Over-the-counter healthcare products play a critical role in addressing everyday medical needs, from minor pain relief to allergy management. As consumer demand grows, the OTC pharmaceuticals market is projected to reach significant revenue growth in the years ahead. In today’s FA Alpha Daily, we explore how Prestige Consumer Healthcare (PBH) is strategically positioned within this expanding market and assess the potential implications for long-term investors.

FA Alpha Daily

Powered by Valens Research

Each day, thousands of Americans turn to over-the-counter (“OTC”) drugs to treat everyday ailments ranging from the common cold to other ailments such as allergies, muscle pain, sore eyes, and digestive issues like acid reflux.

In 2024, it was found that nearly half of Americans turned to OTC medication, with many purchasing drugs for cold, flu, internal pain, and allergy treatment.

Due to widespread consumer reliance, the OTC pharmaceuticals space is expected to generate an estimated revenue of nearly $45 billion this year.

OTC drugs present a compelling investing opportunity over long periods of time because these are a consumer staple and are relatively immune from the effects of economic downturns as consumers will continue to prioritize their basic health needs even if their financial situations change.

And unlike manufacturers of prescription drugs, it’s easier for OTC brands to release their products to the market and for consumers to buy them because this class of medications do not require prescriptions and are not subject to stricter regulatory oversight and requirements.

Due to these market dynamics, the OTC pharmaceuticals market is expected to grow by 5% annually in the next five years.

Prestige Consumer Health (PBH) is positioned to leverage this growth.

This manufacturer of consumer healthcare products has built its business throughout the years by establishing its own OTC brands and expanding its portfolio through acquisitions.

Prestige currently maintains a broad OTC product portfolio across multiple categories: Digestive care, eye/ear/nose & throat care, oral care, pain relief, pediatric products, dermatological care, skin care, sleep aids, and women’s health.

Through its multiple offerings, the company has established a foothold in the multi-billion dollar OTC pharmaceuticals space.

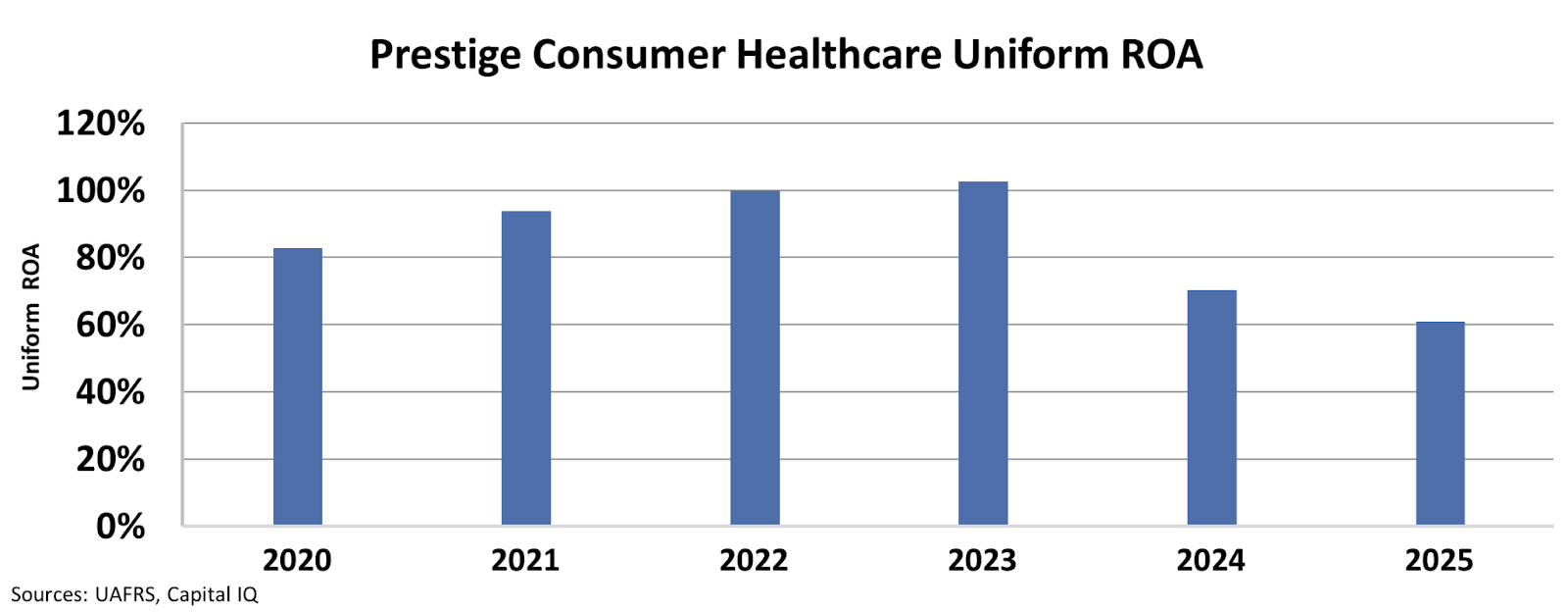

And as a result, Prestige has delivered a Uniform return on assets (“ROA”) of 60% and a Uniform asset growth of 12% this year.

