market will sometimes become too bearish or too bullish.

According to Marks, the real money is made via contrarianism. Resist emotion in investing, do not follow the herd. When the market is bearish, it’s time to be bullish and vice versa.

Therefore, to be successful in these situations, you need to understand what the rest of the market is thinking and why. If you spot the rest of the market acting truly irrationally, you can capitalize.

All of these factors combine into one central idea: identify irrational behavior in the markets by distinguishing market movement from a psychological viewpoint. Try to make sense of the changes.

Subscribers to our monthly newsletters have access to our Timetable Investor’s monthly macroeconomy update. We summarize the macro signals we are seeing right now for the market, and show how you need to be positioned for the next three to 24 months.

We focus on credit signals first and foremost. Those have us worried right now. Credit is constricted, and that could lead to a credit crunch at some point.

The second signal we look at is corporate investments. This is so we understand how much companies are putting capital to work that can drive earnings going forward. Right now, earnings are forecast to shrink this year, and that’s not great.

There is one last component that needs to be considered. As Marks highlights, it’s important to understand if investors are too bullish or bearish given the market context.

All other macro signal metrics are turning negative. With this outlook, it would logically make sense that investors would have a bearish view of the market.

Yet, that does not seem to be the case. Investors are excessively bullish right now.

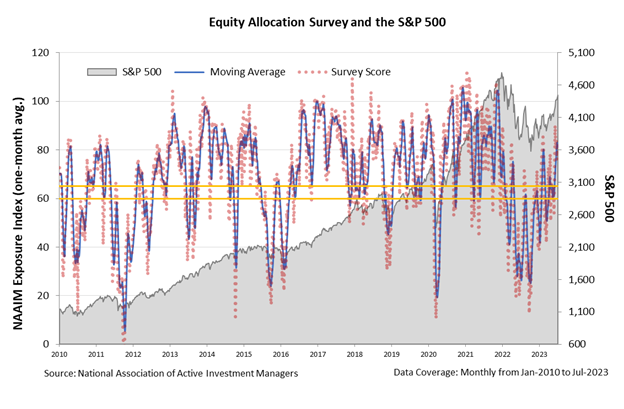

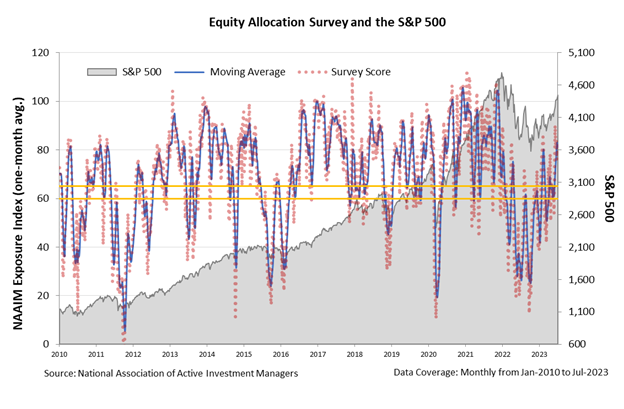

We can use the National Association of Active Investment Managers (“NAAIM”) Exposure Index to visualize this sentiment.

The index gets its data from a weekly survey that tracks how much members are investing in equities. Results tend to fall between 0% and 100%. But they can be lower or higher than that if investors are shorting stocks or using leverage.

The long-term average allocation is between 60% and 65%. That means in an average market, active investors have 60% to 65% of their assets in stocks.

When allocations rise, investors are bullish. They’re pouring a lot of money into the stock market.

Investors are getting bullish, and fast. Total equity exposure reached 83% earlier this month. That’s way above the long-term average.

This is a clear sign investors are getting bullish, even though other macro factors like credit and earnings are getting worse.

Marks may call this trend irrational. Investors seem overly optimistic in a time when other fundamental markers, namely the credit market and corporate earnings, suggest reason to be more pessimistic.

Marks would very likely say the same thing about today’s market. There seems to be a clear dislocation between where the fundamentals are heading and where sentiment is heading. When we see these two factors getting farther apart, it gives us a reason for pause.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.