Evidenced by recent successes in delivering blockbusters, Warner Bros. Discovery’s robust IP library provides itself an edge over other media giants. Hits like the “Barbie” film and the “Hogwarts Legacy” gaming venture have boosted its position in the fiercely competitive media landscape. In today’s FA Alpha Daily, let’s take a look at Warner Bros. using Uniform Accounting to determine its true profitability that the market has failed to recognize.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Media is a competitive industry.

The top companies can’t rest on their laurels… they need to keep finding ways to make money. That’s especially true when it comes to movies and TV series. You only make money as long as people are watching.

Naturally, that means all content has a shelf-life. So, the biggest media companies are vying for the rights to top movies and series.

Once a company begins to lose out on the content that people are lining up to watch, they lose their competitive edge, and ultimately, their performance and growth follow suit.

Investors pay attention to these platforms’ performance and growth. Once they begin to slow down on their ability to contract top productions, they lose their attractiveness.

However, one company has stood the test of time and has remained a solid force within the space: Warner Bros. Discovery (WBD).

Warner Bros Discovery used to be known as Warner Media – an American multinational mass media and entertainment conglomerate. It was a subsidiary of AT&T before being merged with Discovery to create a new, standalone media company.

The company is involved in the creation, production, distribution, licensing, and marketing of various forms of entertainment and news.

Despite Warner’s low market capitalization compared to other competitors like Disney (DIS), Netflix (NFLX), and Amazon (AMZN), it arguably has among the strongest intellectual property libraries in the entire space.

It has the rights to Hollywood darlings such as Harry Potter, The Lord of the Rings, Game of Thrones, and the DC cinematic universe, and it’s constantly looking for the newest content they know people will love.

Most recently, in July, Warner brought the Barbie movie to the big screen and raked in almost $1.4 billion in global box office sales: its best-performing movie ever.

Warner utilizes its intellectual property to have a big role in the gaming industry as well. Most recently, it released Hogwarts Legacy, a game based on the world of Harry Potter.

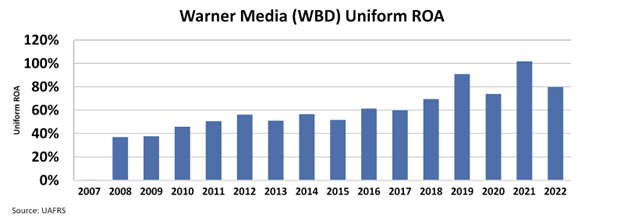

This impressive content creation has translated into a strong Uniform return on assets (“ROA”) performance as well. ROA for Warner averaged 86% between 2019 and 2022.

The chart shows that the company has been performing incredibly well. Warner’s growing backlog of unrivaled IP will continue to allow the company to grow.

And yet, the market fails to recognize this opportunity.

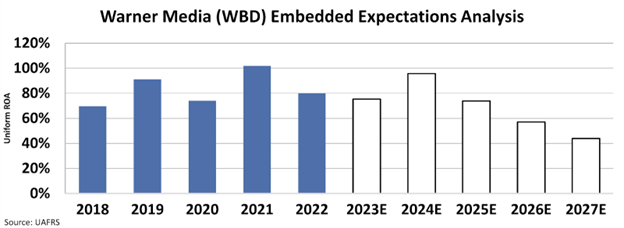

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall to 41%.

Investors think Warner is doomed to lose its competitive edge and profitability.

So far, the company has not shown any signs of slowing down. If it can keep adding content to its backlog while keeping ROA where it is, the stock may not deserve to be as cheap as it is.

Ultimately, the company has substantial upside for a company that the market deems to be losing its competitive edge.

That is why Warner showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

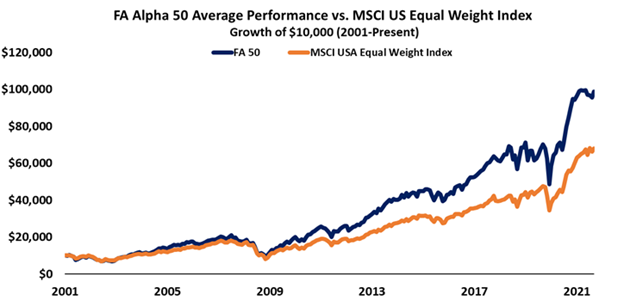

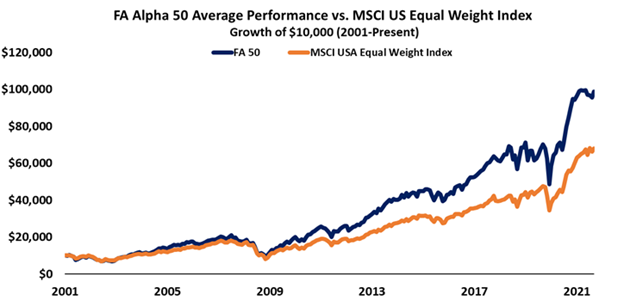

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Warner Bros. Discovery, Inc. (WBD) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.