The S&P 500 is up 14% year-to-date driven primarily by the tech sector, which rallied by over 37% so far this year. Meanwhile, the industrial sector has posted a modest 7% year-to-date performance despite showing potential with the supply chain supercycle. In today’s FA Alpha Daily, let’s discuss the disparity between what the market thinks and what actually is happening in the industrial sector.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Industrials are having a great year.

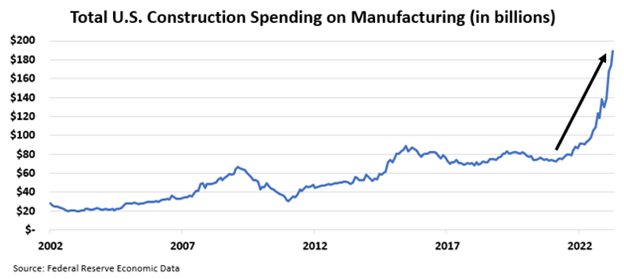

A key gauge of industrial health in the U.S. is total construction spending on manufacturing. It includes projects like new buildings and renovations. The two kinds of construction are private and public construction.

Private construction includes homes and any private businesses while public construction includes projects for highways, schools, and water supply.

Construction and manufacturing spending is important to look at since it tells us if there’s demand for blue-collar workers.

If more money is being spent on projects, there’s greater demand for more workers. It’s beneficial for the economy. It also gives us insight into what types of projects are being worked on and where money is being allocated.

For example, President Biden announced an infrastructure plan in January that has designated over $500 billion to upgrading existing U.S. infrastructure.

In a recession driven by struggles in the commercial real estate (“CRE”) sector, like we’re starting to see, construction could benefit.

Construction and engineering (“C&E”) companies could benefit from the repurposing of offices and new apartments as CRE firms are forced to sell off their properties.

And when we look at construction spending since the start of last year, it’s been skyrocketing.

However, it’s clear that there’s a disconnect between what the market thinks and what actually is happening in the industrial sector.

Industrial stocks are up about 7% while manufacturing and construction spending has ballooned by over 36% since the beginning of the year.

Take a look.

To us, this a sign that the supply chain supercycle is still underway, it’s just not being recognized like it should.

Investors are focusing on factors like high interest rates and continued inflation, but they’re not looking at what’s happening on a day-to-day basis in this space.

There’s still plenty of opportunities for industrial companies to grow and perform well going forward.

It’s only a matter of time before the market starts to recognize what’s really happening.

Just because tech is driving the market today does not guarantee it’s going to power the next bull market. Industrials are still set up to do well.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.