The rapid advancement of artificial intelligence is reshaping the global technology landscape. Dell Technologies (DELL), traditionally recognized for its personal computing business, has strategically repositioned itself as a key provider of AI data center infrastructure. In today’s FA Alpha Daily, we examine how this transformation places Dell in a strong position to exceed market expectations amid a shifting technological environment.

FA Alpha Daily

Powered by Valens Research

The artificial intelligence (“AI”) boom has been a boon for tech companies that develop critical technology needed in AI development and rollout.

For instance, Nvidia (NVDA) has grown from a designer of chips used for personal computing to a juggernaut that designs advanced chips for AI uses. Meanwhile, Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOG) have seen tremendous growth due to their respective cloud infrastructures, which are highly sought after in the development and delivery of AI tools and services.

On the other hand, utility companies and power producers such as NextEra (NXT) and NRG Energy (NRG) have seen their fortunes improve since they are crucial in solving AI’s biggest bottleneck: energy.

Those are just a few of the sectors that have benefitted from the AI boom. However, what’s clear is that companies that are critical, or have some exposure to AI, have seen their valuations rise.

Despite this, there are still companies with exposure to this game-changing technology that remain undervalued by the market.

One of those firms is Dell Technologies (DELL), a company that’s long been associated with personal computers (“PCs”) and other end-user peripherals.

The company, founded in 1984, established itself as a leading supplier of PCs and other related hardware in both consumer and enterprise markets.

While Dell still operates in the PC market, it’s now an entirely different business, as it has positioned itself as market leader in the infrastructure solutions space for servers and data centers.

At present, its business is divided into two key segments: Client Solutions Group (“CSG”) and Infrastructure Solutions Group (“ISG”)

CSG includes the company’s commercial and consumer segments and products such as PCs, laptops, monitors, and other related hardware. Meanwhile, ISG includes the firm’s storage, server, and networking products.

Historically, CSG has been the primary revenue driver for Dell as this segment has leading positions in the commercial and consumer markets for PCs. Over the past five years, it has generated revenues of over $12 billion, with the fourth quarter of 2020 as an exception.

However, ISG has slowly closed this gap and has managed to take the lead. From 2020 to 2023, it generated revenues over $8 billion. By 2024, this climbed to $10 billion and eventually, to $16 billion as of the second quarter of 2025, making more revenues than CSG for the first time in years.

ISG managed to capture the lead because Dell has steadily positioned itself as a leading provider of cloud infrastructure necessary in the AI boom. For data centers and cloud services to operate smoothly, hyperscalers need server racks, storage, networking, data management and data management solutions—all of which Dell provides in droves.

While the ISG segment has only recently passed the CSG segment in terms of revenue, it has long been the majority contributor to Dell’s profits. ISG’s operating income has exceeded the CSG’s segment in eight of the last nine years. In 2024 ISG generated $5.6 billion in operating profit while CSG’s operating profit declined from $3.7 billion in 2023 to $3 billion.

ISG now occupies a large portion of Dell’s business, positioning it to drive the company’s growth and returns moving forward.

Going forward, Dell expects its ISG segment, where it holds a #1 share over the server market, to grow between 11% and 14% per year, while its less profitable CSG segment is only forecast to grow 2% to 3% per year.

Despite Dell’s leadership position in a part of the AI market, and its shifting business mix, investors are doubting the company.

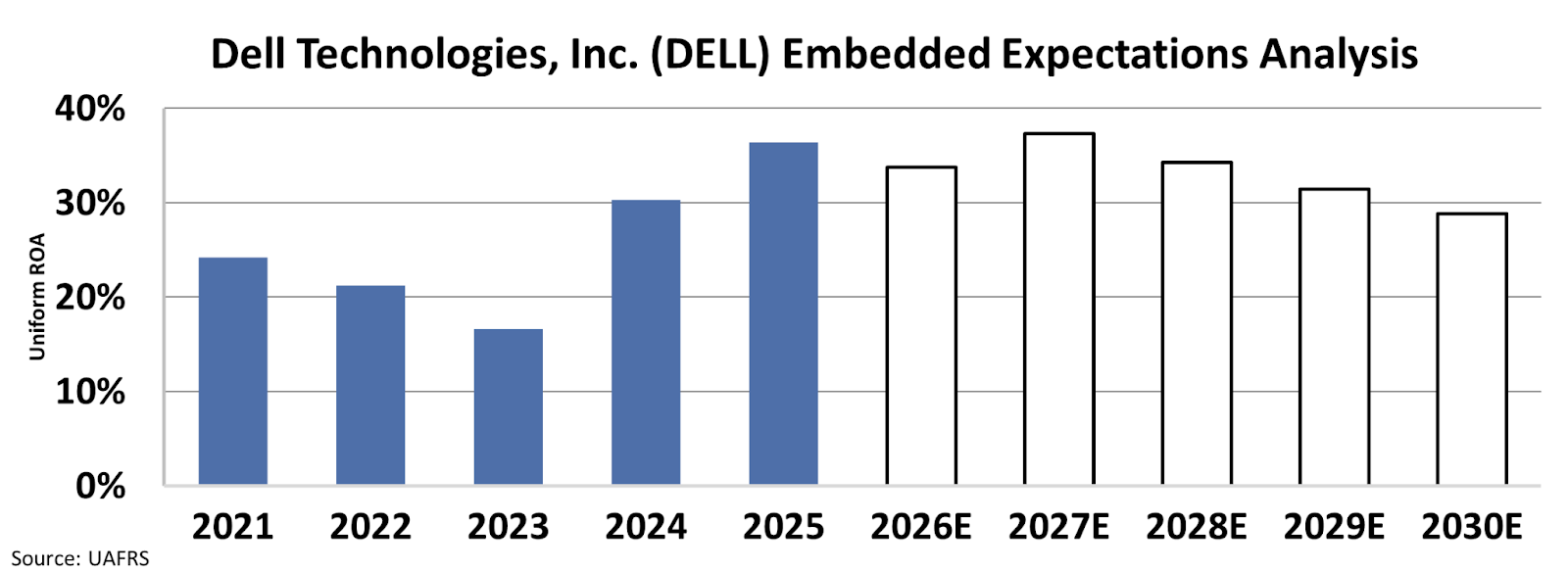

We can see what the market thinks about this company through our Embedded Expectations Analysis (“EEA”).

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At current valuations, investors are betting that Dell’s Uniform return on assets (“ROA”) will go down from 36% this year to 29% by 2030.

As Dell continues to be instrumental in AI data center buildout, as long as it remains a market leader, and as long as its more profitable ISG segment continues to outpace its CSG segment, the company’s returns should be able to exceed the market’s expectations, providing considerable upside to investors.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.