Spending time and money was much different than what we are used to now. We turned to shop more online and spent more money even when we are at home and some retailers make the best use of it. In today’s FA Alpha, we’ll take a look at how Bath & Body Works’ divestment of Victoria’s Secret will improve its profitability and lower its credit risk using Credit Cash Flow Prime.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The pandemic and the At-Home Revolution changed our lives in many aspects, including our work, education, relationships, and consumption.

We turned to online shopping as going to malls was impossible. We were stuck in our homes, which made us spend more money at home.

Bath & Body Works has been one of the most successful beneficiaries of this trend. The company is a specialty retailer of home fragrances, body care, soaps, and sanitizer products.

It’s a clear market leader in fragrant body care and home fragrance products.

The difference between Bath & Body Works and other retailers in that industry is that 80% of the company’s supply chain is located in North America.

This means that the company avoided global supply chain problems when almost every single retailer was suffering from this. In other words, it could meet its customers’ demand quickly with short delivery times.

Additionally, the company divested its Victoria’s Secret (VSCO) business in 2021, and it focused more on digital sales channels and stores in non-mall locations, which significantly decreased its operating expenses and grew its profitability.

Coupling its increased operational efficiency with the booming demand due to the At-Home Revolution, the company has seen massive profitability in the last two years.

Its Uniform return on assets (“ROA”) increased from 18% in 2020 to 45% in 2022, a huge jump.

However, Moody’s seems to miss these factors, still thinking of the company as it was before the Victoria’s Secret divestiture, and rating it with a 10% chance of default.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand the company’s obligations matched against its cash and cash flows.

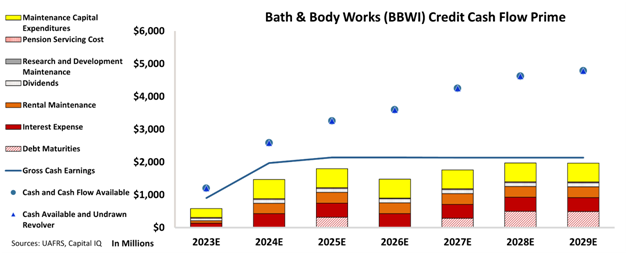

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Bath & Body Works’ cash flows are always above its obligations going forward.

CCFP chart indicates that Bath & Body Works have very limited debt maturities that will not stress its financial positioning and have steady cash flows over its obligations in the next 7 years.

Taking into account its increased operational efficiency and profitability, and its strong economic moats, it would be unfair to think it has a very high credit risk.

For these reasons, here at Valens, we think that the company belongs to the investment grade and deserves a rating of IG4, which implies approximately a 2% chance of default as opposed to 10% by Moody’s.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Bath & Body Works (BBWI:USA) Tearsheet

As the Uniform Accounting tearsheet for Bath & Body Works (BBWI:USA) highlights, the Uniform P/E trades at 14.0x, which is below the global corporate average of 18.4x, but above its historical P/E of 12.7x.

Low P/Es require low EPS growth to sustain them. In the case of Bath & Body Works, the company has recently shown a 30% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Bath & Body Works’ Wall Street analyst-driven forecast is for a -18% and 10% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Bath & Body Works’ $46 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2022 was 8x the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 170bps above the risk-free rate.

Overall, this signals a moderate credit risk and a low dividend risk.

Lastly, Bath & Body Works’ Uniform earnings growth is below its peer averages and is trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Bath & Body Works (BBWI) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.