With huge disruption in the technology sector in the past few years, credit and equity investors need to look for stability. Today’s FA Alpha Daily will talk about the true fundamental credit risk of Upland Software, Inc. (UPLD), whose steady performance is set to surprise rating agencies

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The technology industry is a place where dramatic changes can occur seemingly overnight.

After years of iterating on old designs such as building the next smartphone, the conversation has tilted towards the next evolution in technology.

Today, some of the most popular buzzwords are terms like cloud computing, digital transformation, full suite solutions, and low code no-code solutions.

It is the companies that are able to not just identify what these terms are, but actually provide high-quality solutions that have prospered. And as one might expect, companies that are doing well in the equity market tend to be viewed favorably by the credit markets as well.

That’s why it has been so surprising to see how Upland Software (UPLD) has been treated. Upland specializes in cloud-based software for enterprises, offering plug-and-play solutions spanning from project management to CRM.

For a company that has a history of generating a high Uniform ROA, north of 30% for several years, credit rating agencies are not recognizing how strong of a company it is.

S&P, for example, doesn’t think very highly of it. Rather, it has it rated as a B- rated name which means that even though Upland Software has been consistently profitable for years, S&P believes it has a 25% chance of going bankrupt in the next five years.

Rather, as demand for these intricate technology solutions remains high, Upland Software has positioned itself well.

Using our CCFP framework, we can understand Upland’s true fundamental credit risk and why we have it rated so much higher.

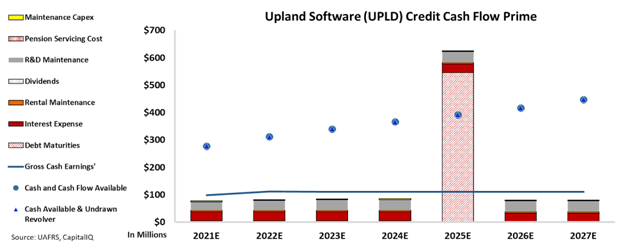

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

As you can see, Upland Software has cash flows that are forecasted to typically be above any of their cash requirements. Add to that a growing war chest, and the company should have little trouble refinancing its one-time debt obligation in 2025 to a later date, or across multiple years.

That’s why we rate Upland Software as having a much lower risk, with a strong IG4 rating.

Using Uniform Accounting, we can see through the distortions of as-reported numbers to get to the true fundamental credit picture for companies as strong as Upland Software.

To see Credit Cash Flow Prime ratings for thousands of other companies we cover, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Upland Software, Inc. Tearsheet

As the Uniform Accounting tearsheet for Upland Software, Inc. (UPLD:USA) highlights, the Uniform P/E trades at 15.2x, which is below the global corporate average of 24.0x, but around its historical P/E of 16.1x.

Low P/Es require Low EPS growth to sustain them. That said, in the case of Upland, the company has recently shown 9% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Upland’s Wall Street analyst-driven forecast is for a 58% and 3% EPS decline in 2021 and 2022, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Upland’s $19.93 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 4% over the next three years. What Wall Street analysts expect for Upland’s earnings growth is below what the current stock market valuation requires in 2023, but slightly above the requirement in 2022.

Meanwhile, the company’s earning power in 2020 is 7x the long-run corporate average. Also, cash flows and cash on hand are well above its total obligations by 3x. This signals a low credit and dividend risk.

Lastly, Upland’s Uniform earnings growth is below peer averages and the company is trading above its peer average valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Upland Software, Inc. (UPLD) credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.