At the outset of the supply-chain supercycle trend, there is a global opportunity for companies that operate in the infrastructure and supply chain space. Siemens (XTRA:SIE), a company that provides solutions for power generation and transmission, and offers automation, drives, and software technologies, is one of these companies. In today’s FA Alpha, we will be examining Siemen’s financials through the lens of Uniform Metrics and determine what the company’s true potential is.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

We have spent a lot of time talking about the supply chain supercycle and how the U.S. ignored investments into its infrastructure and supply chains for a long time.

As COVID-19 made people realize the issues with our infrastructure, the government and companies pumped up their investments into these areas, mirroring the late 1940s. There are a lot of companies benefiting from this trend.

The exact same scenario happened in Europe as they sought to rebuild in the late 1940s and 1950s. That is also starting to happen now, and no one is paying attention to it.

With the energy crisis and geopolitical conflicts, Europe is determined to decrease its reliance on China and Russia. This requires improving their own systems and lots of investments.

As these investments happen, the same kind of companies that will benefit in the U.S. could benefit in Europe. One of these companies is Siemens (XTRA:SIE).

Contrary to popular opinion, Siemens is not only producing consumer goods and home appliances. That is actually only a small part of its business.

The company provides solutions for power generation and transmission, and offers automation, drives, and software technologies. The energy and smart infrastructure segments generate nearly 70% of total revenue.

Therefore, the services it provides are essential for the supply-chain supercycle and will become more important as investments increase.

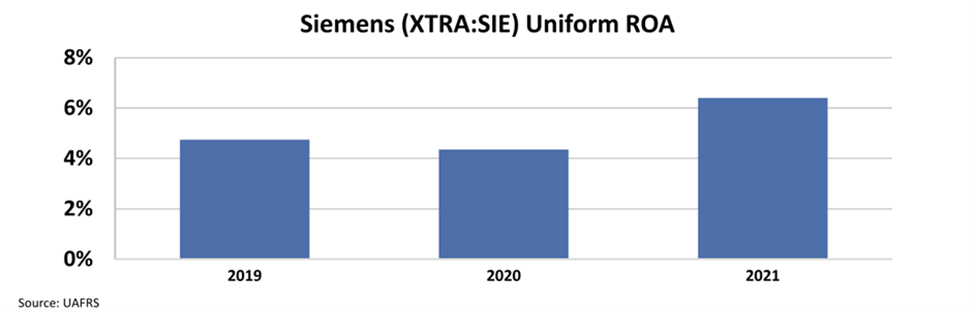

Siemens already saw profitability grow last year, being affected by easing pandemic conditions and increasing investments. The Uniform return on assets (“ROA”) increased from below 5% in 2019 to above 6% in 2021.

As the supply-chain supercycle plays out and the companies increase their investments in infrastructure, there is a huge possibility that Siemens will improve its profitability further.

However, the market does not seem to realize this potential.

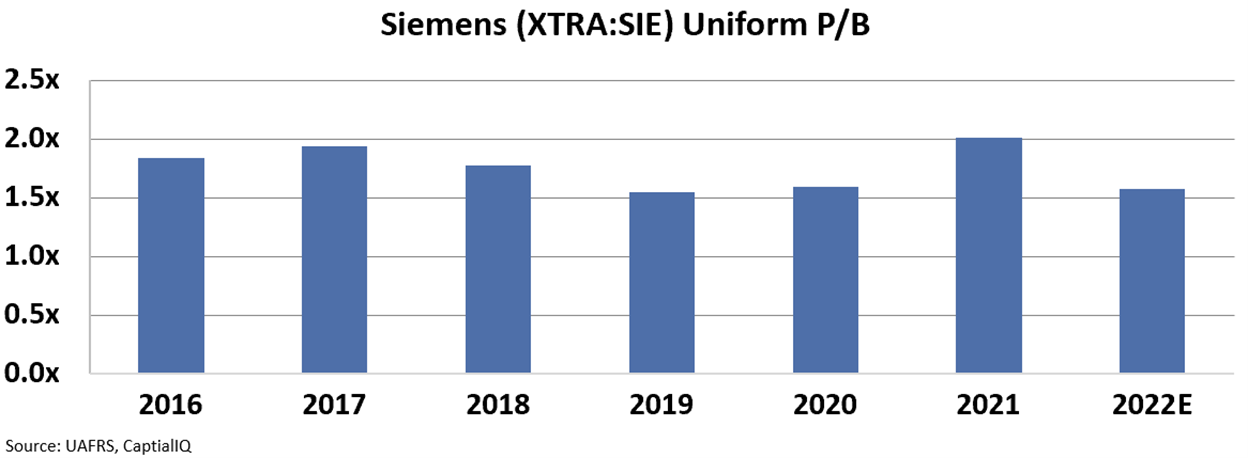

The Uniform price-to-book ratio (“P/B”) of the firm has been moving between 1.6x and 2x in the last decade. With profitability increasing in 2021, it also surged to 2x from 1.6x in 2020. The current P/B is trading at historically low levels at 1.5x for the company.

This means that the market fails to recognize how the demand for Siemens’ products will increase in the near future, as Europe renews itself to become less reliant.

Uniform Accounting shows this inefficiency in the market and helps investors realize a big upside potential.

SUMMARY and Siemens Aktiengesellschaft Corporation Tearsheet

As the Uniform Accounting tearsheet for Siemens Aktiengesellschaft (XTRA:SIE) highlights, the Uniform P/E trades at 20.9x, which is above the corporate average of 17.8x, but below its historical P/E of 26.3x.

High P/E require high EPS growth to sustain them. In the case of Siemens, the company has recently shown a 38% increase in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Siemens’ Wall Street analyst-driven forecast is a 3% and 60% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Siemens’ €96.80 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 5% annually over the next three years. What Wall Street analysts expect for Siemens’ earnings growth is below what the current stock market valuation requires in 2022 but above its requirement in 2023.

Furthermore, the company’s earning power in 2021 is 1x the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 60bps above the risk-free rate.

All in all, this signals average dividend risk.

Lastly, Siemens’ Uniform earnings growth is in line with its peer averages and above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.