Technology has transformed the gambling industry, giving rise to simpler yet highly addictive games. Companies like Playtika (PLTK), a company that makes casino “slot” games and more traditional mobile gaming, monetize upsell opportunities for its customers and thrive due to their incredibly addictive games. In today’s FA Alpha Daily, we will examine the profitability of the company and how consumer behavior mitigates the risk of macroeconomic constraints.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Technology has completely changed the world of gambling.

It has enabled companies to develop far simpler but addictive games for people to be attached to during their commute, while watching TV, or doing pretty much anything else.

Likewise, it has opened the door for mobile gambling, be it casino gambling or sports betting. All these things have one thing in common, it has made kings of specific niche businesses.

One example of this is Playtika (PLTK), which makes casino “slot” games and also more traditional mobile gaming, monetizing upsell opportunities for its customers.

The market thinks people will gamble less because they have to tighten their belts in the face of the tight macro environment, but these games are incredibly addicting. As a result, people will be far less willing to give up gambling than other things they spend money on.

Moreover, the fact that it is headquartered in Israel has also led to negative sentiment for its share price. However, a big portion of Playtikas revenue is generated in the U.S. In 2022, U.S. based revenues for Playtika totaled 70% of their total revenues.

Furthermore, the global mobile gambling market is expected to see substantial growth. In 2022, the market reached a total size of $112 billion. It is expected to grow at a CAGR of 15.6% from 2023 to 2029 and reach a value of $267 billion.

Leveraging its strong position in the addictive mobile gaming space, the company has delivered strong profitability recently. Playtika’s return on assets (“ROA”) has averaged 76% in the last five years.

As the mobile gambling market continues to grow, Playtika should continue performing well.

And yet, the market fails to recognize this opportunity.

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall below 10%, assuming the demand will collapse.

Given the growing usage of mobile gambling and the company’s essential position in its supply, these expectations seem overly pessimistic.

Playtika has substantial potential to scale its operations and release new games that will continue to interest the growing number of mobile gambling users.

That is why Playtika showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

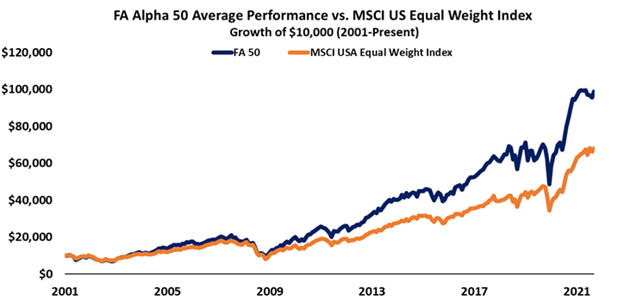

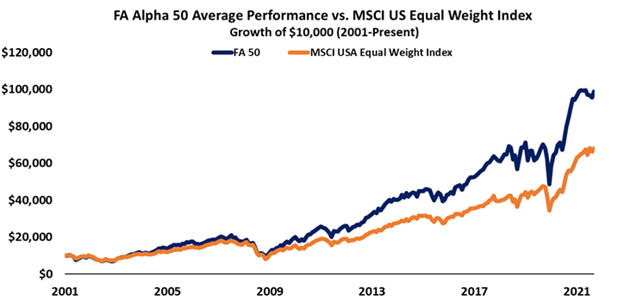

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Playtika Holding Corp. (PLTK) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.