The US government’s construction, engineering, and manufacturing investment is expected to revitalize deindustrialized communities and boost profitability, even in a recession. The government’s investment in new infrastructure will benefit construction and engineering companies through increased demand and government subsidies. Also, manufacturing companies will benefit from the government’s investment through increased demand for equipment and materials and manufactured goods. In today’s FA Alpha Daily, we’ll discuss how government spending creates winners in the stock market and show potential investors the importance of picking them.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

The U.S. wants to see places formerly ravaged by deindustrialization and rustbelt decay come back to life. These subsidies are a chance to make this happen.

As factories moved abroad, we abandoned thousands of towns and cities around the country.

However, all of these spending bills means hundreds of billions of dollars are going to be reinvested into old factories, roads, and bridges. Project developers estimate the creation of up to 85,000 new jobs, too.

The biggest winners of this are going to be industrial companies, in particular, construction and engineering (“C&E”) and manufacturing companies.

To rebuild these once illustrious cities of industry, companies will need to build new factories, offices, and other facilities.

This is where C&E companies come into play.

The subsidies are likely to stimulate demand for new industrial projects. This means that C&E companies are going to have their plates full actually working on all of these construction projects.

And what’s good for C&E is also good for manufacturing. Manufacturing companies make a lot of the equipment and materials that C&E companies use to get their jobs done.

As long as C&E companies are in high demand, manufacturing will win as well.

Moreover, subsidies can reduce the costs for these companies undertaking industrial projects. As a result, these savings might lead to better pricing for both C&E and manufacturing services, boosting their profitability.

We are not alone in thinking that.

Construction and engineering firms have already increased their profitability thanks to these actions by the government and favorable pricing in recent years.

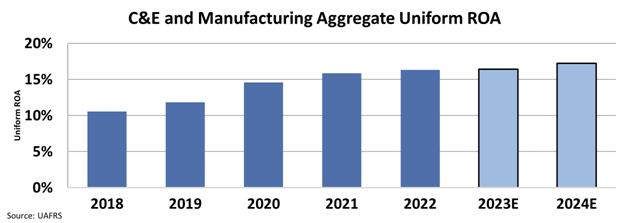

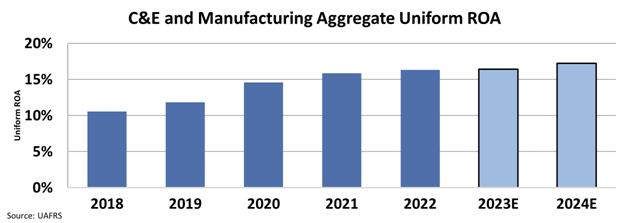

The industry’s aggregate Uniform return on assets (“ROA”) jumped from 10% in 2018 to 16% in 2022. Analysts expect this trend to continue going forward, with aggregate ROA remaining above 17% in the next two years.

Even with a possible recession on the horizon, analysts think C&E and manufacturing will keep getting stronger.

We still think we’re likely heading for a recession some time next year. While that will put pressure on a lot of sectors, it won’t hurt all sectors equally.

For instance, if interest rates stay high, real estate will be a difficult sector to invest in, as rising purchasing costs will hurt demand. More than 50% of your portfolio’s performance has nothing to do with the stocks you pick. It has to do with the sectors you pick.

Considering how much spending is set to hit C&E and manufacturing companies, the industrials sector looks set up for success. We’d recommend spending time researching industrials, and specifically, the construction and engineering industry.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.