Despite rising interest rates, some companies with strong commitments have been able to proceed with their mergers and acquisitions strategy. One of which is AZZ Inc. (AZZ), a galvanizing and metal coating solutions company that made a billion-dollar acquisition last year to scale up its operations, expand its offerings, and fuel its continued transition. Rating agencies have expressed concern about this decision, given the unfavorable macro environment for such a strategy and the perceived risk of default for AZZ. In today’s FA Alpha Daily, we’ll use Uniform Accounting to examine AZZ and assess whether rating agencies have accurately assessed the company’s credit risk.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The high-interest rate environment over the last year or so made it harder for companies to take strategic actions and drive their growth trajectory.

Since higher interest rates affected companies’ cost to borrow, obtaining, refinancing, and repaying debt has become much more difficult.

On top of that, the U.S. economy is also facing a looming recession in the short term. This further increases the risks to businesses in terms of declining profitability and their ability to meet obligations.

In these types of uncertain macroeconomic environments, businesses usually tend to take less risky actions and try to maintain some level of stability.

However, that shouldn’t always be the case. If a company has a strategic roadmap to improve its efficiency, increase profitability, and grow to reach a much larger scale, it can still carry on these types of actions regardless of rising rates or an unfavorable macro environment.

AZZ Inc. (AZZ) is a great example of such a business. The company provides products that are used to protect metal from corrosion and extend its lifespan.

It is also the leading provider of hot-dip galvanizing and coil coating solutions to a broad range of end markets in North America.

The company acquired Precoat Metals last year, in order to reach a much greater scale and to drive its continued transition from being a diverse holding company to becoming a focused provider of coating and galvanizing services. The acquisition size was almost as large as AZZ’s own Enterprise Value (“EV”) at the time of the transaction.

While this strategic decision might seem highly risky considering the uncertainty in the current macroeconomic environment, it provided fruitful results for the firm in a very short amount of time.

After the acquisition, the company’s Uniform return on assets (“ROA”) doubled in the fiscal year 2023 and recorded the highest profitable year of the firm historically.

Additionally, since AZZ started to implement this strategy, its Uniform ROA has risen from around 6% two years ago to its historical record-breaking 22% this year. This shows the company knows what it’s doing and that it’s not taking unnecessary risks.

Yet, credit rating agencies seem to miss that fact and just take it as a risky strategy due to the current macroeconomic environment with high levels of cost of debt. As a result, they are giving an unreasonable rating to the firm.

For instance, S&P has given AZZ a “B” rating. This rating suggests a huge risk of default, around 24% over the next five years. It also places the company in the risky high-yield basket.

We believe that AZZ deserves a much safer credit rating given its proven acquisition success, its well-thought strategic decisions, and its financial positioning over the next five years.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

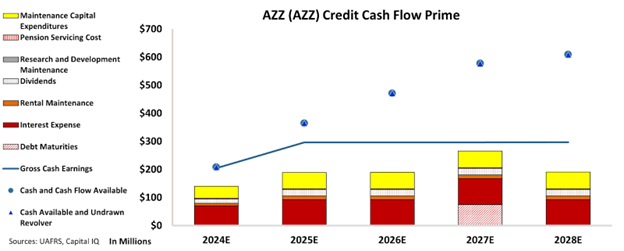

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that AZZ’s cash flows are more than enough to serve all its obligations going forward.

The chart suggests that the company has a strong financial footing and should be able to meet its obligations without difficulty over the next five years.

The only debt maturity over that time period is in 2027 which is not concerning at all considering AZZ’s massive cash flows going forward.

On top of that, the concerning debt headwall due to the acquisition is six years from now, maturing in 2029. With the increased scale and significantly improved profitability AZZ has seen after the acquisition, this debt headwall could be refinanced or repaid much more easily until that time.

That’s why we believe that AZZ is not facing a significant risk of default, as opposed to the rating agencies’ assessment.

Thus, we are giving an “IG4” rating to the company. This rating ensures it is in the safer investment-grade basket and implies a risk of default of around just 2%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and AZZ Inc. (AZZ:USA) Tearsheet

As the Uniform Accounting tearsheet for AZZ Inc. (AZZ:USA) highlights, the Uniform P/E trades at 13.6x, which is below the global corporate average of 18.4x, but around its historical P/E of 15.2x.

Low P/Es require low EPS growth to sustain them. In the case of AZZ, the company has recently shown a 7% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, AZZ’s Wall Street analyst-driven forecast is for a 39% EPS shrinkage and a 22% EPS growth in 2024 and 2025, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify AZZ’s $47 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 4x the long-run corporate average. Moreover, cash flows and cash on hand are above its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 500bps above the risk-free rate.

Overall, this signals a low dividend risk.

Lastly, AZZ’s Uniform earnings growth is below its peer averages but is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Prepare for the storm! We are inviting you to attend our upcoming event this Wednesday, September 27, 2023 at 8:00 PM EDT to learn how to protect your wealth in the oncoming stock market crash.

This analysis of AZZ Inc.’s (AZZ) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.