Different aspects of the pandemic have affected our lives and attracted our attention, including diseases and medicine. Some parts of the industry did not receive equal attention, such as companies using technology to study diseases and develop drugs. In today’s FA Alpha, we dive deep into Ligand Pharmaceuticals (LGND), the company that has high quality, impressive returns, high asset growth, and low valuation on our FA Alpha Screen, proving that it has a profitable business.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The pandemic has affected our lives in different ways and attracted our attention to certain topics. The biggest ones of them were diseases and medicine.

There is one sector in particular that enjoys this attention: pharmaceuticals.

Typically, these pharmaceutical companies are in intense competition to study diseases and invent new drugs to be used against them. The industry is highly regulated, so they try to get the necessary approval before their competitors.

Everyone still remembers the discussion about who was going to develop the first Covid-19 vaccine. After months of research and development, AstraZeneca (LSE:AZN) came out on top.

That same battle continues for nearly every other disease we face.

However, this is not what all pharmaceutical companies do. Instead of creating therapies and medicines, some of them enable other developers to do so. Ligand (LGND) is a perfect example.

The company focuses on acquiring and developing technologies that help other pharmaceutical companies to discover medicines worldwide.

It does not specialize only in one area but provides solutions to a wide range of disease areas. It also benefits from the research and development processes in all of them.

By owning the economic rights to highly demanded and successful medicines, Ligand has driven both its profitability and asset growth up.

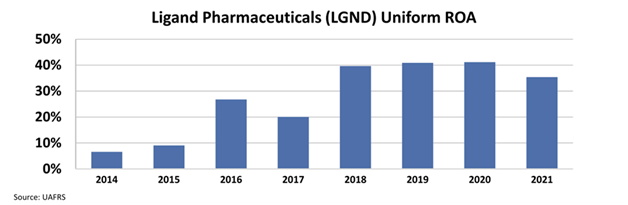

The company’s Uniform return on assets (“ROA”) consistently increased from the cost of capital levels in 2014 and reached an incredible 35% in 2021. Its asset growth in 2021 was also above 35%, which means it had record earnings that year.

However, it does not seem like this growth in assets, and profitability is seen as sustainable by the market.

Currently, the stock is trading at 14x Uniform Price to Earnings (“P/E”). This is very close to the lowest levels in the last decade and down from 2013 highs of 83x.

If Ligand can continue to find the right opportunities for growth in the therapeutics space, there is a high chance for it to see a significant upside from current levels.

The high quality, impressive returns, high asset growth, and low valuation mean that Ligand is a great candidate to be an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

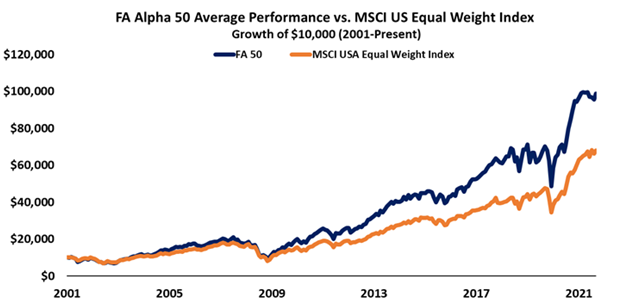

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Ligand Pharmaceuticals (LGND) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.