Remote work and digital nomads have caused low rental demand for office spaces even after the pandemic, leading to office lessors defaulting on their debt obligations. As this trend continues, office spaces and towers will soon join the list of risky assets, and companies such as Boston Properties which owns many class-A offices in major cities in the U.S. will suffer. In today’s FA Alpha, we will discuss how the market is still bullish on Boston Properties, even if its market is experiencing slow demand.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

Office landlords have been struggling for a long time.

First, it was the pandemic. Suddenly, everybody was stuck at home.

Companies adapted to tools for communication and people got used to working remotely from home.

Landlords could not wait for the pandemic to end and for the people to come back to their 8 am to 5 pm schedules.

But it turns out, people liked staying home. It gave them more flexibility, more time with family, and less time wearing suits.

According to surveys, employees are saying they have less stress, more focus, and a better work-life balance.

That was the second disaster landlords faced. People were not coming back.

Companies that did not become fully remote adopted the hybrid working model. Now, workers show up at the office only 1.5 days a week on average.

It seems like working from home is going to be here for a lot longer and that is very bad news for office landlords.

They are starting to default on their obligations because of these huge challenges.

According to Wall Street Journal, five to ten office towers each month join the list of properties at risk of defaulting because of low occupancy, expiring leases, or maturing debt.

Some big investment managers already experienced defaults on huge mortgages.

One of the names that struggle is Boston Properties (BXP). It is the largest publicly-held owner of class-A office properties in the U.S.

It is mostly concentrated in New York, Boston, Los Angeles, San Francisco, and Washington DC.

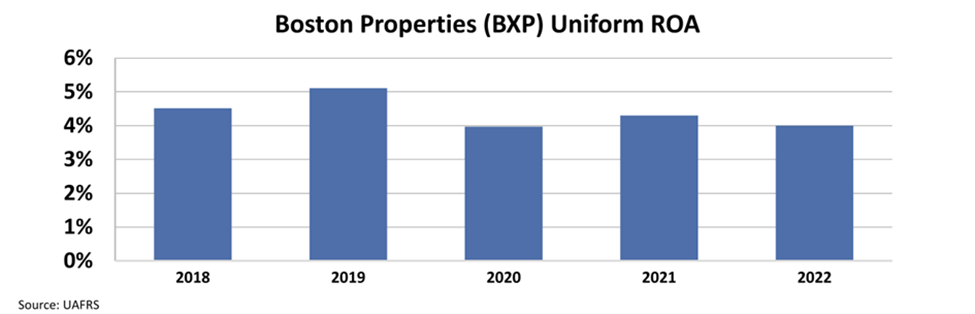

For years, it has been a very stable business. Its return on assets (“ROA”) has been moving slightly above 4% for the last decade, before falling to 4% in 2020 because of the pandemic.

With the recent news in the office space, one would expect this profitability to go down even further. Landlords are having problems keeping their office spaces leased.

However, the market has different ideas.

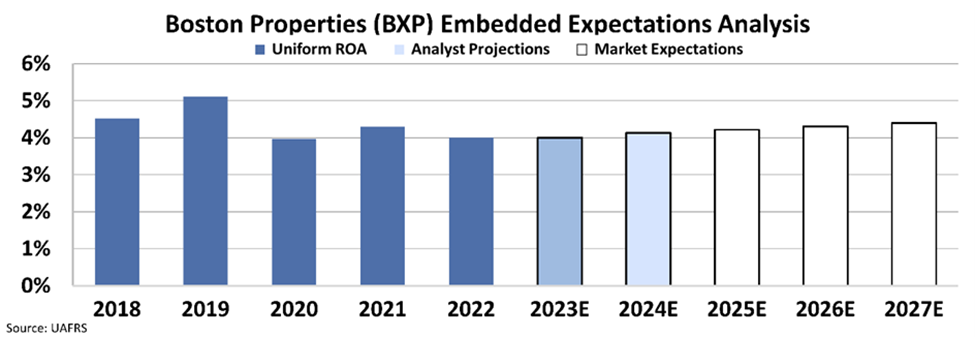

By utilizing our Embedded Expectations Analysis (“EEA”) framework, we can see what is expected from Boston Properties using its current valuation.

Our EEA starts by looking at the company’s current stock price. From there, we can calculate how the market thinks the company will perform in future years. Then, we can see if those expectations make sense or not.

At the current price of $70 per share, the market seems hopeful that ROA will be flat, even slightly up compared to the last two years.

Even after the stock’s massive 46% fall in 2022, the name still trades at high valuations.

The market believes Boston Properties will be able to keep its profitability high regardless of what is happening in the office space. That expectation seems a bit rosy.

Considering the sustainability of working from home, escalating defaults, and vacancy rates, there might be more room to fall.

SUMMARY and Boston Properties CorporationTearsheet

As the Uniform Accounting tearsheet for Boston Properties (BXP:USA) highlights, the Uniform P/E trades at 26.6x, which is above the corporate average of 18.4x but below its historical P/E of 34.3x.

High P/Es require high EPS growth to sustain them. In the case of Boston Properties, the company has recently shown a 53% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Boston Properties’ Wall Street analyst-driven forecast is a 118% EPS growth in 2022 and a 61% EPS shrinkage in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Boston Properties’ $70 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 7% annually over the next three years. What Wall Street analysts expect for Boston Properties’ earnings growth is above what the current stock market valuation in 2022 but below its requirement in 2023.

Furthermore, the company’s earning power is below its long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 190bps above the risk-free rate.

All in all, this signals low dividend risk.All in all, this signals high dividend risk and moderate credit risk.

Lastly, Boston Properties’ Uniform earnings growth is above its peer averages but below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.