The return of student loan payments, with millions resuming monthly installments, is expected to reduce disposable income, slow consumer spending, and drive student loan delinquency rates back to pre-pandemic levels. This increase in delinquency rates will have a ripple effect, leading to higher rates of default on other types of loans, pushing financially strained borrowers into foreclosures and bankruptcies, and ultimately, weakening the economy. In today’s FA Alpha Daily, let’s discuss why it is important to monitor delinquency rates for all types of consumer credit.

FA Alpha Daily:

The Monday Macro Report

Powered by Valens Research

For most of the pandemic, the U.S. has been finding ways to keep money in consumer pockets.

Stimulus and relief packages to families, small businesses, and industries kept spending strong, companies happy, employment high, and interest rates low. These are all the opposite of what would happen in a recession.

Consumer balance sheets were looking great, and the same was true for corporate credit.

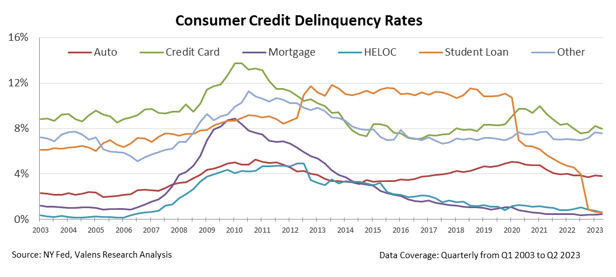

From 2020 to 2022, almost every form of consumer credit saw declining delinquency rates. Actually, many of them trended toward historically low levels.

Student loan delinquency rates fell the most. They had been above 11% for most of the 2010s and dropped below 2% by late 2022.

Unfortunately, that trend couldn’t last forever. Things are getting tougher for borrowers, specifically those with student loans.

That’s why analysts forecast delinquencies to rise back to pre-pandemic levels.

Student loan payments being halted drove delinquency rates down. So, it makes logical sense that as those payments pick up, so too will delinquency rates.

This is going to put pressure on the entire economy. As we discussed, it’s likely to send other types of loan delinquencies higher, and it’s going to put pressure on retail businesses.

This is yet another catalyst to create more pressure on the U.S. consumer and consumer-facing businesses.

In the coming months, keep an eye on all kinds of consumer delinquency rates.

As they start rising, we’re likely to see credit issues worsen, and we may even see the retail landscape deteriorate. Those are all signs that we’re not out of the water yet.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.