The semiconductor industry faced significant challenges in 2022, including a potential recession, stringent restrictions, and volatile global demand. However, Onto Innovation (ONTO) is unlike any other semiconductor manufacturing company. In today’s FA Alpha Daily, we will see how Onto Innovation differentiated itself to stay profitable amidst a difficult semiconductor industry.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Semiconductor firms were crushed in 2022.

As October 2022 approached, semiconductor stocks responsible for chips used in items ranging from vehicles to PCs were already experiencing significant downturns. This was in anticipation of a potential recession.

The preceding two years were not easy either, with the pandemic and a significant factory fire disrupting production. To add to this, on October 7, the U.S. Department of Commerce imposed stringent restrictions on semiconductor sales to China.

These measures could lead to huge revenue losses for several chip companies that were already predicted to face challenges in the coming years. As a result of this announcement, companies like Nvidia (NVDA) and Advanced Micro Devices (AMD) saw their share prices drop dramatically.

Although the semiconductor sector has seen improvements in 2023, it remains adversely affected by a combination of factors such as escalating costs, geopolitical unrest, and lingering effects of the pandemic.

These dynamics have a direct bearing on consumer expenditures, leading to an unpredictable global economic environment and volatile demand for semiconductors.

So, it seems like all semiconductor companies can be lumped together into one big group that will all suffer the same fate.

This statement couldn’t be more wrong…

Onto Innovation (ONTO) isn’t like most semiconductor companies.

The company stands out in the semiconductor industry because it doesn’t actually produce chips. Instead, it specializes in offering advanced process control tools, software, and metrology systems that are essential for semiconductor manufacturing.

This positions Onto Innovation uniquely within the industry, as its success is tied to the broader health and technological advancements of the semiconductor world rather than the cyclical demand for specific chip products.

In essence, while most semiconductor companies are in the race to design and sell chips, Onto Innovation equips them with the tools they need to stay competitive and efficient in that race.

As long as there is an industry to supply, the company is likely to continue winning. It does not matter which player wins the chips race.

Moreover, the competition has been getting fiercer since the pandemic thanks to the initial surge in customer spending and the big technological developments like AI that followed. This allowed the company to improve its profitability immensely.

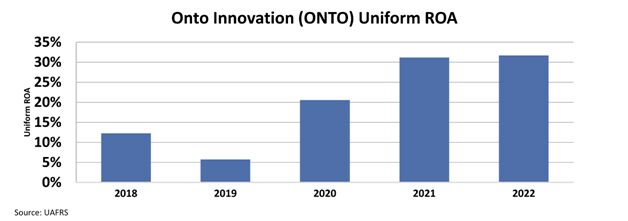

Onto’s Uniform return on assets (“ROA”) jumped from 5.8% in 2019 to 31% in 2021 and then remained at a similar level of 32% in 2022.

The chart also shows that the company performed incredibly well during a time of hurting in the semiconductor market. This shows that even in a difficult semiconductor landscape, Onto can still perform well.

And yet, the market fails to recognize this opportunity.

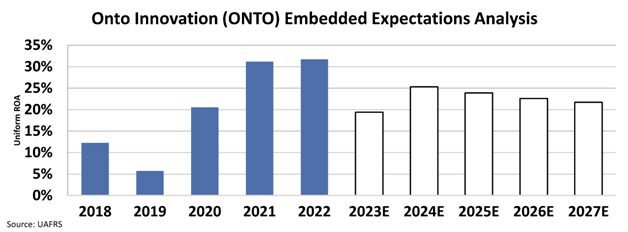

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall below 22%, assuming the demand will collapse.

Given the continued competition in its end markets and Onto’s ability to weather a difficult semiconductor market, these expectations seem overly pessimistic.

That is why Onto Innovation showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

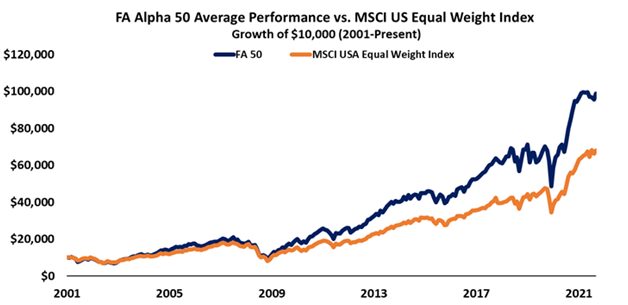

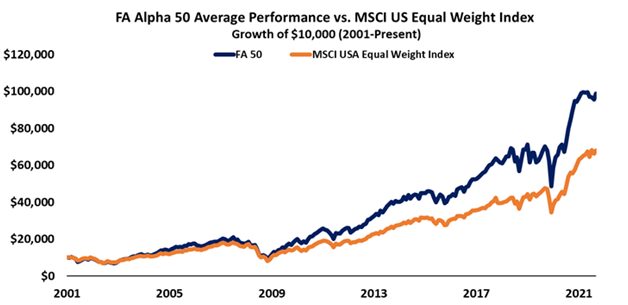

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

U.S. stocks are in CODE RED–and you’re about to learn why! We are inviting you to attend our upcoming event this Wednesday, October 4, 2023 at 12:00 PM CT to learn how to protect your wealth in the oncoming stock market crash.

Today’s highlight, Onto Innovation (ONTO) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.