In an uncertain economy with signs of a slowdown and rising interest rates, companies face credit challenges. US bankruptcy filings are up, unemployment has increased, and consumer spending is cautious due to student loans. However, there are resilient companies like Netflix (NFLX) that, despite a 2022 stock drop, managed to recover, and maintain high subscriber retention, indicating their popularity and loyalty. In today’s FA Alpha Daily, let’s discuss Netflix’s resiliency in an uncertain economy and how potential investors can capitalize on it.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

It is tough to invest In these uncertain economic times. Indicators are showing an economic slowdown soon. The Fed just announced that they see interest rates higher for longer. This changes things…

A lot of firms are already having a big issue with their credit structure. The number of U.S. bankruptcy filings year-to-date through August topped the prior two years.

Not only that, but customers are getting weaker as well. The unemployment rate jumped higher in August, and with student loan payments resuming, nobody wants to spend too much besides the necessities.

That is why it is crucial to focus on companies that offer protection against the looming recession and potential credit risks.

Amidst the turbulence, one notable player emerges: Netflix (NFLX).

The first half of 2022 was tough for the company. After management announced it couldn’t meet subscriber growth targets, the stock fell almost 40% overnight. But it has been recovering since.

It has plans to increase revenue from existing users, and now there are significant developments that represent a significant milestone in the company’s journey.

It seems like Netflix successfully navigated the transition away from password-sharing while managing to preserve its substantial revenue streams.

When Netflix decided to address the problem of password sharing, there were concerns that such a move might result in a substantial loss of revenue. However, the outcome defied these expectations.

Despite the crackdown on password sharing, the vast majority of subscribers chose to retain their memberships. And those kicked off of sharing subscriptions have actually gotten their own subscriptions in pretty good numbers.

This remarkable retention rate underscores the loyalty and commitment of Netflix’s user base. The fact that Netflix could enforce these changes without causing a mass exodus demonstrates just how popular the platform is.

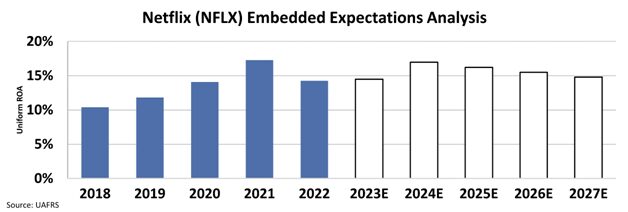

That’s great for cash flow stability. We can see that the market agrees with this statement through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s Uniform return on assets (“ROA”) to stay flat around 15%.

Additionally, the company has very limited debt considering how big it is. This is very important in the context of our theme of credit and recession protection.

Netflix is not going to feel any pressure from high rates even if those are here to stay for longer.

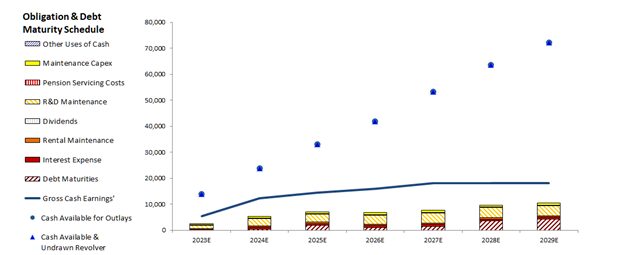

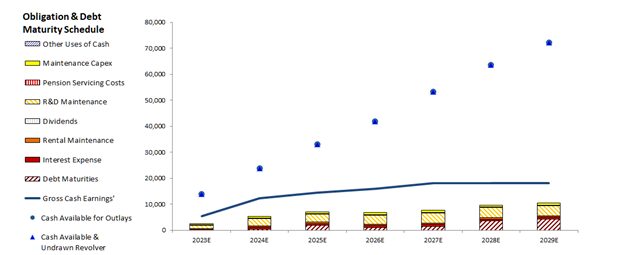

We can see this by looking at the company’s Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that NFLX’s cash flows are more than enough to serve all its obligations going forward.

Low debt levels translate to decreased financial vulnerability, especially in a scenario where interest rates remain high.

With the platform’s popularity, sustained cash flows, and low debt levels, Netflix seems like a good recession protection name.

SUMMARY and Netflix Inc. Tearsheet

As the Uniform Accounting tearsheet for Netflix Inc. (NFLX:USA) highlights, the Uniform P/E trades at 25.9x, which is above its global corporate average of 18.4x but below its historical P/E of 33.0x.

High P/Es require high EPS growth to sustain them. In the case of Netflix, the company has recently shown a 5% shrinkage in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Netflix’s Wall Street analyst-driven forecast is a 7% and 26% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Netflix’s $377.59 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow 9% annually over the next three years. What Wall Street analysts expect for Netflix’s earnings growth is around what the current stock market valuation requires in 2023 but above its 2024 requirement.

Furthermore, the company’s earning power is 2x its long-run corporate average. Moreover, cash flows and cash on hand are 5x its total obligations—including debt maturities, capex maintenance, and dividends.Also, the company’s intrinsic credit risk is 30bps above the risk-free rate.

All in all, this signals low credit risk with no dividends.

Lastly, Netflix’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.