The pandemic has caused widespread lockdowns, forcing people to adapt to new ways of living, including shopping online, socializing through apps, and working remotely. As a result, there has been a shift towards more comfortable and casual attire, with Crocs emerging as a leading brand in the footwear industry. This is due in part to their successful rebranding efforts and collaborations with Gen Z and popular artists. Despite their impressive performance, Crocs’ stock trades at lower multiples compared to the market average, indicating a growth potential. In today’s FA Alpha Daily, we will discuss Crocs’ impressive growth and how the market may not fully recognize the company’s sustainable high returns.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

One of the biggest impacts of the pandemic was undoubtedly making everyone stay inside their houses for months.

Everyone was alone for work or study, and it was viewed as risky to even go out to meet friends and have a cup of coffee.

Life had to go on somehow, and we adapted. We bought essentials online, found apps to socialize, learned through Zoom (ZM), and started working remotely. It was the At-Home Revolution.

People quickly adapted to a more relaxed business casual type of attire. A button-down shirt and shorts below the camera became the norm.

This pushed a very clear shift in apparel demand. Customers became more casual and wanted things that were comfortable, easy to wear, and clean.

Many think the biggest winner was Lulu (LULU) and their leisurewear. One might argue it was really the footwear company Crocs (CROX).

Even before the pandemic, the company was trying out new marketing strategies to communicate better with Gen Z. It had started rebuilding the brand through collaborations with many designers.

It even worked with artists such as Justin Bieber and Post Malone, giving the company more demand from the new generation.

The pandemic scaled this success amazingly. Sales and margins really took off when people embraced a world where wearing Crocs became normal for daily use.

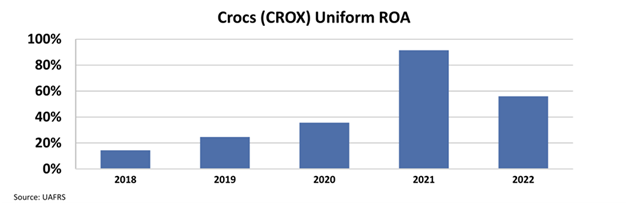

The chart below shows the story. Croc’s Uniform return on assets (“ROA”) was already rising before the pandemic and increased from 14% in 2018 to 36% in 2020.

But the surge from 2020 to 92% in 2021 was something else. That reflects how the demand changed in only one year.

Crocs managed to sustain high returns in 2022, with ROA still above 55%.

That is a big success story. The company took the right steps and was ready for the flood of demand.

However, the market does not seem to realize how sustainable this surge in profitability is.

Trends in apparel take time to change. There needs to be a significant catalyst for customer preference to change, and the pandemic was just that.

Working from home and the new, more casual lifestyle is going nowhere. Crocs will benefit from this shift for years to come.

And yet, the market is trading the stock at only a 12.8x price to earnings (“P/E”), way below the market average.

The market doesn’t think its high profitability will be sustainable and doesn’t realize the impressive growth, leading this name to be undervalued.

This makes Crocs a classic FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

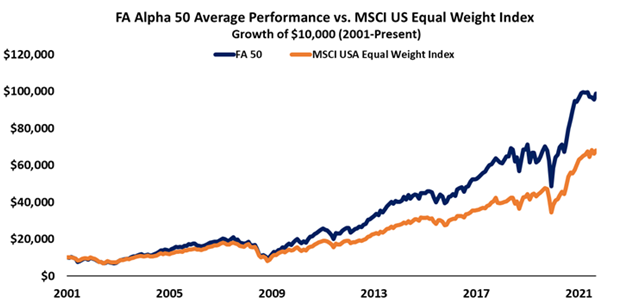

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Crocs, Inc. (CROX) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.