ESG-centric investing receives backlash with some investors calling for management teams to focus solely on profit-making. Today’s FA Alpha Daily will assess if the performance of BlackRock ESG Capital Allocation Trust, one of the largest ESG portfolios, can challenge these investors’ claims.

FA Alpha Daily:

Friday Portfolio Analysis

Powered by Valens Research

Just as it took decades for Americans to build good recycling habits, it has taken years for money managers to convince the world that ESG and impact investing are essential elements of a good portfolio.

However, in the past few years, the ESG boom has reached soaring heights, with record inflows coming into these funds, not to mention the number of firms that have opened investment vehicles or issued investment directives for ESG investing.

While the point of ESG investing is to build a more sustainable and equitable world, ESG-centric funds still face an uphill battle.

Strive is attacking the idea that ESG and impact investing can make the world better.

Founded by the pharmaceutical investor Vivek Ramaswamy, he has seen support from big investors like Peter Theil and Bill Ackman by saying that management teams should just focus on capitalism and profits, not on being “woke”.

With the support of these industry titans, he’s got BlackRock and other big investors who have been pushing for more ESG exposure in his sights.

What are the companies in BlackRock’s ESG fund he might be targeting to change how they think about things and prioritize?

Let’s take a look using Uniform Accounting to see how BlackRock’s ESG fund is poised to deliver going forward.

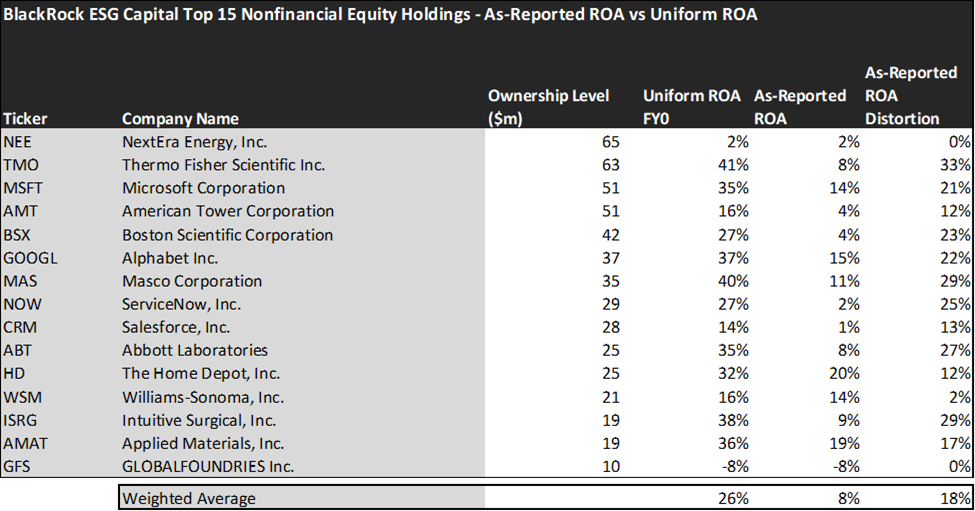

Economic productivity is massively misunderstood on Wall Street. This is reflected by the 130+ distortions in the Generally Accepted Accounting Principles (GAAP) that make as-reported results poor representations of real economic productivity.

These distortions include the poor capitalization of R&D, the use of goodwill and intangibles to inflate a company’s asset base, a poor understanding of one-off expense line items, as well as flawed acquisition accounting.

It is no surprise that once many of these distortions are accounted for, it becomes apparent which companies are in real robust profitability and which may not be as strong of an investment.

Just as one would expect, there is merit to investing in ESG companies, as the Uniform returns are much stronger than the as-reported metrics dictate.

See for yourself below.

Using as-reported accounting, investors would think investing in ESG companies would result in the portfolio achieving a very weak return on assets (ROA).

On an as-reported basis, many of these companies are poor performers with an average as-reported ROA of around 8%.

However, once we make Uniform Accounting (UAFRS) adjustments to accurately calculate earning power, we can see that the returns of the companies in BlackRock ESG Capital Allocation Trust portfolio are much more robust.

The average company in the portfolio displays an impressive average Uniform ROA of 26%. This is significantly above corporate average returns.

Once the distortions from as-reported accounting are removed, we can realize that Thermo Fisher Scientific (TMO) doesn’t have an ROA of 8%, but returns of 41%. Thermo Fisher isn’t an average company with average returns.

Similarly, Boston Scientific’s (BSX) ROA is really 27%, not 4%. Boston Scientific has enjoyed great success by creating products for the medical community.

Intuitive Surgical (ISRG), is another great example of as-reported metrics mis-representing the company’s profitability. In fact, the company’s ROA isn’t 9%, it’s actually 38%.

If BlackRock’s investment strategy for ESG companies was powered by as-reported metrics, it would agree that there’s no point in investing in companies with a socially inclined focus.

To find companies that can deliver alpha beyond the market, just finding companies where as-reported metrics mis-represent a company’s real profitability is insufficient.

To really generate alpha, any investor also needs to identify where the market is significantly undervaluing the company’s potential.

BlackRock is also investing in companies that hopefully have an upside scenario going forward.

Once we account for Uniform Accounting adjustments, we can see that many of these companies are strong stocks but are already realizing most of their potential.