The company recently announced its $100 million acquisition of Pillar5 Pharma, a supplier of its flagship eye care brand, Clear Eyes.

This acquisition is expected to help Prestige expand its eye care capacity and resolve the supply chain issues that negatively impacted shipments and its first quarter revenue for fiscal 2026.

Moreover, the company achieved a free cash flow of $78 million during the first quarter of fiscal 2026, up by nearly 46% from the $53.6 million it generated in the same period during fiscal 2025.

Despite Prestige’s brand position and resilient demand for its products, it currently trades at a Uniform P/E of 18x, well below corporate averages.

This valuation indicates that the market is concerned about competition and limited organic growth. And as a result, it likewise expects that the company’s profitability will decline.

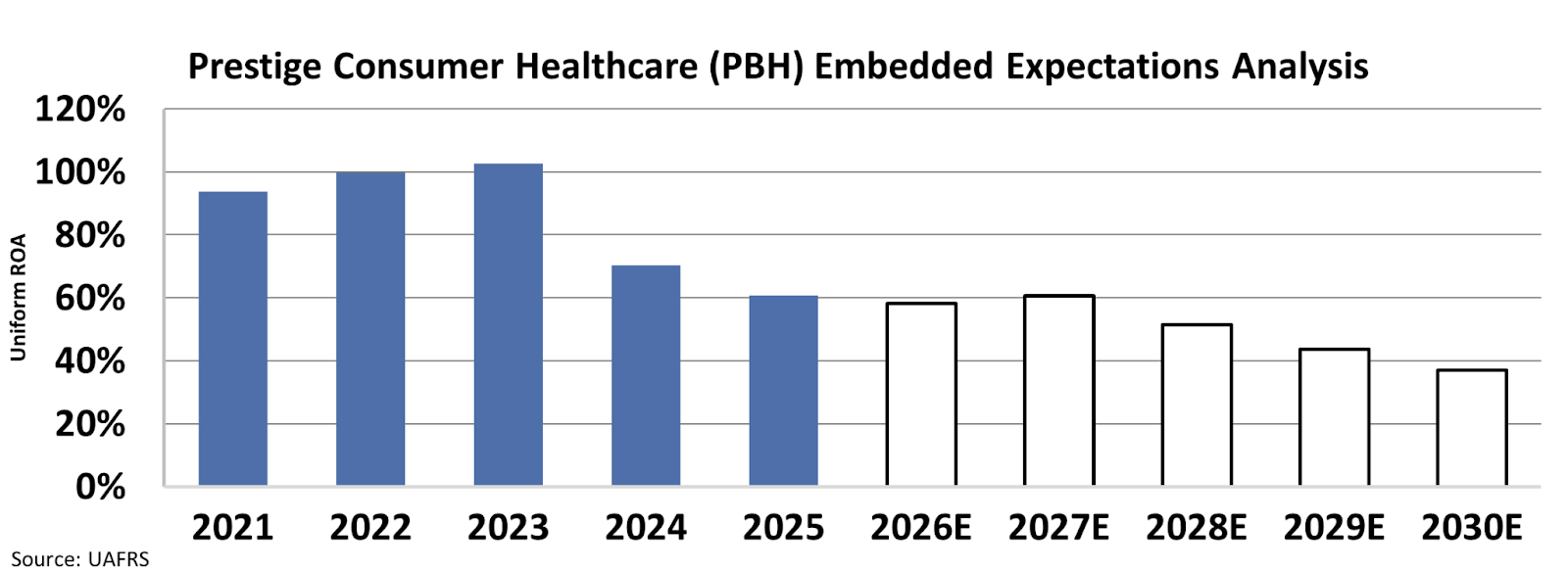

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At its current stock price, the market expects Prestige’s Uniform ROA to decline to 37% by 2030.

If Prestige can successfully capitalize on the forecasted growth of the OTC drugs market and if its recent acquisition pays off, it could provide a compelling opportunity for investors looking for upside in a growing market.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.