Due to the pandemic revealing issues in the supply chain, the government, and companies are now prioritizing long-overlooked infrastructure and supply chain investments, indicating the arrival of the Supply Chain Supercycle. Companies like Schnitzer Steel Industries (SCHN) are benefiting from the high demand for steel due to the Bipartisan Infrastructure Law’s funding. Despite all of this, the market is currently mispricing Schnitzer Steel Industries’ performance, anticipating it to perform worse than pre-pandemic levels. In today’s FA Alpha Daily, we will look at Schnitzer Steel Industries to see why the market is missing an opportunity by mispricing a profitable company.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

We have been calling for a Supply Chain Supercycle for a while. It is slowly but surely materializing.

The U.S. has been underinvesting in its supply chains and infrastructure, which became quite visible during and after the pandemic.

Orders got canceled, lead times got longer, and the output of a lot of U.S. firms fell because they could not get their hands on the raw materials needed for production.

The government and companies are now working together to right this and invest in the correct areas to make supply chains more resilient and our infrastructure more effective.

A great example of this is the Bipartisan Infrastructure Law. President Biden has put billions in the budget for all kinds of infrastructure investments to “get America moving again”.

This budget will be used to build and replace bridges and tunnels, improve airports, expand harbors, and build transportation centers and rail tracks.

Additionally, we see companies reshoring their manufacturing facilities. This means they are bringing production back home, making the supply chain much more resilient to global problems.

Caterpillar (CAT) is moving its truck manufacturing from Mexico to Texas, Apple (AAPL) launched a new “American Production Line”, and Walmart (WMT) has committed to purchasing the U.S. manufactured products.

These are only the tip of the iceberg…

All these infrastructure investments have one thing in common and that is the need for steel. It is used everywhere from bridges and transportation centers that the government funds to new domestic manufacturing facilities.

Steel is in high demand and will continue to be so, and that is great for companies like Schnitzer Steel Industries (SCHN).

It is one of the biggest steel recyclers in the country. It recycles salvaged vehicles, rail cars, and all sorts of manufacturing scrap to offer ferrous and nonferrous metal.

It also sells serviceable auto parts after collecting and fixing them.

The huge demand for steel meant good times for Schnitzer Steel, and the company enjoyed high profitability in the last two years.

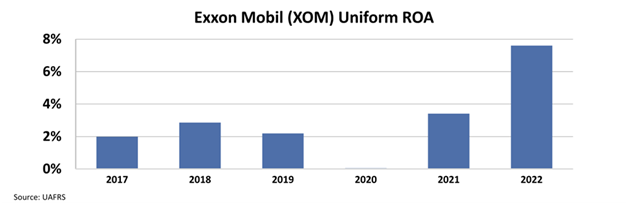

After a terrible year during the worst times of the pandemic, the Uniform return on assets (“ROA”) surged from 1% in 2020 to 9.8% in 2021. The company managed to keep the same high profitability in 2022.

However, a company performing well lately does not mean that it is a great investment. We need to understand what the market thinks, and only invest if we disagree with the market consensus.

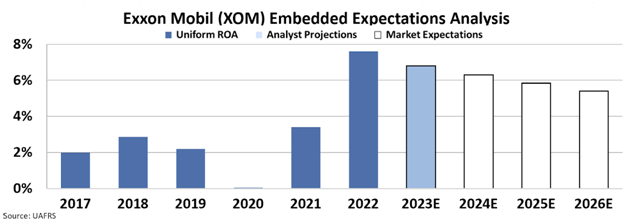

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At around $30 per share, the market expects the company’s ROA to tank below the pre-pandemic levels to 3%.

This seems incredibly pessimistic for a company that is essential for the Supply Chain Supercycle.

Schnitzer Steel has a strong positioning in a period when companies and the government are investing together in infrastructure.

The demand might keep steel prices high. Moreover, recycled steel in particular will be in high demand with companies trying to reach their emission goals.

If the company’s ROA remains high for a longer period, that might mean an upside opportunity for investors.

SUMMARY and Schnitzer Steel Industries, Inc. Tearsheet

As the Uniform Accounting tearsheet for Schnitzer Steel Industries, Inc. (SCHN:USA) highlights, the Uniform P/E trades at 7.4x, which is below the corporate average of 18.4x but around its historical P/E of 7.2x.

Low P/Es require low EPS growth to sustain them. In the case of Schnitzer Steel, the company has recently shown a 7% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Schnitzer Steel’s Wall Street analyst-driven forecast is a 5% EPS growth in 2023 and a 1% EPS shrinkage in 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Schnitzer Steel’s $30 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 17% annually over the next three years. What Wall Street analysts expect for Schnitzer Steel’s earnings growth is above what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 2x its long-run corporate average. Moreover, cash flows and cash on hand are 2.2x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 350bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Schnitzer Steel’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.