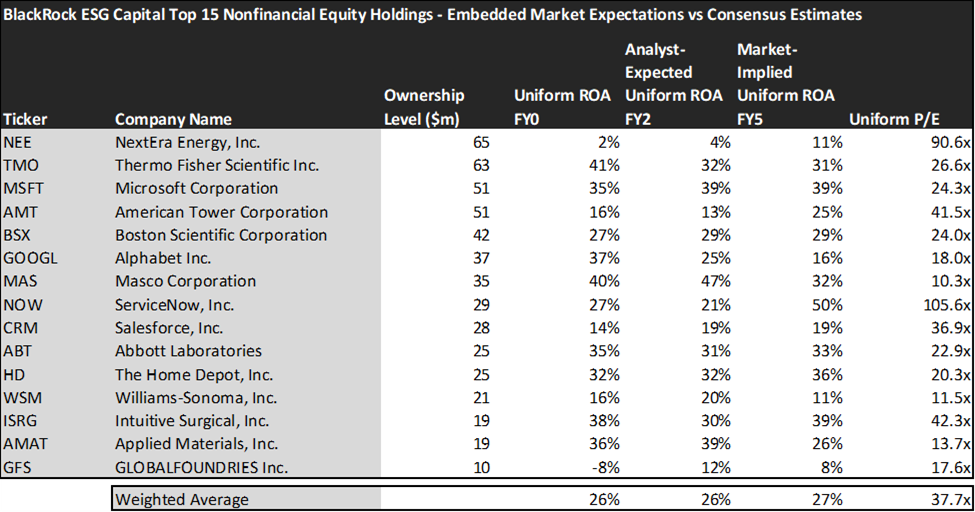

These dislocations demonstrate that most of these firms are in a different financial position than GAAP may make their books appear. But there is another crucial step in the search for alpha. Investors need to also find companies that are performing better than their valuations imply.

Valens has built a systematic process called Embedded Expectations Analysis to help investors get a sense of the future performance already baked into a company’s current stock price. Take a look:

This chart shows four interesting data points:

- The Uniform ROA FY0 represents the company’s current return on assets, which is a crucial benchmark for contextualizing expectations.

- The analyst-expected Uniform ROA represents what ROA is forecasted to do over the next two years. To get the ROA value, we take consensus Wall Street estimates and we convert them to the Uniform Accounting framework.

- The market-implied Uniform ROA is what the market thinks Uniform ROA is going to be in the three years following the analyst expectations, which for most companies here is 2023, 2024, and 2025. Here, we show the sort of economic productivity a company needs to achieve to justify its current stock price.

- The Uniform P/E is our measure of how expensive a company is relative to its Uniform earnings. For reference, average Uniform P/E across the investing universe is roughly 24x.

Embedded Expectations Analysis of BlackRock ESG Capital Allocation Trust paints a clear picture of the fund. While the stocks it tracks are strong performers historically, the markets are pricing them in for more upside while analysts are expecting them to be flat.

While the fund is forecasted by analysts to see Uniform ROA remain at 26% over the next two years, the market is pricing in the fund to see returns slightly increase to 27%, which may lead to some downside.

In particular, there are a couple of companies that may lead investors to be cautious.

The markets are ServiceNow’s (NOW) Uniform ROA to rise to 50%. Meanwhile, analysts are projecting the company’s returns to drop to 21%.

NextEra Energy (NEE) may similarly disappoint investors as their returns are expected to only increase to 4% Uniform ROA, while analysts expect them to increase their returns to 11%.

This just goes to show the importance of valuation in the investing process. Finding a company with strong growth is only half of the process. The other, just as important part, is attaching reasonable valuations to the companies and understanding which have upside which have not been fully priced into their current prices.

To see a list of companies that have great performance and stability also at attractive valuations, the Valens Conviction Long Idea List is the place to look. The conviction list is powered by the Valens database, which offers access to full Uniform Accounting metrics for thousands of companies.

Click here to get access.

Read on to see a detailed tearsheet of one of BlackRock ESG Capital Allocation Trust’s largest holdings.

SUMMARY and Thermo Fisher Scientific Inc. Tearsheet

As one of BlackRock ESG Capital Allocation Trust’s largest individual stock holdings, we’re highlighting Thermo Fisher Scientific Inc. (TMO:USA) tearsheet today.

As the Uniform Accounting tearsheet for Thermo highlights, its Uniform P/E trades at 26.6x, which is above the global corporate average of 20.6x and its historical average of 22.6x.

High P/Es require high EPS growth to sustain them. In the case of Thermo, the company has recently shown a 26% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that, in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Thermo’s Wall Street analyst-driven forecast is for EPS to compress by 15% in 2022 and grow by 9% in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Thermo’s $572 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 5% annually over the next three years. What Wall Street analysts expect for Thermo’s earnings growth is below what the current stock market valuation requires in 2022, but above that requirement in 2023.

Meanwhile, the company’s earning power is 7x long-run corporate averages. Also, cash flows and cash on hand are around 2x the total obligations—including debt maturities and capex maintenance. Moreover, intrinsic credit risk is 50bps. Together, these signal low dividend and credit risks.

Lastly, Thermo’s Uniform earnings growth is below peer averages, but is trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This portfolio analysis highlights the same insights we use to power our FA Alpha product. To find out more visit our website.