Europe finds itself amidst an energy crisis due to dwindling Russian energy supplies and soaring energy prices. As it looks for gas replacement to meet demand, Europe has turned to the United States, the second-largest exporter of natural gas. This presents a great opportunity for American energy production companies, like Comstock Resources (CRK). However, the market does not seem to be aware of this tailwind and expects the natural gas market to dry out, causing a gross undervaluation of CRK. In today’s FA Alpha Daily, let’s take a closer look at this matter and determine what makes Comstock Resources a great stock pick.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The energy crisis is not over.

While the market is assuming that a warm winter in Europe means everything is fine for natural gas, that is actually not the case.

Russia was a big supplier of natural gas for Europe. More than 50% of the gas Europeans used came from Russia in 2021.

However, its invasion of Ukraine led to Europe’s decision to lower its consumption of Russian energy resources, which made the ratio fall to 13% at the end of 2022.

With Russian natural gas being almost out of supply for Europe, energy prices are still very high, and the continent is still searching for permanent solutions.

Though, it seems like this supply shock has not changed Europe’s sustainability plans. The goal is to use energy sources that are as clean as possible.

That is why the continent is moving away from Russian natural gas but still towards different natural gas providers, and not coal.

Being the second largest gas exporter in the world, the U.S. is ready to step in.

The country’s energy producers pledged to keep pumping natural gas to Europe, as they see a market with very high demand and not enough supply. It didn’t take long for the U.S. to become the largest natural gas exporter like it is today.

One of the biggest beneficiaries of this is Comstock Resources (CRK). It explores and produces a ton of natural gas in the southern U.S.

Thanks to this strong production, the company recognized very high profitability.

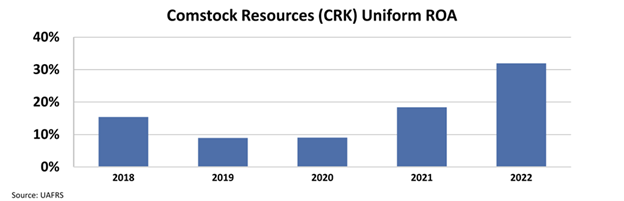

Its return on assets (“ROA”) has been over 9% every year since 2018 and reached 32% in 2022, thanks to high production and prices.

The company has strong positioning and benefits due to the surge in demand and prices.

If demand for American gas continues to be high in Europe, Comstock is likely to sustain these profitability levels or even reach a higher ROA.

But before making an investment decision, let’s understand what the market is thinking about the name to see if we disagree.

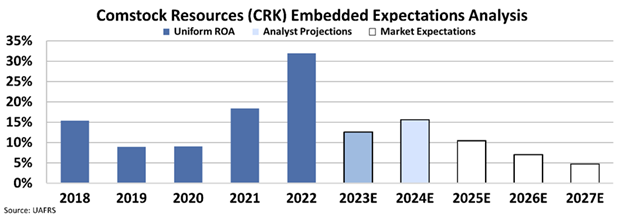

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At today’s price, the market is expecting the company’s ROA to tank to cost of capital levels of 5%.

As we discussed, there are strong tailwinds that will help the company keep its profitability and growth high.

And yet, the market is missing the picture, assuming that the natural gas market is slowly vanishing.

This results in very low valuations and an upside potential for investors.

That is why Comstock Resources showed up on our screen. Its high returns, high growth, sustainability of those, and low valuation make it a great FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Comstock Resources, Inc. (CRK) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.