The “Supply-Chain Supercycle” is coming, reflecting the new patterns in how companies address supply chain issues. Companies in the United States have started to invest in infrastructure to improve efficiency, and among them is Micron Technology (MU), as it just announced a $100 billion investment in a new chip facility. In today’s FA Alpha, we’ll look at how the market doesn’t fully comprehend MU’s operation, which might lead to mispricing.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Last week, we talked about how Intel (INTC) could be a beneficiary of the closing off of tech trade between the U.S. and China.

However, they are not the only company looking to invest in U.S. infrastructure.

As we have mentioned regularly, the “Supply-Chain Supercycle” is coming.

It means new trends are emerging in how firms deal with their supply chain issues, and they try to rebuild and strengthen supply chains in the U.S.

Some of these companies are bringing their production facilities home, while others find different ways to reduce lead times to pre-pandemic levels.

One of these companies is Micron Technology (MU). It manufactures and sells memory and storage products worldwide.

The company recently announced that it is going to invest up to $100 billion in building a new chip factory in upstate New York, just north of Syracuse.

While Intel is a diversified chip maker, Micron Technology focuses on doing one thing and doing it really well: memory and storage chips like NAND and DRAM.

Over the past ten years, the company has recognized robust profitability because of the high demand for its offerings.

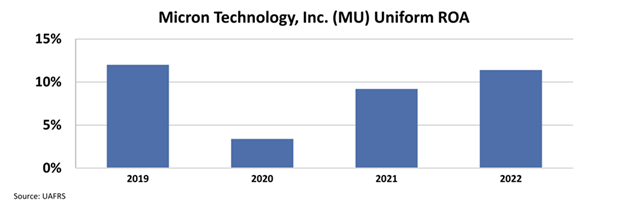

Micron’s Uniform return on assets (“ROA”) dropped from 12% in 2019 to 3% in 2020 because of the pandemic and issues with semiconductor supply. However, it had a quick recovery in the last two years, as Uniform ROA have been reaching 11% this year.

Consistent robust returns are one of the signs of a good business. Yet, the market does not seem to be pricing in that resiliency. It is important to understand how the market thinks about the company’s future performance before making an investment decision.

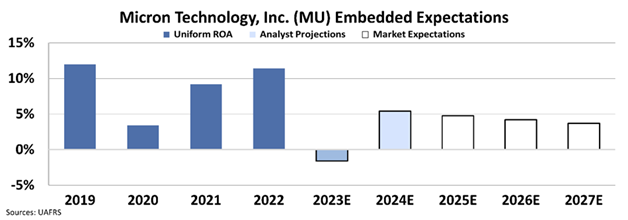

By utilizing our Embedded Expectations Analysis (“EEA”) framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow (“DCF”) model, which makes assumptions about the future and produces the “intrinsic value” of the stock.

We know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

At around the $54 price level, the market expects the company to have an ROA of 4%, close to the pandemic times. Analysts have similar expectations, as they think Micron’s ROA will drop to 5% in the next two years.

Our Embedded Expectations Analysis and Uniform Accounting make it clear that the market is missing the picture with this name, and there might be upside opportunities.

Micron’s profitability is likely to get stronger thanks to demand tailwinds. Additionally, it will now have some level of protection in the U.S. potentially due to the understanding of the rivalry for this technology, adding to its advantages.

SUMMARY and Micron Technology, Inc. Corporation Tearsheet

As the Uniform Accounting tearsheet for Micron Technology, Inc. (MU:USA) highlights, the Uniform P/E trades at -56.2x, which is below the global corporate average of 17.8x and its historical P/E of -24.0x.

Negative P/Es only require low EPS growth to sustain them. In the case of Micron Technology, the company has recently shown a 48% increase in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Micron Technology’s Wall Street analyst-driven forecast is a -117% and -365% EPS shrinkage in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Micron Technology’s $54 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 15% annually over the next three years. What Wall Street analysts expect for Micron Technology’s earnings growth is below what the current stock market valuation requires through 2023.

Furthermore, the company’s earning power in 2021 is 2x the long-run corporate average. Moreover, cash flows and cash on hand are 1.6x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 70bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Micron Technology’s Uniform earnings growth is below its peer averages and average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.