Recessionary concerns worry investors as this could negatively affect their investments, as a result, we have seen increased activism in the market. One of which is activist fund ValueAct Capital Management which is pressuring the streaming giant Spotify to make some changes as its expenses are steadily increasing. In today’s FA Alpha, we will look into ValueAct Capital Management and its activist campaigns to see if they are well-positioned for this year.

FA Alpha Daily:

Friday Portfolio Analysis

Powered by Valens Research

Activist campaigns are on the rise as recessionary concerns affect companies’ profitability and as the stock market disappoints investors.

In this environment, investors are trying to find a way to make the companies they have invested in more resilient.

In this pursuit, one of the activist funds, ValueAct Capital Management, started pushing for a change in Spotify, the largest music streaming company in the world.

It’s not their first rodeo though, the fund’s previous activist campaigns included massive companies like Citigroup (C), Seven & i Holdings (TSE:3382), and Nintendo (TSE:7974).

ValueAct’s CEO Mason Morfit criticizes Spotify as its operating expenses have been significantly increasing since 2019.

The company has been heavily investing in new markets like podcasts, audiobooks, and live chatrooms to increase the quality and quantity of content it offers.

While Morfit believes the company’s strengths in combining engineering breakthroughs with organizational abilities, he is concerned if these huge investments will make or break the company.

He also mentions that a possible recession will show which businesses are built to last and which ones were built for the bubble.

In order to become a successful business that is built to last, Morfit is trying to push Spotify to cut down its podcast investments and to reduce the headcount along with other cost cuts.

Keeping this in mind, let’s have a look at ValueAct’s top holdings from the Uniform Accounting perspective to determine if the fund has “built to last” companies in its portfolio.

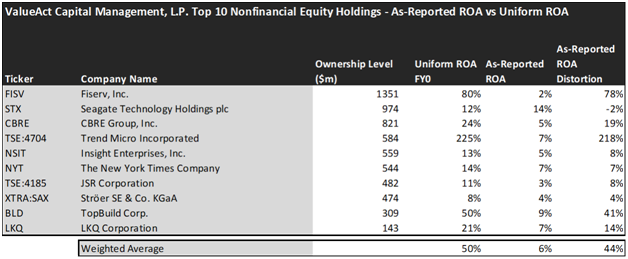

Economic productivity is massively misunderstood on Wall Street. This is reflected by the 130+ distortions in the Generally Accepted Accounting Principles (GAAP) that make as-reported results poor representations of real economic productivity.

These distortions include the poor capitalization of R&D, the use of goodwill and intangibles to inflate a company’s asset base, a poor understanding of one-off expense line items, as well as flawed acquisition accounting.

It’s no surprise that once many of these distortions are accounted for, it becomes apparent which companies are in real robust profitability and which may not be as strong of an investment.

See for yourself below.

Looking at as-reported accounting numbers, investors would think that investing in ValueAct Capital Management is not really rewarding.

On an as-reported basis, many of the companies in the fund are poor performers. The average as-reported ROA for the top 10 holdings of the fund is 6%.

However, once we make Uniform Accounting adjustments to accurately calculate the earning power, we can see that the average return in ValueAct’s top 10 holdings is actually 50%.

As the distortions from as-reported accounting are removed, we can see that Fiserv (FISV) isn’t a 2% return business. Its Uniform ROA is 80%.

Meanwhile, Japanese multinational cyber security software company Trend Micro (TSE:4704) looks almost like a cost of capital level return business with only 7% ROA, but it actually powers a staggering 225% Uniform ROA.

To find companies that can deliver alpha beyond the market, just finding companies where as-reported metrics misrepresent a company’s real profitability is insufficient.

To really generate alpha, any investor also needs to identify where the market is significantly undervaluing the company’s potential.

These dislocations demonstrate that most of these firms are in a different financial position than GAAP may make their books appear. But there is another crucial step in the search for alpha. Investors need to also find companies that are performing better than their valuations imply.

