The pandemic exposed the vulnerabilities of supply chains. As a result, companies have invested heavily in supply chains and infrastructure to improve supply chain resiliency and flexibility. In turn, more raw materials such as copper and aluminum will be needed for these developments. In today’s FA Alpha, let’s see the true profitability of Arconic Corporation, one of the notable suppliers to the whole Supply Chain Super Cycle.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

The Supply Chain Super Cycle is coming and is set to bring significant changes to how companies operate.

The pandemic has exposed the vulnerabilities in the supply chains of many U.S. companies, which ignored investments in this space for too long.

The supply chain disruptions caused by the pandemic have highlighted the need for companies to have more resilient and flexible supply chains. Now, companies are investing heavily in supply chains and infrastructure to solve these problems.

Thanks to these developments, we are spending more on capital expenditures to build things out.

That means we are going to need more raw materials, especially materials like copper and aluminum.

That is where Arconic Corporation (ARNC) comes into play. The company manufactures and sells aluminum sheets, plates, extrusions, and architectural products all over the world.

In other words, it helps mold aluminum into the shapes and supplies you need to make any kind of material.

These products are provided to a wide array of sectors from transportation to aerospace, and from industrial to packaging markets.

The biggest part of revenues comes from the U.S., however, the company has operations in Russia, China, Hungary, France, and internationally.

Considering that the company is supplying the whole Supply Chain Super Cycle, investors would expect to see its profitability go up as demand increases.

However, as-reported metrics paint a disappointing picture.

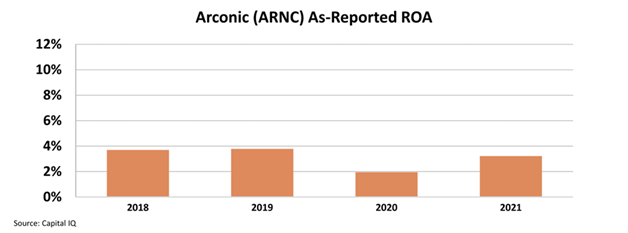

As-reported return on assets (“ROA”) of Arconic fell from just below 4% in 2018 to 2% in 2020, before recovering to around 3% in 2021.

Even though fundamentals show that the products of the company are the building blocks of the economy, it cannot be seen looking at the as-reported metrics.

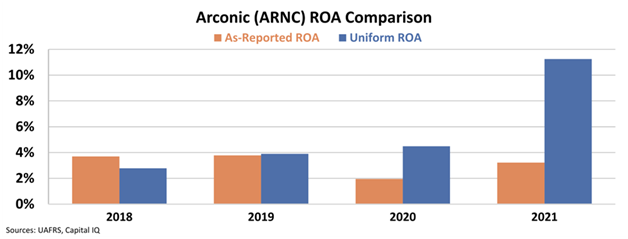

However, the picture of profitability suggested by as-reported accounting is inaccurate.

This is because of the distortions in as-reported accounting. We can fix it by making the over 130 adjustments needed under Uniform Accounting and uncover the real performance of the business.

When we clear the numbers using Uniform Accounting, we see an extraordinarily different scenario.

The Uniform ROA of the company has increased steadily from just below 3% to above 4% in 2020, despite the headwinds caused by the pandemic.

Arconic saw the real boost last year when the Uniform ROA jumped to 11%.

Investors looking at the wrong data would not be able to understand how important the company’s operations are for the supply chain and infrastructure investments.

Supply Chain Super Cycle is just starting. As investments ramp up, Arconic will continue to do what it does best, and enjoy high demand.

SUMMARY and Arconic Corporation Tearsheet

As the Uniform Accounting tearsheet for Arconic Corporation (ARNC:USA) highlights, the Uniform P/E trades at 10.0x, which is below the corporate average of 18.4x but above its historical P/E of 7.5x.

Low P/Es require low EPS growth to sustain them. In the case of Arconic, the company has recently shown a 274% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Arconic’s Wall Street analyst-driven forecast is a 49% EPS shrinkage in 2022 and a 22% growth in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Arconic’s $24 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 22% annually over the next three years. What Wall Street analysts expect for Arconic’s earnings growth is below what the current stock market valuation requires in 2022 but above its requirement in 2023.

Furthermore, the company’s earning power is 2x its long-run corporate average. Moreover, cash flows and cash on hand are 2.2x its total obligations—including debt maturities, capex maintenance, and dividends.

All in all, this signals low credit risk.

Lastly, Arconic’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.