The SaaS industry is facing its first business cycle decline as VC funds shrink due to rising interest rates and concerns about the industry’s long-term viability mount. Because of this, rating agencies’ bias against SaaS companies led to lower credit ratings for many SaaS businesses. Angie (ANGI), an American home services website that connects homeowners with local professionals, was one of the SaaS companies affected by this bias. In today’s FA Alpha Daily, we’ll look at Angie’s credit risk profile using Uniform Accounting and discuss whether rating agencies were right about the company.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The SaaS industry enjoyed a period of unprecedented growth in the last decade, with many companies commanding extremely high valuation multiples.

However, the macroeconomic headwinds took their toll, and the industry saw a 53% decline in value. This is in contrast to the S&P 500 index, which only declined by 15% in the same period.

It is no surprise that the SaaS bubble came to an end as the Fed’s rate hike policy began.

In fact, many tech companies in the SaaS industry were relying on cheap debt to fuel their growth. So they started struggling to make payments as interest rates rose.

This has led to a number of high-profile bankruptcies in the SaaS industry.

On top of that, the rising cost of debt has made it more difficult for SaaS companies to acquire new customers and expand their businesses.

Profitability is also being hurt by rising interest rates, as companies have to pay more to service their debt.

The combination of slower growth and lower profitability led to a fallout in the SaaS industry, putting pressure on subscription businesses.

However, while SaaS may be on the decline, it doesn’t mean every subscription business is in trouble.

Angi (ANGI) is a great example of this. The company is a home services marketplace that connects homeowners with local professionals to get quotes and hire them for home improvement projects from plumbing to electrical work.

It’s a long-standing platform for contractors, not some high flying tech startup.

For that reason, it currently possesses a very clean financial record, with no upcoming debts. Moreover, it is less likely to experience a significant loss of subscribers since it operates somewhat independently from the major tech industry.

Credit rating agencies, on the other hand, have a different viewpoint, which is largely a result of their bias against the SaaS sector.

S&P gives Angi a “B” rating. This rating suggests a huge likelihood of default, estimated at 24% over the next five years. It also includes the company in the risky high-yield basket.

Given the company’s squeaky clean balance sheet, Angi should have a much safer credit rating.

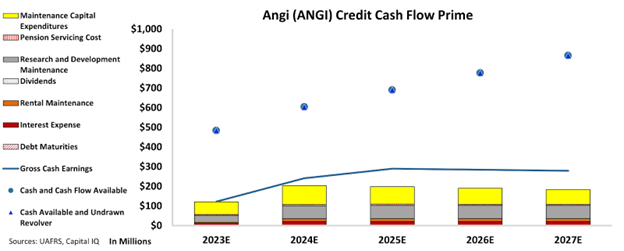

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Angi’s cash flows are more than enough to serve all its obligations going forward.

The chart suggests that the company has a strong financial footing and should be able to meet its obligations without difficulty over the next five years.

Moreover, the company’s large cash reserves and strong cash flow generation give it significant financial flexibility in the event of an economic downturn.

Additionally, the company probably won’t have the same fallout of subscribers since it’s a little outside the big tech industry.

Due to these reasons, our analysis of Angi’s financial statements suggests that the company is not facing a significant chance of default, contrary to the rating agencies’ assessment.

Thus, we are assigning Angi an “IG4+” rating, which places the company in the safer investment-grade basket and implies a default probability of around 2%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Angi Inc.(ANGI:USA) Tearsheet

As the Uniform Accounting tearsheet for Angi Inc.(ANGI:USA) highlights, the Uniform P/E trades at 59.7x, which is above the global corporate average of 18.4x and above its historical P/E of 40.2x.

High P/Es require high EPS growth to sustain them. In the case of Angi, the company has recently shown a 86% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Angi’s Wall Street analyst-driven forecast is for a -85% and -292% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Angi’s $3 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was below the long-run corporate average. Moreover, cash flows and cash on hand are 3x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 300bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, Angi’s Uniform earnings growth is below its peer averages and is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Angi Inc’s (ANGI) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.