During difficult times, companies signal recovery by doing a ‘big bath’ write-off on their financial statements. Fidelity National Information Services (FIS) is one such company that is currently doing so. FIS spent billions consolidating the payments industry in the late 2010s, but now management has announced a significant loss in goodwill, realizing it may not have been the best decision. In today’s FA Alpha Daily, let’s examine FIS and analyze how the market is interpreting its big bath scenario as negative news.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

Companies had a lot of issues during the pandemic. They saw their supply chains getting disrupted, acquisitions failing, and the demand for products falling.

The market dipped in only two months. Everyone was looking for the light at the end of the tunnel, but it seemed like it could be a long one.

Back in 2020, we highlighted one of the best indications of a company seeing the first beam of that light.

That is when it throws the baby out with the bath water and writes off everything it can to clean up its financial statements. Only then can the company truly recover and get rid of all the things that happened during the bad times.

We call this “the big bath”. It is a great tool to watch for companies that are finally taking their lumps so they can start to focus on the future.

This might be when a new CEO comes in or when the company changes its strategy after really tough times.

We can also watch this on a macro level for the entire market to see when things might be bottoming out.

We have not seen it yet overall for the market. But there is one company that is a great example of the big bath right now.

That is Fidelity National Information Services (FIS). The company provides payment processing solutions for financial institutions and businesses.

It tried to be one of the big consolidators of the payment space in the mania of the late 2010s.

It bought SunGard Data Systems in 2015 for $10.5 billion and Worldpay in 2019 for a whopping $35.3 billion, looking to be involved in point-of-sale business acquisition rather than banks’ back office work.

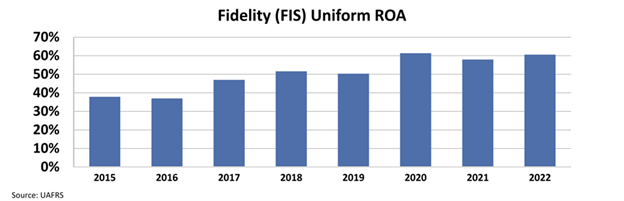

This seems to have worked. With global payment volume increasing, Fidelity’s profitability surged. Its Uniform return on assets (“ROA”) jumped from 38% in 2015 to 61% in 2022.

This seems to have worked. With global payment volume increasing, Fidelity’s profitability surged. Its Uniform return on assets (“ROA”) jumped from 38% in 2015 to 61% in 2022.

They finally recognized that maybe consolidating that much was not the right idea. They are writing off all the goodwill they acquired and looking to spin it off.

The management announced $17.6 billion in impairment of goodwill. The stock has been falling since, showing that the market is not taking this news positively.

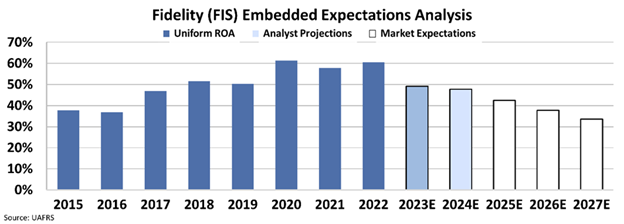

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At around $56 per share, the market is expecting the company’s ROA to tank below 35%. This would be the lowest profitability in the last decade for Fidelity.

The market is not seeing that these one-time write-offs could be a great way for the management to embrace the pain and put it behind them.

This way, they can focus on what Uniform Accounting shows is a great and growing business.

Considering the market’s pessimistic view, there might be an upside opportunity for investors as the management continues to do the right things.

SUMMARY and Fidelity National Information Services, Inc. Tearsheet

As the Uniform Accounting tearsheet for Fidelity National Information Services, Inc. (FIS:USA) highlights, the Uniform P/E trades at 15.2x, which is below the corporate average of 18.4x and its historical P/E of 20.9x.

Low P/Es require low EPS growth to sustain them. In the case of Fidelity National Information Services, the company has recently shown a 15% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Fidelity National Information Services’ Wall Street analyst-driven forecast is an 11% EPS shrinkage in 2023 and an 8% EPS growth in 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Fidelity National Information Services’ $53 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 9% annually over the next three years. What Wall Street analysts expect for Fidelity National Information Services’ earnings growth is below what the current stock market valuation requires in 2023 but above its 2023 requirement.

Furthermore, the company’s earning power is 10x its long-run corporate average. Moreover, cash flows and cash on hand are 1.3x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 160bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Fidelity National Information Services’ Uniform earnings growth is below its peer averages but in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.