Today, a lot of countries are experiencing high inflation, and raising interest rates is the most common response that can be observed from central banks, including the U.S. Federal Reserve. The combination of elevated inflation and interest rates can weaken income as goods, services, and mortgages will increase. In today’s FA Alpha, we will learn why Cavco Industries’ (CVCO) business model has benefitted from the current high inflation and high-interest rate environment.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Inflation is a global issue nowadays.

Central banks all around the world have different responses to control it, but raising the interest rates seems like the consensus action.

That is what happened in the U.S. also. After lowering the rates to prevent a recession during the pandemic, the Federal Reserve (“Fed”) recognized the rising inflation and took the necessary measures.

In a year, the Fed funds rate reached above 4%. It is expected to raise the rates even higher, as inflation and employment numbers are not quite where it wants them.

Interest rates affect all of us. It makes it harder for corporates to borrow and it dramatically affects their credit structure.

Mortgage rates are also tied to this rate, as banks offer them by adding a spread on top of the rate announced by the Fed.

That is why the average mortgage rate surged from around 3% at the end of 2020 to 7% in 2022.

Families are having difficulties reaching the capital to buy a home, as they do not want to pay that much for debt.

This has made the homebuilding industry suffer. It has slowed down significantly, and the outlook for the near term does not look bright.

However, some people just need to get home. They are either getting married, having kids, or moving. And they need a place to stay at.

The biggest issue is affordability, which is why they prefer manufactured homes more. They are much cheaper than other alternatives.

Actually, these manufactured homes might see less of a decline in demand because of this. The number of houses sold gets lower, but the ones that buy prefer manufactured and cheaper options.

That is where Cavco Industries (CVCO) gets into play. It produces and retails manufactured homes primarily in the United States.

Among its diversified portfolio are factory-built vacation cabins, commercial structures, apartment buildings, hotels, and schools.

Additionally, it provides housing financing for its customers. That is another attraction for customers and makes demand more resilient.

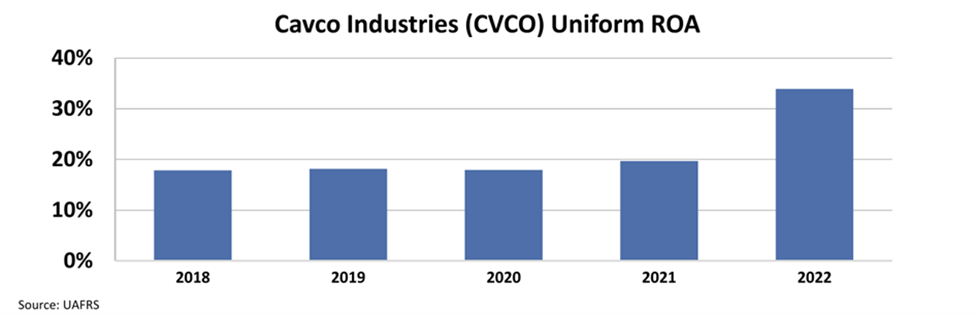

The company has seen its profitability surge last year.

It used to have a Uniform return on assets (“ROA”) of around 20% between 2018 and 2021. In 2022, this number jumped to 34%.

The Fed seems determined to kill inflation and do whatever is necessary. This indicates it might increase rates further, driving higher mortgage rates.

In a high mortgage rate environment, customers will need Cavco’s affordable housing. Demand seems sustainable, and the outlook for the company is clear.

However, the market also seems to reflect its pessimistic ideas about the housing industry to this company. It does not recognize how Cavco differs from all the names in the sector.

Uniform P/B fell from 5.5x to 4x, showing the market’s sentiment. Uniform P/E has also been consistently falling throughout the years, reaching 11.5x in 2022. It was 23x in 2018.

The market’s lack of understanding of the sustainability of its high returns and low valuation means that Cavco Industries is a great FA Alpha 50 candidate.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

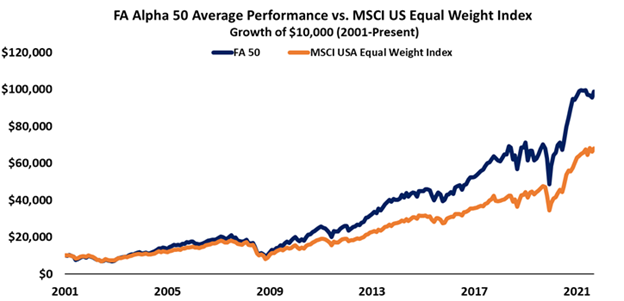

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Cavco Industries’ (CVCO) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.