Private credit is booming, and Apollo Global is leading the charge. As traditional lenders pull back, Apollo is stepping in and quietly transforming the future of finance. In today’s FA Alpha Daily, we delve into Apollo’s rise through private credit, smart strategy, and growth.

FA Alpha Daily

Powered by Valens Research

For decades, the biggest fortunes in finance were made by hedge fund titans, private equity giants, and corporate raiders.

These were the high-profile dealmakers who dominated public markets, making headlines with their bold trades and leveraged buyouts.

However, a quiet group is accumulating wealth today.

According to Bloomberg’s latest Billionaires Index, some of the fastest-growing fortunes in finance are no longer tied to hedge funds or private equity.

Instead, the new money-maker is the once-overlooked private credit, a booming sector where firms lend directly to businesses, bypassing traditional lenders such as banks and bond markets.

The numbers tell the story… private credit assets have tripled in a decade, reaching $1.6 trillion.

Apollo Global Management (APO) has established itself as a leader in alternative investments, managing portfolios across private equity, credit, and real assets.

Apollo has shown remarkable earnings growth, especially in its private credit segment, which has benefited significantly from higher interest rates in the current economic environment.

This emphasis on private credit has positioned Apollo favorably compared to competitors like Blue Owl Capital (OWL) and Ares Management (ARES), who haven’t capitalized on the private credit boom to the same extent.

The company attracted $150 billion in inflows and generated $220 billion in originations last year, with a substantial portion coming from its private credit operations.

Assets under management (AUM) reached an all-time high of $750 billion.

Private credit has become Apollo’s crown jewel, with the segment showing extraordinary resilience even during market downturns.

As traditional lending sources have pulled back, the firm has stepped in to fill the void, offering financing solutions to companies unable to access public markets or traditional bank loans.

This counter-cyclical approach to lending has enabled Apollo to generate consistent returns regardless of broader market conditions.

Moreover, the firm is set to benefit significantly from potential regulatory changes allowing investment-grade private credit to be included in retirement accounts, such as 401(k) plans.

This could unlock a massive market potentially worth trillions of dollars, providing Apollo with a vast new pool of capital to manage.

Given the firm’s already well-established presence through Athene, its annuities and retirement solutions arm, the company is strategically positioned to capitalize quickly on these regulatory shifts.

Apollo’s management has laid out clear and ambitious growth targets, aiming for approximately 20% annual growth in fee-related earnings (FRE) and around 10% in spread-related earnings (SRE).

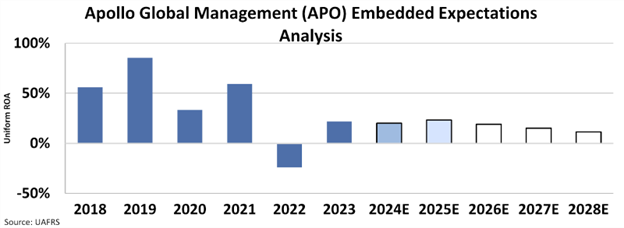

All these factors enabled the firm to achieve a strong 22% Uniform return on assets ”ROA” last year.

Despite this strong performance, the stock trades at a 22x Uniform P/E, reflecting the market’s concerns due to regulatory scrutiny, financial market volatility, and a changing funding landscape.

Our EEA model clearly shows this.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the firm’s Uniform ROA to decline to 11% from 22% last year.

Beyond private credit, Apollo sees promising growth potential in infrastructure investments across energy, infrastructure, and data sectors, as well as increased demand from individual investors alongside institutional clients.

These complementary strategies provide additional growth opportunities, further reinforcing the firm’s diversified yet targeted approach.

Apollo’s robust private credit division, coupled with its strategic readiness for new regulatory opportunities and diversified investment capabilities, strongly positions the company for continued success, even amid broader market uncertainties.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.