The supply-chain supercycle has begun and Steel Dynamics (STLD), one of our FA Alpha 50 picks last August, has continued to outperform the market in the last few months. Despite this, we believe there is still a huge upside for the company. In today’s FA Alpha, we take a deep dive into Steel Dynamic’s financials and valuations and discover how much upside this company has in the near future.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

We highlighted Steel Dynamics (STLD) back in August in FA Alpha 50 as our pick, and the stock has been up 22% since.

This was not by chance but because we saw the trend that the market failed to recognize – the supply-chain supercycle.

The pandemic and geopolitical crises made people realize how underinvested we are in infrastructure and supply chains. Lead times were extended, orders were canceled, and manufacturers could not get their hands on the raw materials needed.

Now, the U.S. and the rest of the world are trying to catch up and make up for years of ignoring this space. Companies are bringing their manufacturing facilities home, energy infrastructure is being renewed, and supply chains are becoming more resilient.

Nearly all of these investments require the products of Steel Dynamics, which operates as a steel producer and metal recycler.

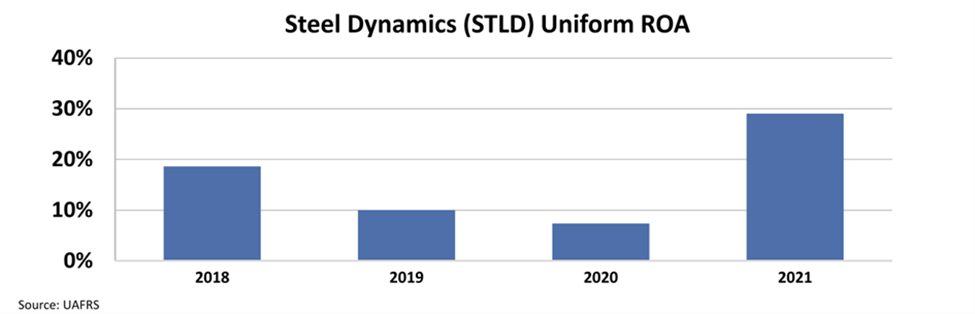

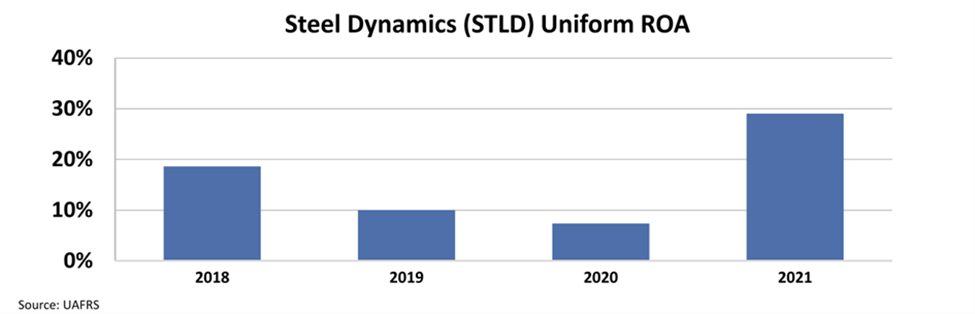

The booming demand as a result of the supply-chain supercycle explains the surging profitability in the last year. Its Uniform return on assets (“ROA”) jumped from cycle low 7% levels in 2020 to 29% in 2021.

As investments in infrastructure continue, Steel Dynamics should enjoy sustained high profitability. The market started to realize this, but we think the stock still has a lot more upside potential.

As we rebuild and renew our supply chains and industry, Steel Dynamics is going to keep providing steel to a wide range of customers.

ROA is sky-high, and the growth is strong, but the market still does not completely understand the size of the opportunity.

The stock is currently trading at an 8.2x price-to-earnings (P/E) ratio. Even though the ratio is slowly improving from its rock bottom levels of 3.3x during the pandemic, there is still a huge way up to historical averages of 16x.

The company is already one of the biggest suppliers in the space. If it manages to sustain its position in the market, it can enjoy even more demand for its products and massive profitability.

The high quality, impressive returns, strong growth, and low valuation make Steel Dynamics an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

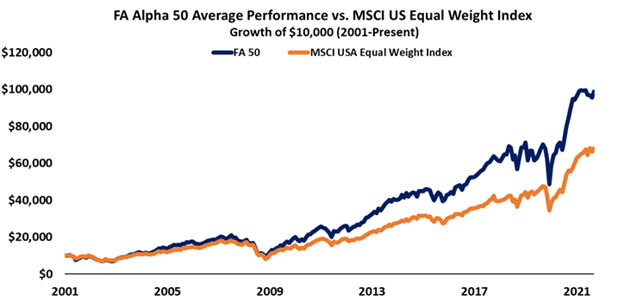

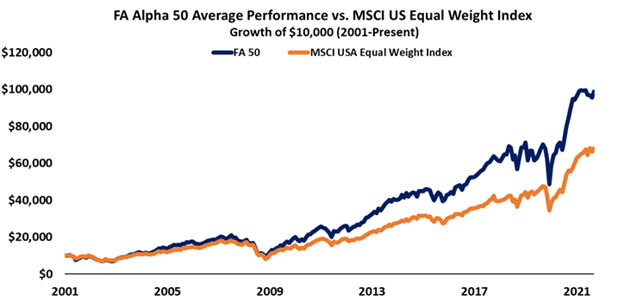

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Steel Dynamics, Inc. (STLD) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.