There are rising concerns in hospital staffing due to the burned-out doctors, nurses, and all other medical staff experience after the years-long battle against COVID-19. Additionally, these medical staffs are aging and retiring, adding to the attrition issues.

Cross Country Healthcare tries to solve precisely that with its nurse and physician staffing services. The company benefited greatly from the industry’s most significant need and improved its profitability.

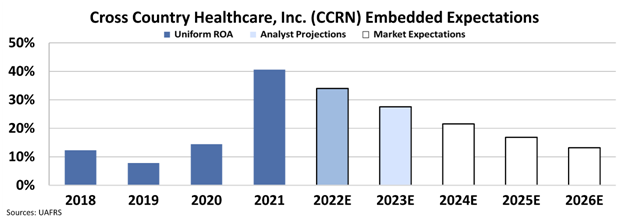

However, our Embedded Expectations Analysis (“EEA”) shows that the market doesn’t think this level of profitability is sustainable, resulting in very low valuations.

That’s why it showed up on our FA Alpha Screen. Its high quality, high growth, and low valuations make it an interesting name.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Doctors, nurses, and all medical staff have indeed been at the frontlines of the fight against COVID-19. They were exposed day and night to the disease, risking their health.

There were times they could not see their families so that they could protect them from the probability of getting infected.

Naturally, they feel burned-out after these challenges from the past two years of fighting COVID-19.

Unsurprisingly, the healthcare industry is experiencing some of its highest attrition ever. It’s not just COVID-19 burnout either. Doctors and nurses are aging out and retiring, creating huge issues with hospital staffing. These concerns are not going away but getting worse.

Cross Country Healthcare (CCRN) is one of the companies trying to help solve those issues. It is one of the biggest nurse and physician staffing companies, providing talent management and other consultative services for healthcare clients in the United States.

As the need for medical staff shot up during, and after the pandemic, demand for Cross Country’s service is very high. It has benefited a lot from this trend and successfully increased profitability.

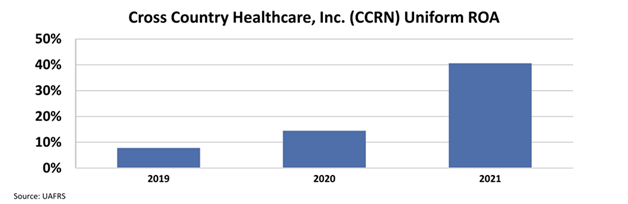

Its Uniform return on assets (“ROA”) surged from 8% in 2019 to 41% in 2021, showing how desperate the healthcare sector is for new staffing opportunities.

However, we cannot understand investment opportunities only by looking at the company’s operations. We also need to understand the market and see if it already prices in the opportunity we are seeing.

By utilizing our Embedded Expectations Analysis (“EEA”) framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow (“DCF”) model, which makes assumptions about the future and produces the “intrinsic value” of the stock.

We know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

At around $37, the market expects Cross Country Healthcare’s Uniform ROA to fade back to 13% – in line with its Uniform ROA in 2018, pre-pandemic. Analysts are also expecting the company to have lower profitability, dropping to 27% in two years.

Cross Country Healthcare successfully benefited from staffing shortages, leading to a surge in ROA.

Right now, the market is pricing in a full reversal – for Uniform ROA to settle back to where it was historically. However, staffing shortages aren’t ending any time soon. So,many healthcare professionals have retired in the last two years, and incoming professionals increasingly want to work in specialty care or a different field altogether.

This is just the beginning of a multi-year staffing shortage, and Cross Country will remain a key vendor to that.

The high quality, high growth, impressive returns, and low valuation meant that Cross Country Healthcare was a great candidate to become an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

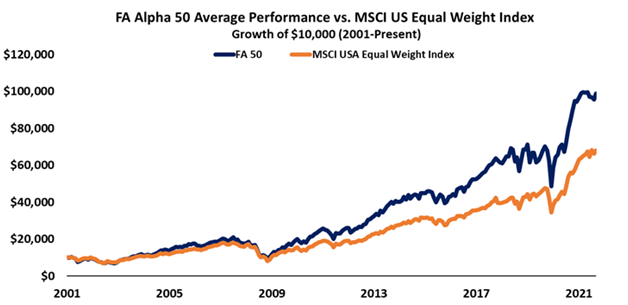

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

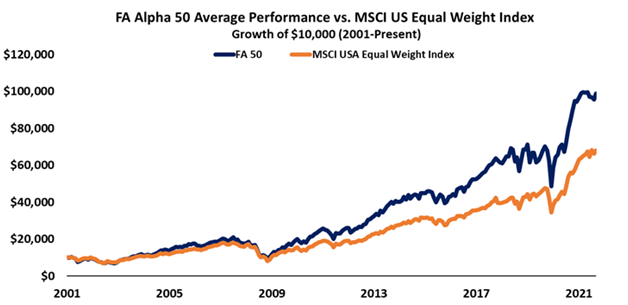

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Cross Country Healthcare, Inc. (CCRN) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.