Moving hard assets between countries, cities, and other locations will be crucial in the next wave of growth for the U.S. and the economy. Investors in supply chain technologies and private investment in this field are continuously growing. In today’s FA Alpha, Uniform Accounting will reveal the true profitability of Expeditors International of Washington (EXPD), one big player in the supply chain and logistics services.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

The pandemic has unearthed many problems with our infrastructure and supply chains.

End customers faced extended lead times as companies had a hard time getting their hands on the raw materials they needed.

When these customers questioned where their orders have been, they received no certain answer, as these retailers had none.

This is why companies and the government are investing in their supply chains at a pace not seen in the last two decades, and why we have been talking about the Supply Chain Super Cycle.

Even Silicon Valley is admitting that the next wave of growth for the U.S. and the economy will not be asset-lite software firms selling products for developing software.

It is going to be related to hard assets and how these are moved between countries, cities, and neighborhoods.

Both the number of unicorns that provide supply chain technologies and the private investment in this field almost doubled since late 2020. These investments are here to stay for the next decade.

One big player that is in the heart of the supply chain and logistics services is Expeditors International of Washington (EXPD).

Traditionally, the firm has been providing freight services, cargo monitoring, customs brokerage purchase order management, and other supply chain solutions.

Now, they are recognizing that there is going to be big investment and innovation in this space and trying to position themselves for the Internet of Things (“IoT”) supply chain and Supply Chain Super Cycle.

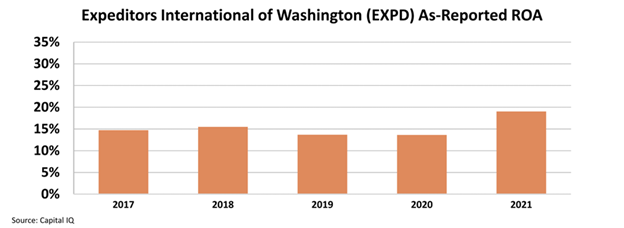

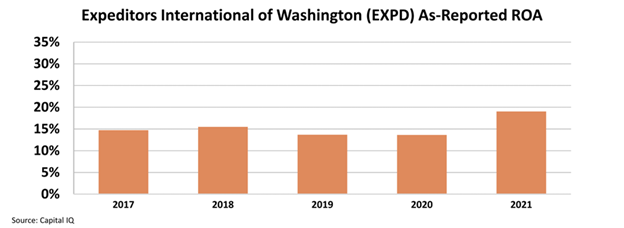

The as-reported metrics show that the company has been generating a return on assets (“ROA”) of around 14%. Its profitability surged to the highest level in the last decade to 19% in 2021.

It may be understandable why they might have been a little slow to the draw, as other logistics companies also see these low ROAs.

However, Expeditors International is no ordinary logistics company. Its peers are decades behind the innovation it has been investing in.

Considering this fact, Expeditors should be an outlier, not just like one of its peers. This can be captured by Uniform Accounting.

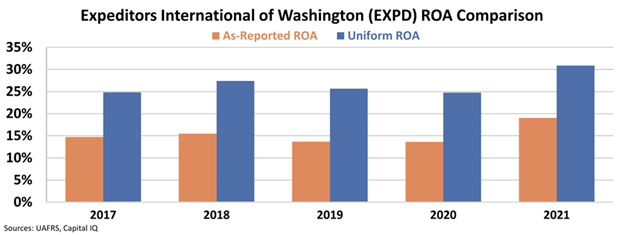

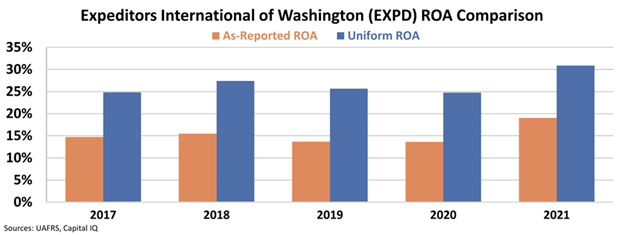

The picture of profitability above is inaccurate. This is because of the distortions in as-reported accounting and can be fixed by making the over 130 adjustments needed under Uniform Accounting.

When we clear the numbers, we see that the ROA in 2020 was not 14%, but a whopping 25%. Similar to the surge in as-reported metrics, Uniform ROA surged in 2021 and reached 31%.

Uniform Accounting successfully reveals that the investments in innovation improved the business and that Expeditors is actually much more profitable than as-reported accounting shows.

The company is well-positioned to benefit from investments in the supply chain space, and it has already started to recognize increased profitability.

As companies need the correct data to make corporate decisions, investors need the correct data to make informed investment decisions.

Investors looking at the as-reported metrics would not be able to see the effects of these investments in innovation and could have the wrong idea about the company.

SUMMARY and Expeditors International of Washington, Inc. CorporationTearsheet

As the Uniform Accounting tearsheet for Expeditors International of Washington, Inc. (EXPD:USA) highlights, the Uniform P/E trades at 20.9x, which is above the corporate average of 18.4x and its historical P/E of 16.7x.

High P/Es require high EPS growth to sustain them. In the case of Expeditors International, the company has recently shown a 95% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Expeditors International’s Wall Street analyst-driven forecast is an 11% EPS growth in 2022 and a 37% shrinkage in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Expeditors International’s $110 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 1% annually over the next three years. What Wall Street analysts expect for Expeditors International’s earnings growth is above what the current stock market valuation requires in 2022 but below its requirement in 2023.

Furthermore, the company’s earning power in 2021 is 5x the long-run corporate average. Moreover, cash flows and cash on hand are 9x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 80bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Expeditors International’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.