The global tobacco industry faces scrutiny amid shifting regulatory landscapes and evolving consumer behaviors. Altria Group, a prominent player in the U.S. tobacco market, faces market skepticism, reflecting broader concerns about the industry’s future trajectory. In today’s FA Alpha Daily, we delve into Altria from a Uniform Accounting perspective.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

When people think about staple products, household essentials like diapers, soap, and paper towels typically come to mind.

However, tobacco products represent one of the largest and most reliable staples markets globally due to their addictive nature.

Tobacco use is highly addictive due to the nicotine found in these products. Once regular use is established, it becomes very difficult for users to quit due to both psychological and physical dependence on nicotine.

As a result, demand for tobacco has proven relatively inelastic.

Customers will continue purchasing tobacco products even with rising prices or increased regulations on marketing and sales.

One of the leading players capitalizing on this captive customer base is Altria Group (MO), the largest tobacco company in the United States. Altria holds a 48% share of the U.S. cigarette retail market.

Through acquisitions, Altria also has a significant presence in smokeless tobacco and cigar markets, controlling around 46% of the market.

As regulations on the tobacco industry have increased globally to reduce smoking rates, the market has become less competitive over time. However, this has benefited dominant players like Altria.

With a stable customer base reluctant to quit tobacco use, Altria has been able to generate high and reliable returns.

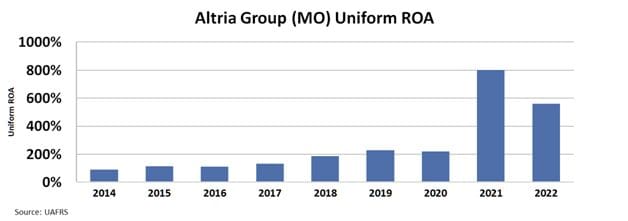

In the last two years, Altria’s return on assets (ROA) reached all-time highs above 250%, demonstrating the powerful addictive pull of nicotine on regular consumers.

Take a look…

In 2022, the company managed to reach 560% ROA.

These figures indicate a robust business, with efficient use of assets to generate profits.

However, the market still has concerns about the tobacco industry.

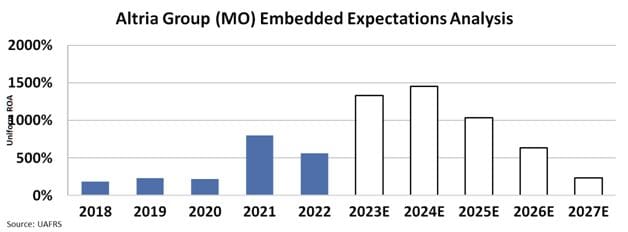

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market predicts that the company’s Uniform ROA will fall to 230%, a far cry from the 560% levels in 2022.

The market’s pessimistic view is caused by regulations on the tobacco industry tightening considerably worldwide in recent years and a decrease in the number of smokers.

For example, a menthol cigarette ban is almost a certainty.

While the smoking population decreases year over year, Altria manages to keep prices high. This offsets revenue lost coming from fewer people smoking.

Tobacco remains a staple industry for companies like Altria due to the difficulties associated with quitting.

Investors have benefited from Altria’s steady cash flows and dividends over decades, capitalizing on one of society’s most stubborn habits. Going forward, tobacco is projected to remain a sizable global market.

For Altria, tobacco addiction will likely continue driving strong financial performance for many years to come.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

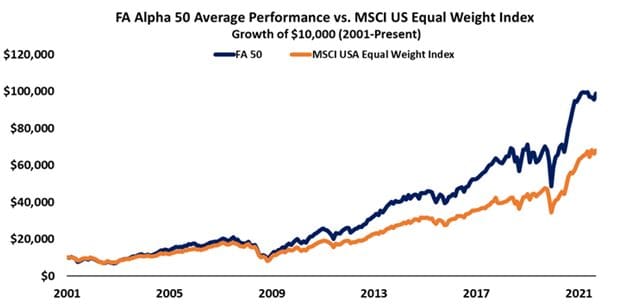

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

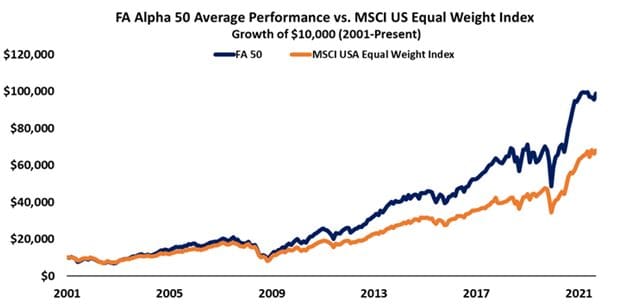

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Altria Group (MO) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.