The Federal Reserve uses the Senior Loan Officer Opinion Survey (SLOOS) as a quarterly tool to assess credit tightness. The SLOOS offers crucial insights into the lending environment, with 51% of banks in the latest report tightening their credit standards. In today’s FA Alpha Daily, let us discuss what the current SLOOS report means for the economy.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Determining the difficulty companies face in obtaining credit isn’t a challenge. Every quarter, the Fed provides insights into credit tightness via the Senior Loan Officer Opinion Survey or the SLOOS.

The SLOOS is a tool used by the Federal Reserve to gather information about lending practices in the U.S.

Essentially, it’s a quarterly survey sent to senior loan officers at various banks. It asks them about changes in their institutions’ lending standards and the overall demand for loans.

By collecting these insights, the Federal Reserve can gauge the health of the banking sector. This information allows them to make informed decisions related to monetary policy.

The SLOOS provides valuable data on the lending environment. It indicates whether banks are tightening or loosening their credit standards, which can reflect broader economic conditions.

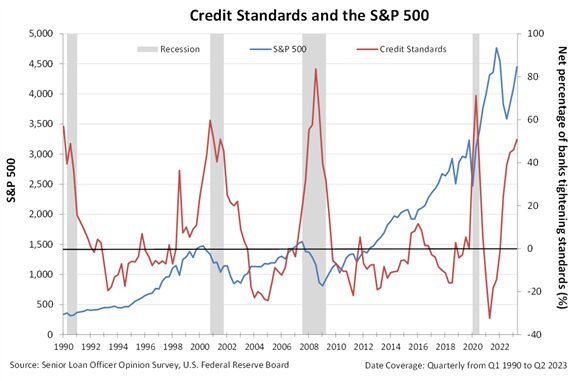

In the most recent SLOOS report, 51% of banks indicated they’ve made their lending standards stricter. Such a level is nearing points historically associated with the onset of a recession.

During the first quarter of 2008, when the U.S. was on the brink of a recession, 32% of banks reported tightening standards. Within a year, that number surpassed 75%. Similarly, 51% of banks were tightening in the early months of 2001, right as the dot-com bubble was bursting.

When the SLOOS indicates a tightening of credit availability, it reflects the financial sector’s growing caution in lending money. This caution is typically triggered by perceived economic risks like high-interest rates and inflation.

And the hesitation of banks to lend to PE firms highlights the growing economic concerns leading to tighter credit conditions.

PE firms traditionally rely on leveraging, or borrowing large sums of money, to fund acquisitions.

Thus, when banks become hesitant to lend to PE firms, it’s a clear sign that they see higher risks in the broader economy.

This reluctance is driven by concerns that, in an economic downturn, PE-backed companies may struggle to generate the returns needed to repay their loans.

When such caution mirrors levels typically observed during recessions, it suggests that banks are bracing for economic headwinds.

In essence, banks tightening their purse strings for PE firms can be viewed as a canary in the coal mine for broader economic concerns.

Credit is the backbone of the market.

Credit availability drives the economy. So, if banks are unwilling to lend, that means we know what comes next. Companies that need to borrow are going to be starved for capital to the point of bankruptcy.

The SLOOS is right around levels where we consistently see recessions kick off, and some plenty of companies are already struggling with refinancing.

Recession risk is rising. That’s why it’s important not to have all your eggs in one basket. If you’re planning on putting any money to work, you’d be best off doing it slowly instead of all at once.

In our Timetable Investor newsletter, we recommend readers allocate their money over a window between three and 24 months. The slower, the worse the near-term outlook.

Today, we recommend a 24-month allocation window, the most bearish we can be.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

We are inviting you to attend FA Alpha’s upcoming CAIA Hong Kong event on Wednesday, 11/1, at 6:30 PM HKT to learn about the latest macroeconomic trends affecting the global economy.

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.