With the Russian crisis, increased oil prices are good news for E&P companies, but even better for equipment and service companies that help shale and other oil producers drill wells and manage production. Today’s FA Alpha Daily will dig into one of these companies in Weatherford (WFRD), and its credit health post-bankruptcy.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Anyone with a car or just an ear to the ground has noticed oil prices rocketing higher in the past several weeks.

As we discussed on Monday, this sharp increase in oil price could create potential headwinds for the economy were prices to remain elevated over the next few months.

Oil is one of the key pieces the global economy runs on and as a result has a unique ability to foster or hold up economic growth compared to other commodities.

High oil prices act similar to a tax on spending for individuals, as it eats directly into disposable income. The impact is even more visible on income statements for corporations, as it shows up twice by limiting both profitability and investable cash flows.

With the invasion of Ukraine continuing to develop, the United States has shut off Russian oil as of last week, which made up around 10% of imports. To make matters worse, it appears that OPEC has zero interest in offsetting surging oil prices by increasing production.

One of the only tangible safety valves to open would be if U.S. shale producers, who have made the responsible decision to keep production stable even as oil prices have risen, were to change their minds.

The numbers may force them to reconsider, with oil future prices at north of $75 a barrel even a year and a half from now. These are levels that are economical for most of the major shale basins, from Midland and Eagle Ford to the Niobrara and SCOOP/STACK.

At current spot prices, essentially every well in these basins has suddenly become economical to produce once again.

While these increased prices are great news for E&P companies if they choose to begin deploying capital, it’s even better news for equipment and services companies. They now have the opportunity to make real money if the wildcatters of America finally let their animal spirits take over again.

One of these companies is Weatherford (WFRD), which is one of the major players in space. They help shale and other oil producers drill wells and then assist them in managing the production.

For those that may have kept up with the oil scene over the past few years, Weatherford went bankrupt in 2019 during a challenging time for service providers.

While they have reemerged out of bankruptcy, it appears that S&P still considers it to be the pre-bankruptcy company, without any strong tailwinds now. With a B- rating, S&P expects there to be a 25% chance of them going bankrupt again in the next five years.

However, we can figure out the true risk by examining it through the lens of the Credit Cash Flow Prime.

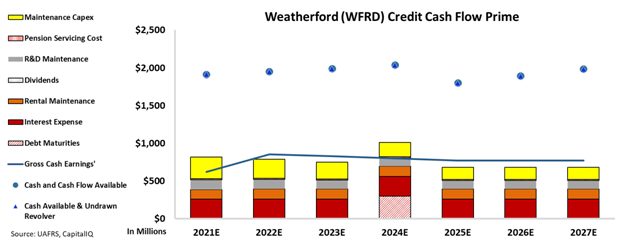

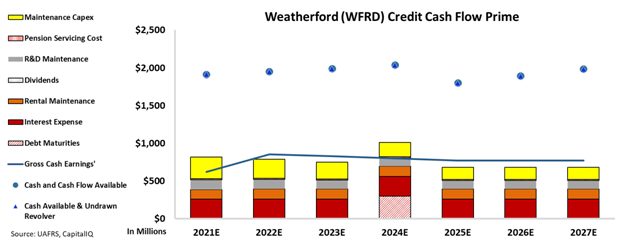

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

Not only does Weatherford have strong cash flows that consistently match all of their operating obligations, but it also has strong cash buffers that will cover the next six years with ease. Furthermore, they have multiple years before its only major debt maturity, and most importantly they have tailwinds for significant upside in cash flows.

See for yourself:

S&P’s B- credit rating isn’t reflective of Weatherford’s current creditworthiness, but rather a reflection of their pre-bankruptcy position.

Looking at the numbers, we are left with a company that points to a much safer XO credit, which is equivalent to a BBB- rated name.

Weatherford is yet another company where the credit rating agencies don’t capture the complete story. While we at Valens recognize the flaws with traditional credit ratings, many creditors do not. The B- credit rating is pessimistic and paints a picture of a weaker company that doesn’t reflect where they are today.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

Weatherford International Tearsheet

As the Uniform Accounting tearsheet for Weatherford International plc (WFRD:USA) highlights, the Uniform P/E trades at 12.4x, which is below the global corporate average of 24.0x, but above its historical P/E of -0.0x.

Low P/Es require low EPS growth to sustain them. That said, in the case of Weatherford International, the company has recently shown a 98% Uniform EPS decline.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Weatherford International’s Wall Street analyst-driven forecast is to see Uniform earnings shrink by 1400% in 2022, but grow by 160% in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Weatherford International’s $36 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 8% over the next three years. What Wall Street analysts expect for Weatherford International’s earnings growth is below what the current stock market valuation requires in 2022, but above the requirement in 2023.

Furthermore, the company’s earning power in 2021 is 2x the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. However, intrinsic credit risk is 230bps above the risk-free rate. All in all, this signals a moderate credit risk.

Lastly, Weatherford International’s Uniform earnings growth is well below its peer averages, and the company is also trading well below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Weatherford’s (WFRD) credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.