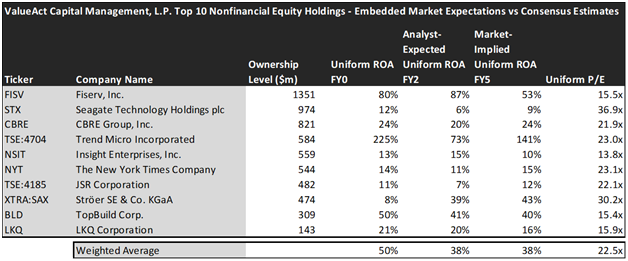

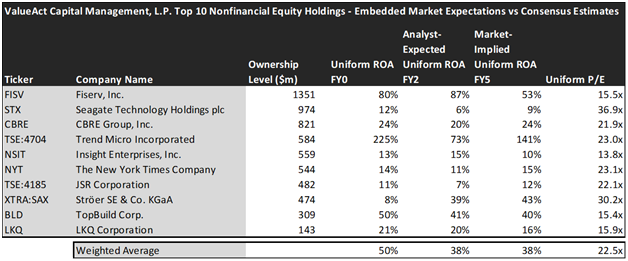

Valens has built a systematic process called Embedded Expectations Analysis to help investors get a sense of the future performance already baked into a company’s current stock price. Take a look:

This chart shows four interesting data points:

- The average Uniform ROA among ValueAct Capital Management’s top 10 holdings is actually 50% which is much higher than the corporate average in the United States.

- The analyst-expected Uniform ROA represents what ROA is forecasted to do over the next two years. To get the ROA value, we take consensus Wall Street estimates and convert them to the Uniform Accounting framework.

- The market-implied Uniform ROA is what the market thinks Uniform ROA is going to be in the three years following the analyst expectations, which for most companies here are 2023, 2024, and 2025. Here, we show the sort of economic productivity a company needs to achieve to justify its current stock price.

- The Uniform P/E is our measure of how expensive a company is relative to its Uniform earnings. For reference, the average Uniform P/E across the investing universe is roughly 20x.

Embedded Expectations Analysis of ValueAct Capital Management paints a clear picture. Over the next few years, Wall Street analysts expect the companies in the fund to see a decline in profitability and the market’s expectations are in line with analysts.

Analysts forecast the portfolio holdings on average to see Uniform ROA fall to 38% over the next two years. At current valuations, the market agrees with the analysts and also expects a 38% Uniform ROA for the companies in the portfolio.

For instance, Seagate Technology (STX) returned 12% this year. Analysts think its returns will drop to 6%. And at a 36.9x Uniform P/E, the market expects a decline in profitability as well but it’s slightly more optimistic and is pricing Uniform ROA to be around 9%.

Similarly, the building material products company TopBuild (BLD), has a Uniform ROA of 50%. Analysts expect its returns will fall to 41% and the market agrees with analysts and is also pricing a decline in returns to 40%.

Overall, ValueAct Capital Management is a well-regarded fund, especially with its activist campaigns. Additionally, it has high-quality companies in the portfolio that are built to last. However, both market’s and analysts’ expectations for the companies in the portfolio could be concerning. That is why investors should carefully consider and analyze the valuation of these companies in order to make a well-rounded investment decision.

This just goes to show the importance of valuation in the investing process. Finding a company with strong profitability and growth is only half of the process. The other, just as important part, is attaching reasonable valuations to the companies and understanding which have upside which has not been fully priced into their current prices.

To see a list of companies that have great performance and stability also at attractive valuations, the Valens Conviction Long Idea List is the place to look. The conviction list is powered by the Valens database, which offers access to full Uniform Accounting metrics for thousands of companies.

Click here to get access.

Read on to see a detailed tearsheet of one of ValueAct Capital Management’s largest holdings.

SUMMARY and Fiserv, Inc. Tearsheet

As one of ValueCapital Management’s largest individual stock holdings, we’re highlighting Fiserv, Inc.’s (FISV:USA) tearsheet today.

As the Uniform Accounting tearsheet for Fiserv, Inc. highlights, its Uniform P/E trades at 15.5x, which is below the global corporate average of 18.4x, and its historical average of 19.7x.

Low P/Es require low EPS growth to sustain them. In the case of Fiserv, Inc., the company has recently shown 5% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that, in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Fiserv, Inc.’s Wall Street analyst-driven forecast is for EPS to grow by 35% and 6% in 2022 and 2023, respectively.

Furthermore, the company’s return on assets was 80% in 2021, which is 13x the long-run corporate averages. Also, cash flows and cash on hand consistently exceed its total obligations—including debt maturities and CAPEX maintenance. Moreover, its intrinsic credit risk is 80bps above the risk-free rate. Together, these signal low operating risks and low credit risks.

Lastly, Fiserv, Inc.’s Uniform earnings growth is above peer averages, and below peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.