Indexes suffer from a fatal flaw and it is the larger cap tech sector’s awful 2022 which clearly pushed the index into a bear market. But when we dig into the data, lots of industries did well in 2022. And many of them are set to continue that momentum this year. In today’s FA Alpha, we’ll look at a chart to get a feel for the market’s performance through something called the S&P 500 Equal Weight Index.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

There has been a great deal of ink spilled about how we entered a bear market last year… and about how stocks came crashing down from their phenomenal performance in 2021.

The Nasdaq Composite Index was down 35% from its all-time high at the end of 2022. Even after a strong January rally, it’s still down about 27% from its peak. The tech sector’s awful 2022 has clearly pushed the index into a bear market.

Likewise, the S&P 500 Index finished the year down 19% – though it fell as much as 25% from its peak. Today, it’s still down about 15%.

Looking at those numbers, it seems obvious that the market took a turn for the worse in 2022. However…

What if I told you that stocks didn’t actually have a bad year?

As we’ll explain today, these indexes suffer from a fatal flaw… and it’s making last year’s performance look a lot worse than it should.

When you dig into the data, you’ll see that lots of industries did well in 2022. And many of them are set to continue that momentum this year.

The world’s biggest companies tanked the overall performance of major indexes. You see, the major indexes are what’s called “market-cap weighted.” That means companies with a larger market cap have a larger effect on the whole index.

And that’s why the underlying performance of the stock market hasn’t been as terrible as it seems on the surface.

For example, let’s look at two companies in the S&P 500 – tech giant Apple (AAPL) and air carrier Delta Air Lines (DAL). Apple has a market cap of more than $2 trillion. Delta’s market cap is only about $25 billion.

If both stocks climb 5% in a day, Apple’s rise has a 100 times bigger impact than Delta’s.

You’ve probably realized the problem by now… It so happens that most of the very biggest companies are tech giants. And tech had a difficult 2022.

Fortunately, there’s another way to get a feel for the market’s performance. We can do this through something called the S&P 500 Equal Weight Index. Rather than weighting companies by market cap, it assigns every company a 0.2% weighting.

This ensures it’s not biased toward megacap tech titans like Apple (AAPL) and Microsoft (MSFT).

The index bottomed out last September, down about 22%. It closed the year down 13%. Even more impressively, it’s only down 8% since the start of 2022.

Take a look at the following chart. It shows the 2022 performances of the Invesco S&P 500 Equal Weight Fund (RSP) – which tracks the equal-weight S&P 500, as well as the SPDR S&P 500 Fund (SPY) – which tracks the standard S&P.

As you can see, the equal-weight fund recorded minimal losses in 2022. The market-cap weighted fund performed much worse…

The point is simple. It’s not that the entire market tanked in 2022. In fact, tech, one of the sectors that led the way for years, accounted for most of the losses. For the first time in a long time, gains weren’t all-but-guaranteed.

If you picked good companies last year, you still could’ve done much better than the market.

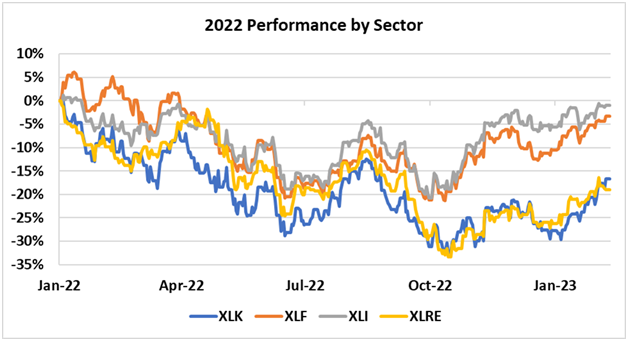

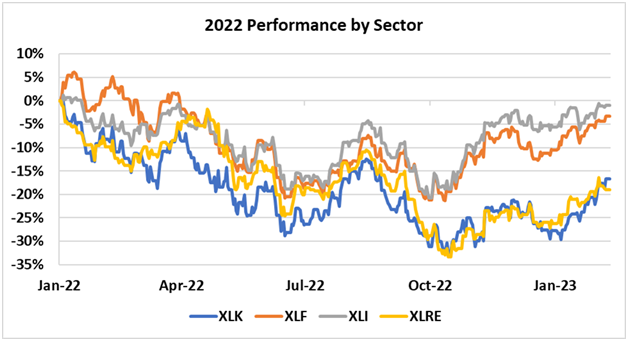

Not every sector had a horrible year. Tech and real estate struggled in 2022 for obvious reasons. Higher interest rates wiped out valuations, venture-capital lending disappeared, and slowing growth crushed expectations.

We can see this through a number of exchange-traded funds (“ETFs”)… like the Technology Select Sector SPDR Fund (XLK) and the Real Estate Select Sector SPDR Fund (XLRE), which track a basket of tech and real estate stocks, respectively.

Both funds are currently down around 19% from their highs. And both bottomed more than 33% below their peaks last year.

On the other hand, rising interest rates actually benefited the financial sector. Financials can make more money when interest rates are high. We also haven’t seen waves of defaults, which would be troublesome for them

Industrials had a good year, too, because of the “supply-chain supercycle” – which we’ve been talking about since mid-2021. It’s our term for the massive wave of investment in U.S. infrastructure as we bring our supply chains closer to home.

The Financial Select Sector SPDR Fund (XLF) is only down about 4% since its peak. And the Industrial Select Sector SPDR Fund (XLI) remains near its December 2021 highs.

Take a look…

The same headwinds that hurt real estate and tech are the key drivers that allowed financials and industrials to outperform. To make money in today’s markets, you don’t have to worry about where all stocks are going…

The days of everything going up are over… for now. That doesn’t mean there are no opportunities left. Choosing the right sector can help your portfolio buck the broader market. That advice applies no matter where stocks go from here.

So pay attention to themes… not to fund managers blaming a down market for their poor performance. We think the same sectors that did well last year are still positioned to win in 2023.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.