The 5G revolution is unlocking faster connectivity, but telecom companies struggle to translate these investments into profit. Deutsche Telekom (DTE:DEU), with its strong presence in Europe and the U.S. through T-Mobile, has made significant operational improvements, yet the market continues to overlook its progress. In today’s FA Alpha Daily, we explore how this disconnect between performance and expectations may present a unique investment opportunity.

FA Alpha Daily

Powered by Valens Research

The 5G cellular revolution is coming, and investors are already seeing the dollar signs of faster speeds.

Better cellular connection will enable speeds equivalent to home broadband internet but on a cell network.

No one has been more excited about the 5G revolution than the cell providers themselves.

Telecommunications companies plan to spend hundreds of billions on both the research & development and the infrastructure needed for 5G.

However, taking a step back, we can see this is not an immensely profitable investment for future performance.

Telecom companies are not going to be able to charge significantly more for these new 5G services, despite the new services costing many billions to implement.

However, the large provider’s hands are forced by circumstance. The cellular service industry is a mature, slow growth industry, so gaining customers is difficult and requires taking market share from the other major players.

The problem is this creates a race to the bottom, where each major telecom company tries to outspend the others to have the best 5G network, as whoever has the best market will take share.

Deutsche Telekom (DTE:DEU) is a telecom giant with a foot in both Europe and the U.S., thanks to its majority stake in T-Mobile US (TMUS).

The company’s European operations are extensive, covering multiple markets with strong regulatory frameworks and intense competition.

Over the past years, Deutsche Telekom has invested steadily in network infrastructure and service quality.

These investments have helped maintain a solid market presence, even as competitors push hard on pricing to gain market share.

The result is a business that continues to perform well in terms of service and customer reach, yet its growth prospects appear to have reached a plateau.

In contrast, T‑Mobile U.S. benefits from a business model that is already priced for future profitability improvements.

American investors have taken notice of the aggressive service improvements and innovative offerings in the U.S. market, which position the brand to capture increased market share.

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market predicts that T-Mobile’s Uniform return on assets ”ROA” will improve to 8% from 5% last year.

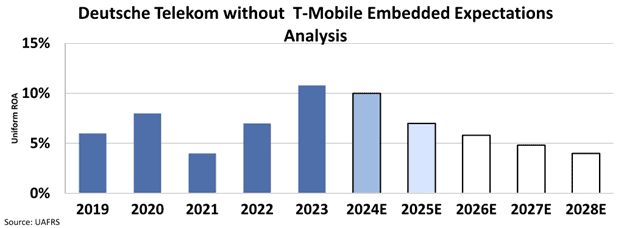

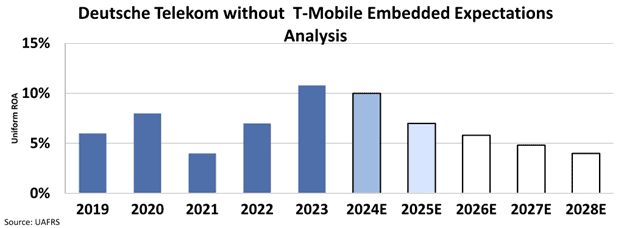

However, the European business of Deutsche Telekom is priced for a decline in profitability, and the market ignores the ROA improvements the company has achieved recently.

We can again see this through our EEA framework.

The market predicts that European business’ ROA will decline to 4% from 10% last year.

Looking at the operational side, Deutsche Telekom’s management has not been idle. They have focused on enhancing network capabilities and customer service across Europe.

Such measures are expected to gradually boost asset returns and operational efficiency.

Nevertheless, these improvements have not yet translated into a more favorable valuation for the European segment.

Instead, market pricing indicates that investors expect the European business to continue with declining profitability.

This gap between operational achievements and market expectations can bring substantial upside.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.