As the cost of borrowing increases due to rising rates and economic downturns, private equity firms face a growing threat as debt and borrowing eat into their profits. However, the market does not use Uniform Accounting to assess the real returns of companies. Through Uniform Accounting, today’s FA Alpha Daily will assess the true returns and real price/earnings ratio of Blackstone (BX), a leading private equity firm, and why it became a compelling name for FA Alpha.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Private Equity’s bread and butter is leverage.

With the rising interest rate environment that we are currently in, many people assume that Private Equity is in big trouble. And it is reasonable to expect this, especially for smaller players in the industry.

The entire business revolves around using leverage to increase returns on company and real estate acquisitions. When the cost to borrow increases, it means fewer deals, lower valuations, and the potential that some deals go belly up because they no longer can cover the interest expense.

PE had a great run following the pandemic, as did banks. Deal flow was strong and didn’t stop.

But, with many banks rumoring layoffs as a recession is impending, where does this leave Private Equity amidst rising rates and economic downturns?

The crux of this issue is interest. When it costs more in interest for every dollar of leverage, the debt and borrowing eat into profits. Therein lies PE’s supposed downfall.

The market has spoiled on players like Blackstone (BX), which is the leading private equity firm on the street.

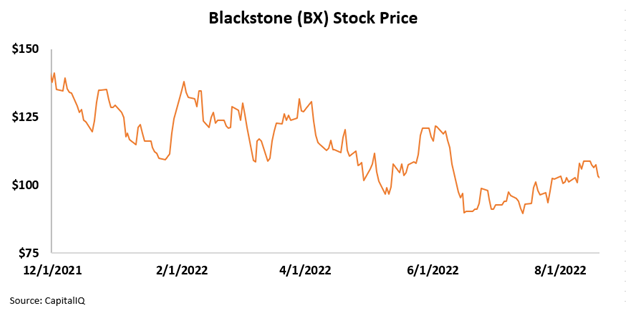

Its stock is down roughly 33% since its peak late in 2021.

A dropping stock, rising rates, and an economic recession all sound alarm bells for Blackstone. It is easy to understand why the market has given up on them.

But, the market doesn’t use Uniform Accounting.

When Uniform Accounting is used to scrub the financials, the returns clearly show Blackstone is actually doing everything right.

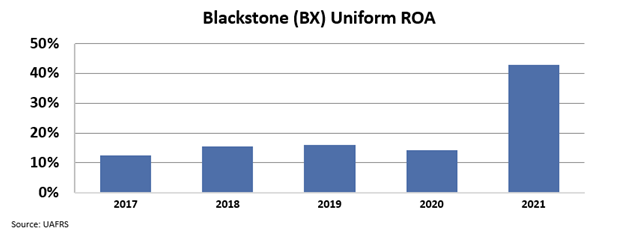

From 2020 to 2021, Uniform return on assets (ROA) shot up from 14% to 43%. With rising rates, Blackstone has taken the approach to diversify its offerings.

It’s gone from a pure-play Private Equity shop to now covering PE, real estate, hedge funds, and even a bit of investment banking.

This, coupled with the pedigree Blackstone has as one of the best operators out there, helped boost returns last year. This is because it now offers so much, it has the ability to keep generating incentive fees even if one part of its business comes under pressure.

2021 wasn’t a fluke either. 2022 and 2023 Uniform returns are expected to stay high at 37% and 40%, respectively.

Blackstone has been a household name on the street, but the market is overlooking it because it still thinks of it as pure PE. Now that it offers more services, Blackstone is reaping the rewards of its strategic business moves. Since it has impressively high Uniform ROAs, it will be able to grow the business at the expense of peers. This, coupled with its low P/E of 6.2x makes it a great FA Alpha 50 recipe.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

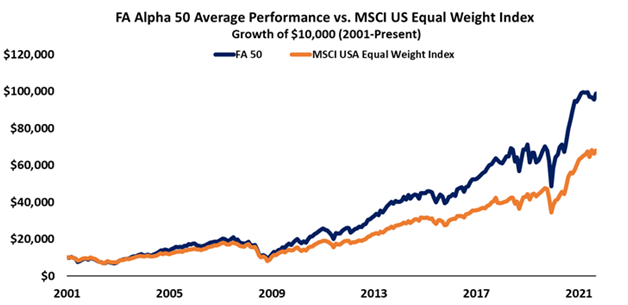

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

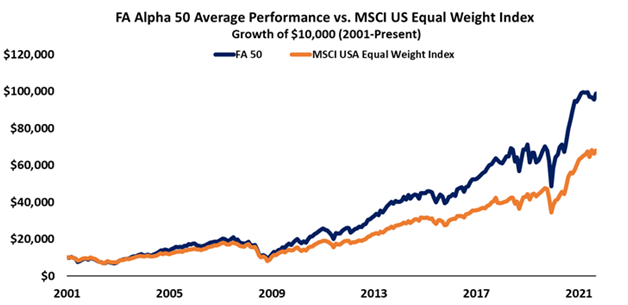

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Blackstone Inc. (BX) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.