Tech companies once prioritized growth over profitability but are now pressured by the market to focus on sustainable returns. Although, companies like Alphabet have successfully balanced growth with profitability since appointing its current CFO, Ruth Porat, in the mid-2010s. In today’s FA Alpha Daily, let’s discuss how the market misunderstands Alphabet and how it may be a potential stock pick for investors.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

For much of the past decade, many in technology just needed to keep investing in growth and put “hockey stick” growth charts in their investor presentations to make the market love them.

These charts showed years of subdued growth, and then a big surge after the inflection point for perpetuity.

Investors believed all these companies could be platforms that could turn on profitability once they were impossible for users to change away from. So instead of chasing profits, the market wanted these companies to focus on growth at all costs.

The best example of this is Uber (UBER) and Lyft (LYFT). For years they defied logic, and kept on investing in growth even as they were hemorrhaging money…and investors kept on giving them more cash to do it!

Investors thought that one (or both) of them would last out of the competition, own the world, and then profits would follow later. Profits today shouldn’t be the taxi companies’ concern.

It was not just these scale-chasing businesses that ignored profitability. Many of the biggest players in technology and high-profit high-growth industries in healthcare did the same.

Now, with the market worried more about profits and how efficiently assets are used, they are also having to care about profitability.

It’s no surprise that Uber generated cash from operations for the first time in its history last year. Lyft is still scrambling to reach that milestone.

These former hockey stick companies are “getting religion” if you will…

Alphabet (GOOGL) was one of the first ones to get religion all the way back in the mid-2010s. The technology giant brought in a professional CFO to make more rational investments.

Alphabet realized investors were souring on how much it was throwing in moonshot opportunities with little chance of profits. Management needed to show investors they were serious about managing the business.

After taking the role in mid-2015, Ruth Porat made sure the long-term strategy of “growth at the expense of profitability” was adjusted.

Alphabet’s engineers still should invest, and invest a lot…after all, in all but 1 year since she took over as CFO the company has grown assets by more than 15%.

However, those investments needed to have a path to generate cash flow for shareholders.

And no surprise, something changed for the company. From 2007 to 2017, Uniform return on assets (“ROA”) had fallen from 68% to 23%.

Once Porat had a handle on things, that decline stopped.

ROA remained above 20% even during 2020 when the pandemic hit the hardest. The business boomed post-pandemic with ROA reaching and remaining at above 30%.

This could mean a great investment opportunity. There is a huge business that is known by everybody and is getting better in terms of financial management.

However, the story appears to be unseen by the market.

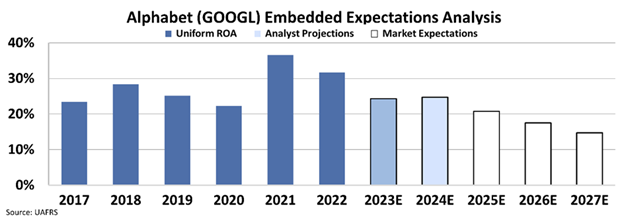

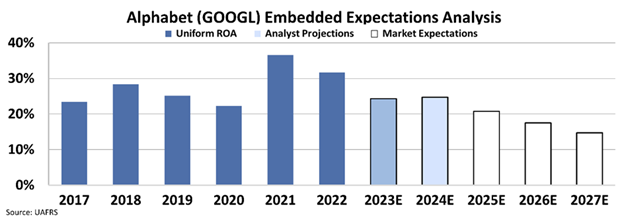

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At around $107 per share, the market is expecting the company’s ROA to tank below 15%. This would be an all-time low for Alphabet.

The market thinks that Alphabet is still the same company as it was before 2015 but that is not true.

The company is not chasing hockey sticks at the expense of profitability anymore. Management is actually looking for ways to maintain and improve returns.

Alphabet is arguably the one former hyper-growth tech stock that has already shown it can “get religion” and stop lighting money on fire for the sake of growth.

Considering these facts, the market’s expectations seem very pessimistic, pointing to a significant potential for equity upside.

SUMMARY and Alphabet Inc., Tearsheet

As the Uniform Accounting tearsheet for Alphabet Inc., (GOOGL:USA) highlights, the Uniform P/E trades at 16.5x, which is around the corporate average of 18.4x and its historical P/E of 15.9x.

Average P/Es require average EPS growth to sustain them. In the case of Alphabet, the company has recently shown a 11% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Alphabet’s Wall Street analyst-driven forecast is a 7% EPS shrinkage in 2023 and 11% EPS growth in 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Alphabet’s $105 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 6% annually over the next three years. What Wall Street analysts expect for Alphabet’s earnings growth is around what the current stock market valuation requires in 2023 but above its 2024 requirement.

Furthermore, the company’s earning power is 5x its long-run corporate average. Moreover, cash flows and cash on hand are 3.9x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 20bps above the risk-free rate.

All in all, with no dividends, this signals low credit risk.

Lastly, Alphabet’s Uniform earnings growth is below its peer averages but in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.