The U.S. government provided financial assistance to businesses during the COVID-19 pandemic to prevent mass failures. This financial assistance to businesses could lead to a “Japanification”, where companies that were unable to pay back their debts continue to live on. This had a negative impact on economic growth, which has still not fully recovered. In today’s FA Alpha Daily, let’s examine the evidence to see if there is a possibility that the U.S. will experience a Japanification of its economy or not.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

The U.S. economy is working as it should.

Since interest rates started rising last year, we’ve started to see that creative destruction show. Companies that should have gone bankrupt have.

In fact, in June, another dozen or so companies went bankrupt (including the publicly traded ATM maker Diebold Nixdorf and aerospace supplier Incora) after seeing rising defaults since the start of the year.

It’s been the worst start to a year for bankruptcies since the end of the Great Recession. We’re even on pace to see more bankruptcies than we did during the pandemic.

It’s clear that these companies going bankrupt have just been delaying the inevitable over the past few years.

Credit rating agency Fitch proved this by studying 30 companies that delayed their maturities or took on more debt during or after the pandemic. Of the 30 companies, 24 of them either have defaulted or some other form of restructuring.

Failure was always on the horizon for these companies… it was only a matter of time.

This is vital to any good capitalist economy. You need the creative disruption that means companies that can’t pay their debts and operate go under. It allows capital to be allocated to areas with more opportunity.

Companies that are run well should benefit so they can continue to do so.

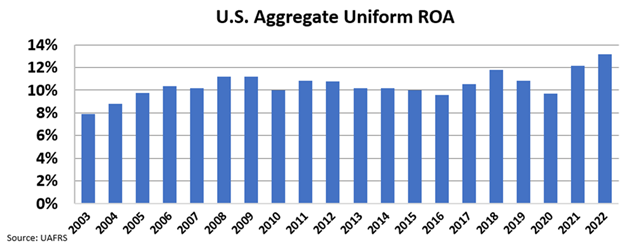

This willingness not to “save sacred cows” is what has allowed aggregate Uniform return on assets (“ROA”) in the U.S. to rise most of the past 20 years.

In 2022, ROA was just over 13% in 2022, compared to 8% levels in 2003.

This key concept of the U.S. economy is why we don’t think that ROA is about to drop massively. The economy rewards companies that are run well and punishes those who are run poorly.

It’s why even though we think we could be in a sideways market for a while, we’ll continue to look at U.S. stocks more than any other market.

The U.S. economy is healthy, like it should be, and we remain bullish on the long-term prospects of the country.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.