The aviation industry relies on specialized electronic systems that ensure flight safety and passenger comfort. Astronics (ATRO) has long supplied these systems to major manufacturers, but its performance slipped amid Boeing’s production setbacks. Now, with aircraft deliveries recovering and demand for passenger planes rising, Astronics is regaining momentum. In today’s FA Alpha Daily, we explore how this aerospace equipment maker’s turnaround could present meaningful opportunities for investors.

FA Alpha Daily

Powered by Valens Research

Commercial aircraft rely on complex electronic systems that enable safe and efficient operations. These systems not only provide pilots with critical navigational data but also deliver in-flight entertainment and comfort features for passengers throughout their flights.

Due to the complexity involved in designing, developing, and installing these electronic systems, aerospace companies such as Boeing (BA) and Airbus (AIR) partner with specialized equipment manufacturers to secure the components needed for the construction and installation of these complex electrical systems.

Astronics (ATRO) provides electronic equipment for both commercial and military aircraft.

The company provides a wide array of equipment and related solutions, including aircraft power systems, connectivity and data management, exterior and interior lighting, safety systems, cabin interiors, and other related equipment.

Astronics has generated most of its returns by providing equipment to Boeing and Airbus, among other companies in the aerospace market. Furthermore, the firm has secured a 90% market share in the aerospace segment. And as of 2024, 66% of the company’s total sales came from the commercial transport market.

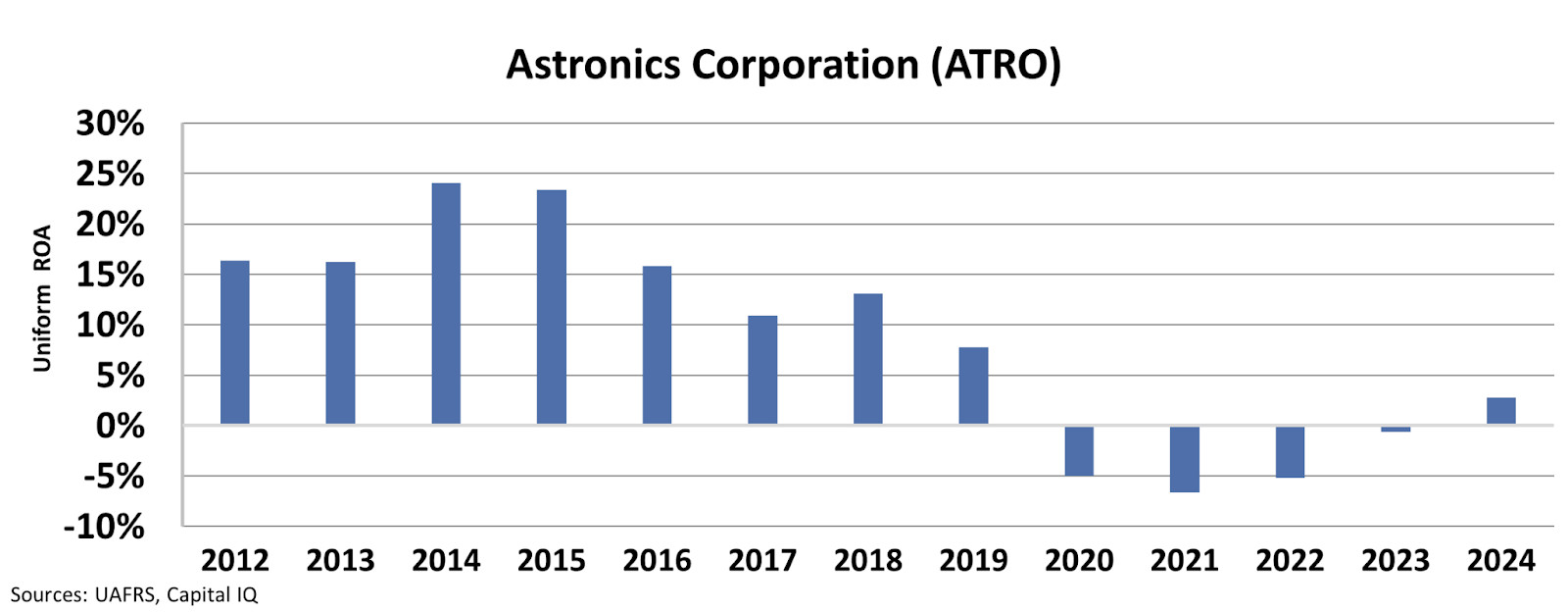

From 2012 to 2019, the company generated stable returns. However, that changed when Boeing—a key customer—began facing problems related to its next-generation passenger aircraft.

The 737 Max, a next-generation model of the flagship 737 passenger plane, was grounded in 2019 by the U.S. Federal Aviation Administration and other global regulators after two crashes in 2018 and 2019 that led to passenger and crew deaths in both flights.

Commercial flights for the 737 Max were halted until December 29, 2020. Four years later, in January 2024, 171 Boeing 737 Max 9 aircraft were grounded following an incident in which a passenger plane lost a door plug mid-flight.

These incidents resulted in both increased regulatory scrutiny for Boeing and significant production slowdowns for its 737 Max aircraft as it went through additional safety checks and inspections.

The FAA also imposed a 38-plane-per-month production cap on the 737 Max aircraft, a restriction that continues to remain in place.

As a result, Boeing’s aircraft deliveries nosedived beginning in 2019, falling to just 380 planes delivered. Deliveries plummeted further to 157 planes in 2020 before recovering to 340 in 2021, 480 in 2022, and 528 in 2023. While production has trended upward since 2020, these numbers remain well below Boeing’s pre-2019 average of over 740 deliveries annually from 2013 to 2018.

This production slowdown cascaded down to Boeing’s supply chain and the equipment manufacturers it worked with. And as Boeing’s production slowed, Astronics’ profitability declined accordingly.

After generating an average Uniform return on assets (“ROA”) of nearly 16% from 2012 to 2019, Astronics saw its Uniform ROA plummet to -5% in 2020 and remained negative until 2023.

After years of negative returns, Astronics’ prospects are finally improving. This recovery is being driven by Boeing’s improving aircraft shipments and strong demand for passenger planes.

Following its safety issues, Boeing delivered around 760 planes per year. This plummeted to 380 in 2019 and just 157 in 2020. Since then deliveries have trended upward and the company expects to deliver 570 planes this year, its most since 2018.

As a result of this rebound, Astronics’ returns returned to positive levels in 2024. If Boeing can maintain safety standards and continue to increase its production, Astronics will benefit, and investors could be rewarded.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.