The United States government has a large amount of debt, and Congress is debating whether to raise the debt ceiling to allow the government to borrow more money to pay its bills. The Republican Party wants to cut spending to reduce the debt, while the Democratic Party wants to raise more taxes. The debt ceiling will likely be raised after a long and contentious debate, but both sides appear to be using this as a bargaining chip. In today’s FA Alpha Daily, let’s delve deeper into this matter and see how it can significantly impact the future of the U.S. economy.

FA Alpha Daily:

The Monday Macro Report

Powered by Valens Research

The U.S. is as safe of a borrower as ever.

In the news, the main story about the debt ceiling is whether it will be increased so the U.S. can borrow more.

However, we also need to discuss the government’s ability to pay its current debt obligations, since that’s relevant to whether or not we ought to raise our borrowing limit.

There’s a simple reason not to worry – the U.S. still remains a global superpower. The U.S.’ positioning in the world hasn’t changed.

We are still spending more on research and development (“R&D”) as a percent of GDP than Europe and China. And that’s leading to a consistent stream of innovations, exporting high-tech and energy products.

As of 2020, U.S. companies had over three times more innovation assets on their balance sheets than China.

American businesses are set up to benefit from the supply-chain supercycle as there’s strong demand for goods and services coming out of the pandemic.

The U.S. is the largest public market by far. Almost 60% of the total equity market value of the world is in the U.S. The next closest country is Japan at 6%.

As a result, U.S. companies are propelling the country upwards and leading us to future success.

This makes the U.S. dollar (“USD”) strong. It is still the world’s reserve currency, despite people worrying it won’t be. Countries have to deal in USD to participate in world markets, increasing the U.S.’ ability to borrow.

Additionally, when we look at the U.S.’ debt and income like financial statements, we can see the U.S. can easily handle its debts.

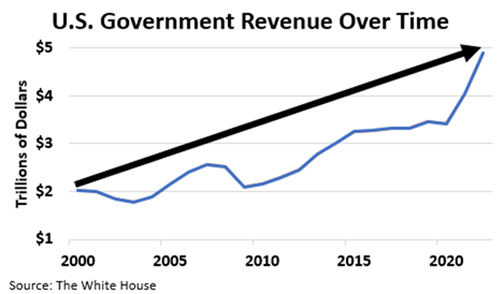

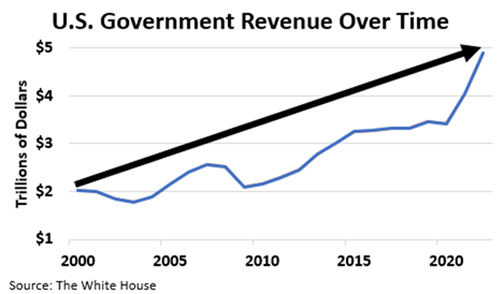

Specifically, the U.S. can spend less than it collects because its tax revenue continues to rise. It hit $4.9 trillion in 2022.

Take a look.

On the other hand, when looking at the expense side, it can easily afford the annual cost of its debt. In 2022, this was $420 billion, and this shouldn’t rise considerably, even as interest rates have soared this year.

Even if the U.S. did get to the point where we struggled to continue making debt payments, it has plenty of assets it could sell.

There are over $400 trillion worth of government assets to be used as collateral.

Therefore, the U.S. can afford its debt.

There’s no reason for the U.S. to go default in the short-term, and worries are out of place. We’re just a few weeks away from the June 1 debt ceiling headwall, and we don’t think there’s any reason to worry that we’ll fail to reach an agreement.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.