With rising interest rates and aging assets, Corporate America’s underinvestment in capex is becoming a headwind. The dwindling “Net-to-Gross” PP&E ratio underscores the urgent need for companies to renew their aging infrastructures to stay competitive. As capex spending ramps up, the companies prioritizing PP&E investments are gearing up to spearhead the next economic resurgence.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

As we mentioned, when rates are low, it’s more efficient just to borrow money to reward investors.

As long as your business is running, you can spend as little as possible on capex, and investors still get paid.

However, that can’t last forever. Now, interest rates are high.

Companies can’t borrow at 2% or less anymore, and worse yet, their assets are getting old.

Despite the fact that financing is more expensive today, companies need to invest if they’re to stay afloat down the line.

To keep generating cash flows that can then be used for buybacks, companies need to invest in long-term investments like property, plants, and equipment (“PP&E”).

And yet, it seems corporate America totally ignored this principle since even before the Great Recession.

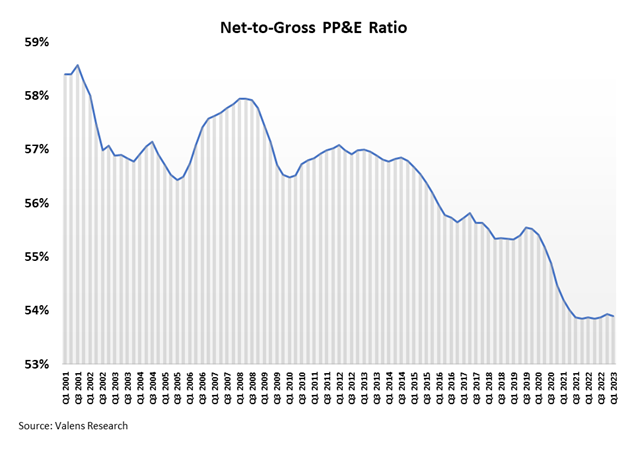

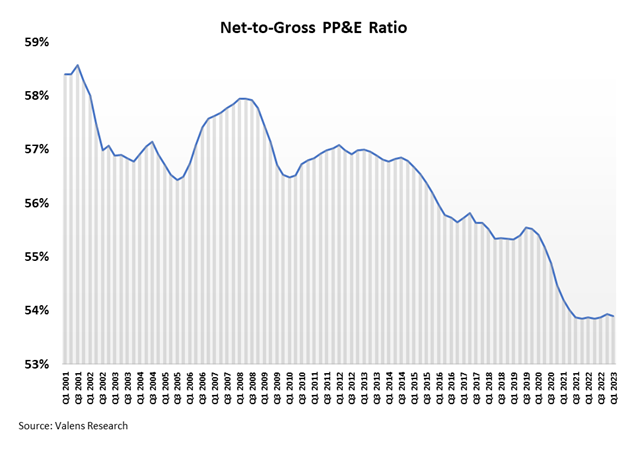

Take a look at the chart below. It measures what we call the “Net-to-Gross” PP&E ratio.

Companies use a metric called gross PP&E to denote the value of their assets when they were new. Net PP&E tells us what those assets are worth today.

The ratio between the two acts as a proxy for age of asset, the lower the ratio, the older the assets.

We can clearly see that companies have underinvested in their assets – the ratio has fallen from above 58% in 2001 to just 54% today.

U.S. companies have underinvested for so long that the assets they’re using are borderline falling apart.

Without capex, companies will be left behind as the world around them continues to invest.

We’ve written many times about how the supply-chain supercycle is inevitable, and it’s starting in earnest.

Thanks to the growing artificial intelligence industry, chipmakers are starting to invest in onshore production. Even tech companies like Apple have started building more manufacturing facilities on or near U.S. soil.

Capex spending is already up 15% in the last year. And clearly, to get back to a normal Net-to-Gross PP&E ratio, there will have to be a lot more spending where that came from.

This is why despite short-term uncertainties about a recession, the U.S. economy is poised for substantial growth over the next five to 10 years.

Companies are just starting to invest heavily in making their operations better. This will undeniably benefit supply chains across the U.S.

Keep an eye on capex spending for specific companies. Those companies are going to lead the charge heading into the next bull market.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.