In recent weeks, we have discussed how rating agencies are biased toward certain industries and how they overstate credit risk for commodity-based businesses. While it is understandable that rating agencies may be biased against cyclical businesses, this bias can sometimes be unreasonable. A prime example of this is Callon Petroleum (CPE), a company whose actual credit risk is lower than what is indicated by traditional financial statements. In today’s FA Alpha Daily, let’s analyze Callon Petroleum using Uniform Accounting to see its actual credit risk and to assess if it is a relatively safe investment, despite its cyclical nature.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

When it comes to assessing the creditworthiness of oil & gas companies and other commodity-based cyclical businesses, there’s a general perception of higher risk.

The major reason for this is the rollercoaster nature of commodity prices.

For instance, oil and gas prices can be highly volatile. This is because they are easily impacted by various factors such as geopolitical tensions, supply-demand imbalances, technological advancements, and the overall state of the global economy.

Such volatility can have a significant impact on these companies’ revenues and profitability, making it difficult to plan and forecast future cash flows.

Due to these factors, it can be understandable why credit rating agencies usually overstate the credit risk of these companies.

However, it is important to note that no two companies should be treated the exact same, and even cyclical companies should be given a chance to get strong credit ratings.

Callon Petroleum (CPE) is an excellent illustration in this case. The company focuses on the acquisition, exploration, and development of oil and natural gas properties in West Texas.

Thanks to rising oil and gas prices last year, the company has reached its highest return on assets (ROA) of all time.

Despite its record profitability, Callon Petroleum has fallen victim to the biases of rating agencies.

S&P rates the company “B+” which places the company at the lowest tranches of the high-yield basket. This rating implies that Callon Petroleum has a 25% chance of bankruptcy in the next 5 years.

This is a significant exaggeration of the company’s credit risk and we think that it is much safer than what S&P suggests.

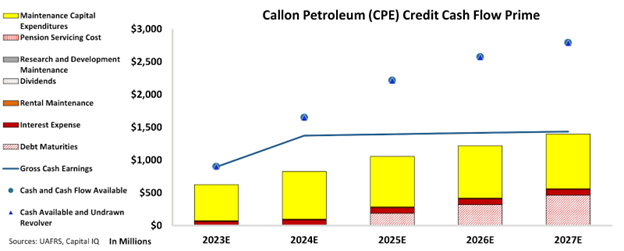

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Callon Petroleum’s cash flows are more than enough to serve all its obligations going forward.

The chart shows the company can handle its obligations even with its gross earnings alone.

Plus, there are a few more factors to consider here. The company is expected to grow its cash balance in the coming years. If it starts worrying about future cash flows, the company can hold onto that cash for a rainy day.

Furthermore, its debt maturities don’t start until 2025, and they don’t surpass $500 million until 2027. The company should have plenty of time to refinance if it needs to.

Finally, most of its expenditures are maintenance capex costs that can be delayed if needed.

These factors show that the company does not deserve to be rated as a high-yield name with a highly overstated risk of default.

Therefore, at Valens, our credit rating for Callon Petroleum will be “IG4+”. This rating ensures that the company is placed within the investment-grade basket, where it deserves to be, implying a risk of default of around 2%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Callon Petroleum Company (CPE:USA) Tearsheet

As the Uniform Accounting tearsheet for Callon Petroleum Company (CPE:USA) highlights, the Uniform P/E trades at 8.9x, which is below the global corporate average of 18.4x and its historical P/E of 9.4x.

Low P/Es require low EPS growth to sustain them. In the case of Callon Petroleum, the company has recently shown a 414% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Callon Petroleum’s Wall Street analyst-driven forecast is for a -51% and 14% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Callon Petroleum’s $32 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 2x the long-run corporate average. Moreover, cash flows and cash on hand 2x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 380bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, Callon Petroleum’s Uniform earnings growth is below its peer averages and is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Callon Petroleum Company’s (CPE) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.