Despite the huge recovery in many markets, commercial real estate investments (REITs) have continued to greatly underperform. With the “At Home Revolution”, it seems as though this industry may not fully recover anytime soon. However, our analysis shows otherwise. In today’s FA Alpha, we look into Vornado (VNO) through the lens of Uniform Accounting and Embedded Expectations Analysis (EEA) to determine if this industry is truly on its path to recovery.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

After two years, most of the impacts of the pandemic are behind us. Children are back at school, employees have started to go to the office, and we can enjoy restaurants again.

However, one market has lagged pretty much all the others in getting people back in the office. That is the concrete jungle of New York.

While the city is packed with people and tourists just like pre-pandemic times, the inside of offices are still different…

New York is still missing 176,000 jobs which have failed to return after the pandemic.

This is because of one of the big themes we have been talking about for two and a half years, the “At Home Revolution”.

This big trend has changed how people work, especially in a place with the biggest commute problems such as New York.

Additionally, the city has a very knowledge-based work environment. That means employees easily find the power to push back against the call to the office.

Big losers of this are restaurants and culture spots that are used to supply this demand, but there is an even bigger loser.

Commercial real estate investment trusts (“REITs”) have been having the hardest time after people started moving to suburbs and heavily concentrated companies like Vornado (VNO) have suffered.

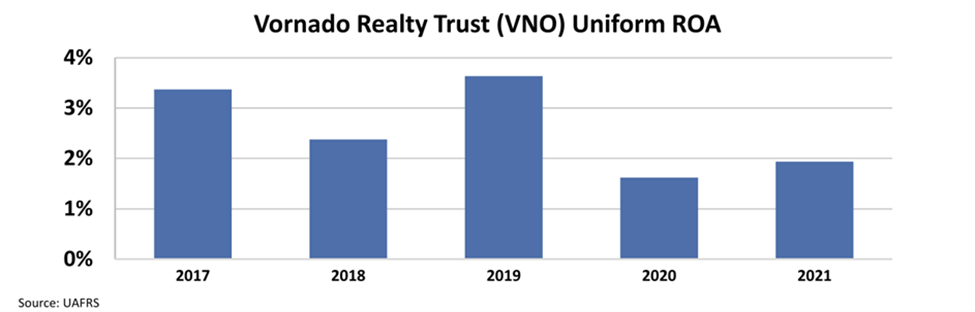

The Uniform return on assets (“ROA”) of the company tanked with the pandemic, dropping from nearly 4% in 2019 to below 2% in 2020. 2021 has not been a very good year for recovery and the ROA stayed at 2%.

While New York looks like it is not going to recover soon, the market has different ideas for Vornado.

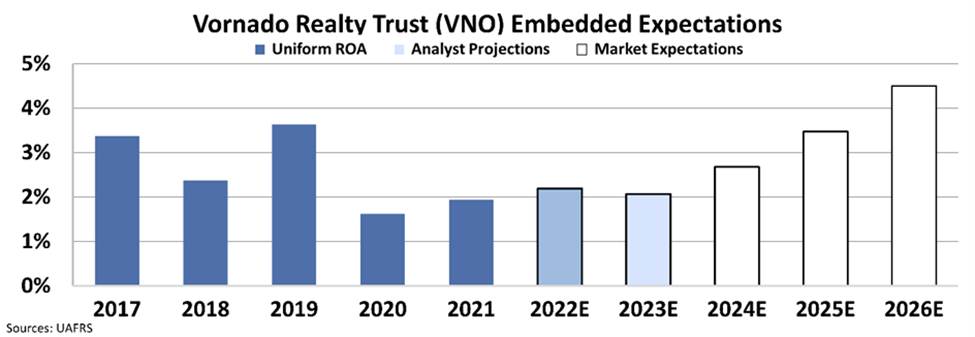

By utilizing our Embedded Expectations Analysis (“EEA”) framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow (“DCF”) model, which makes assumptions about the future and produces the “intrinsic value” of the stock.

We know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

At around $24 price levels, the market expects the company to have a Uniform ROA of nearly 5%, jumping massively from the current 2% level. Meanwhile, analysts expect the company to sustain its profitability, with ROA staying at 2%.

Considering the At Home Revolution and the very slow recovery of New York City, it looks like Vornado will have a hard time living up to expectations.

SUMMARY and Vornado Realty Trust Tearsheet

As the Uniform Accounting tearsheet for Vornado Realty Trust (VNO:USA) highlights, the Uniform P/E trades at 50.2x, which is above the global corporate average of 18.9x, but below its own historical P/E of 65.3x.

High P/Es require high EPS growth to sustain them. In the case of Vornado Realty Trust, the company has recently shown a 112% decline in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Vornado Realty Trust’s Wall Street analyst-driven forecast is a -182% and -604% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Vornado Realty Trust’s $24 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 19% annually over the next three years. What Wall Street analysts expect for Vornado Realty Trust.’s earnings growth is above what the current stock market valuation requires through 2023.

Furthermore, the company’s earning power in 2021 is below the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 130bps above the risk-free rate.

All in all, this signals high dividend risk.

Lastly, Vornado Realty Trust’s Uniform earnings growth is below its peer averages, but above with peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.