Investors are increasingly focused on the potential of artificial intelligence (AI) to drive economic growth. However, some analysts are concerned that the underlying earnings of the economy could decline as AI-powered technologies displace workers. Despite these concerns, the stock market has continued to rally, suggesting that investors may be ignoring the potential risks of AI to earnings growth. In today’s FA Alpha Daily, we’ll take a look at the economy’s earnings outlook through Uniform Accounting and see if analysts’ concerns about the decline in earnings growth are reasonable.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Investors have tunnel vision right now.

As we talked about last Thursday, many investors are hyped up to chase the AI boom.

However, savvy analysts are beginning to see reality amid this wave of AI hype.

Wall Street strategists have raised concerns as they look at what’s going on in the economy.

Even though the S&P 500 is up 27% since its October 2022 low, high interest rates are leading to less borrowing and a cooling off of global growth.

While this comeback was widely welcomed, these experts caution against following the trend.

Despite the booming market, one harsh truth emerges: this year, earnings look like they could decline a lot.

Morgan Stanley (MS) forecasts earnings per share (“EPS”) for the S&P 500 to decline 16% from 2022 levels to $185. The banking crisis and tougher borrowing conditions are making an economic slowdown likely.

Yet, against conventional wisdom, the market seems to be defying expectations, continuing to rally despite the threat of shrinking earnings.

As we’ll discuss today, investors should be paying more attention to corporate earnings. At the end of the day, earnings drive the market, and there may be reason to be concerned.

Corporate earnings include a lot of noise.

When it comes to corporate earnings, companies have a lot of tools to “game” their performance.

For instance, when executive teams know earnings are going to be bad for a few quarters, they’ll sometimes do everything in their power to make those quarters look as bad as possible.

This is called a “big bath,” and it can make earnings expectations look worse than they really are.

This can lead to skepticism toward Wall Street’s numbers. However, in this instance, the cleaned-up data supports the concerns raised by analysts.

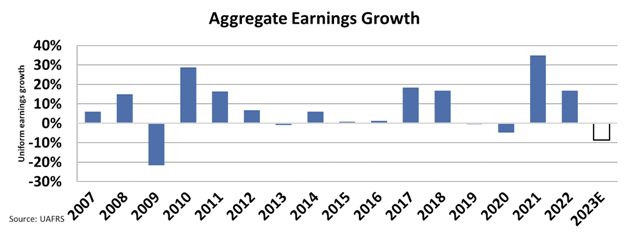

A closer examination reveals that the last time Uniform Earnings—where we multiply Uniform ROA by Uniform assets to calculate the company’s returns, and is also called “earnings” or “cash flows”—experienced a material year-over-year decline was in 2009 during the financial crisis.

Real earnings fell 22% in 2009. Since then, earnings have grown pretty consistently – just a few blips in 2013 and 2019, and 5% earnings shrinkage in 2020.

However, 2023 looks like it’ll be the worst year for earning since the Great Recession.

Take a look.

This year’s forecasts project a similar decline, with Uniform Earnings expected to drop by 8%.

The reality is, the Fed’s interest rate hikes are working. They’re slowing down corporate growth.

Investors need to be cautious.

For example, the technology sector, which is a key driver of AI growth, is also showing signs of weakness.

Remember that the same stocks leading this year’s rally were the companies that sent the market lower last year.

This AI-driven rally seems shortsighted, it’s not being driven by improving earnings.

That’s why we continue to be cautious about the rest of the year. The market tends to follow earnings. And when it doesn’t, it means we’re due for a rude awakening at some point soon.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.