Although semiconductor space continues to show its volatility, solid-state memory players will become more resilient over time as demand for digital storage continues to grow. A prime example of this is Micron Technology (MU), the company recovered very quickly from the pandemic due to strong tailwinds. In today’s FA Alpha, we will discuss how bad news surrounding a sector can misprice a great company to invest in.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

One of the most essential industries supplying the demand for technology is the semiconductor space.

It is a volatile one with fast swinging cycles. This is due to the short life of the chip ecosystem.

Earnings rise and fall as chips build up and clear up.

The one part of the industry we thought was a compelling one that would mostly resist these cycles is the memory semiconductor space.

Players in this space produce devices that store digital data, such as random-access memory (“RAM”), that is used in computers and mobile phones.

The resilience of the memory semiconductor sector comes from several secular growth trends in storage needs.

We continue to create more data as we adopt new technologies like cloud computing and artificial intelligence.

However, the space has recently suffered the same issues as everyone else.

Demand for technological products dropped significantly, causing prices to fall and inventories to surge.

Supply chain issues added to the challenge, as it became harder and more expensive to ship the products from production facilities to other manufacturers.

These issues have taken down big players, who lost a big part of their market capitalizations in the stock market.

One of these players was Micron Technologies (MU). It develops and manufactures memory and storage solutions worldwide.

The company specifically focuses on DRAM and NAND products for server, networking, industrial, and automotive markets, as well as smartphones and computers.

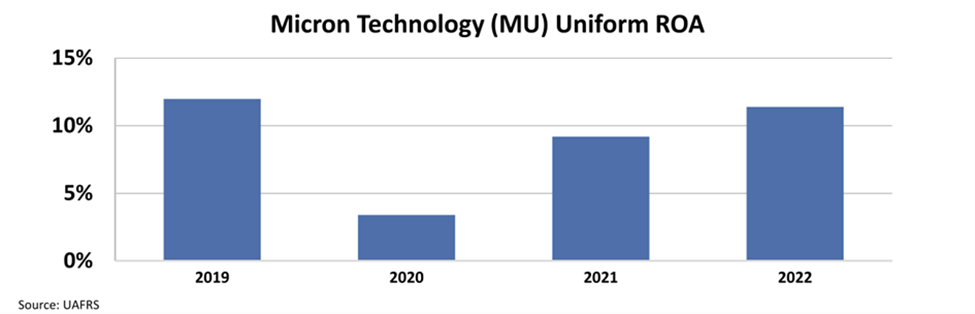

Despite the 27% drop in equity value in 2022, Micron’s Uniform return on assets (“ROA”) has been strong and relatively stable for the past 4 years.

The Uniform ROA fell from 12% in 2019 to just below 4% in 2020. However, the company had a very quick recovery and reached pre-pandemic levels in 2022.

This fast recovery was not by luck. The company has strong long-term tailwinds and continues to benefit from them.

However, the market does not seem to think this will be sustainable.

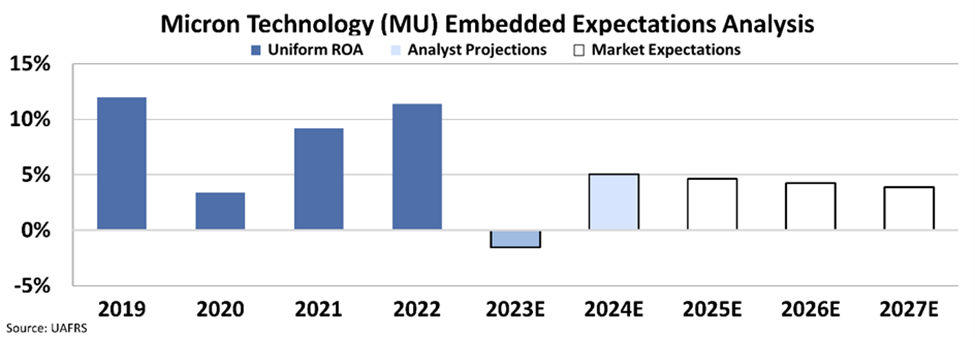

By utilizing our Embedded Expectations Analysis (“EEA”) framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow (“DCF”) model, which makes assumptions about the future and produces the “intrinsic value” of the stock.

We know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

At around $59, the market is expecting Uniform ROA to fall back near to pandemic levels of 4%.

The market is pricing in Uniform ROA to never recover.

As we develop and adopt these new technologies, the need for digital storage will definitely grow. This is not a weak tailwind.

If Micron continues to benefit from these developments, it might have a chance to see profitability increase.

This means that the bad news around the semiconductor industry may be causing this stock to be mispriced, which can be an opportunity.

SUMMARY and Micron Technology, Inc. CorporationTearsheet

As the Uniform Accounting tearsheet for Micron Technology, Inc. (MU:USA) highlights, the Uniform P/E trades at -29.5x, which is below the corporate average of 18.4x and its historical P/E of -17.3x.

Negative P/Es only require high EPS growth to sustain them. In the case of Micron, the company has recently shown a 48% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Micron’s Wall Street analyst-driven forecast is a 153% and 142% EPS shrinkage in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Micron’s $62 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 13% annually over the next three years. What Wall Street analysts expect for Micron’s earnings growth is below what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 2x its long-run corporate average. Moreover, cash flows and cash on hand are 1.6x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 50bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Micron’s Uniform earnings growth is below its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.