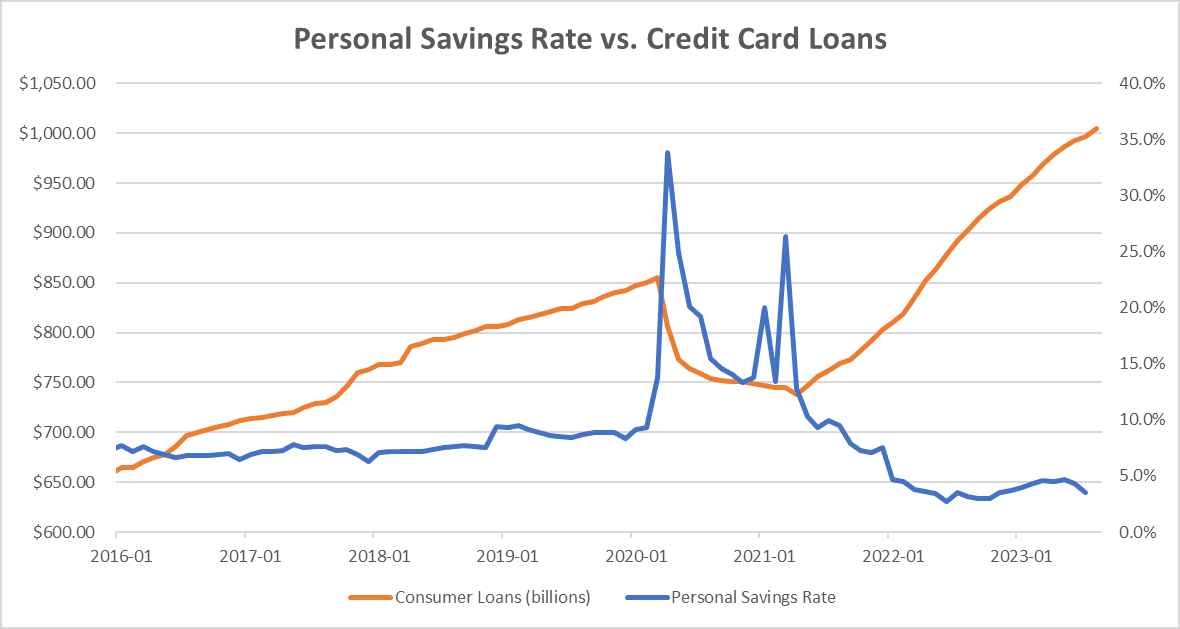

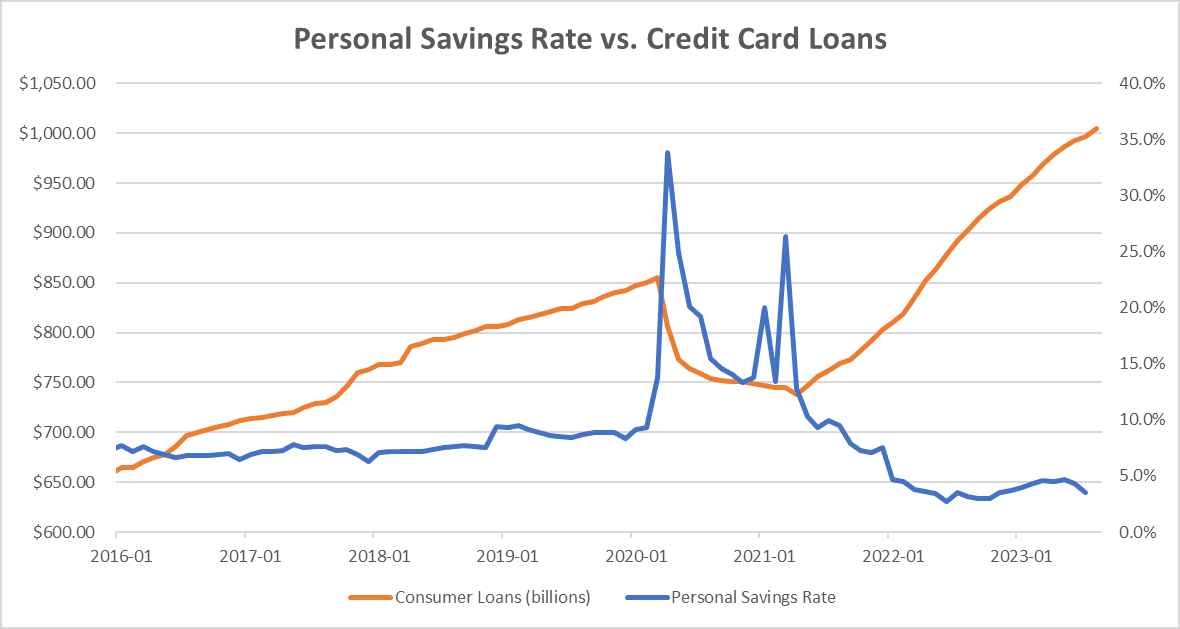

The U.S. economy received several stimulus funds, sending the personal savings rate to record levels in 2021. However, due to a post-pandemic spending spree, that cushion started to deflate. With savings rates mirroring pre-Great Recession levels and credit card debt hitting the ceiling, the consumer-driven engine of the U.S. economy is showing signs of strain. In today’s FA Alpha Daily, we’ll discuss the status of the personal savings rate against consumer loans over a period of time.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

The U.S. government threw the kitchen sink at the economy. It provided $4.6 trillion in stimulus that helped folks keep money in their accounts. As a result, the savings rate shot up like a rocket ship.

Then, spending ramped up with a vengeance. Delta Air Lines (DAL) CEO Ed Bastian asked his team to measure how much “pent up” spending in areas like food, travel, and hotels built up during the pandemic.

As it turns out, his team estimated it was about $300 billion. That’s a ton of spending, and thankfully, folks had the money to spend.

However, that spending spree can only last for so long. Since the start of 2022, personal savings rates have started falling again and credit card debt is coming back with a vengeance.

Today, savings rates are back to similar levels seen in 2005-2007 before the Great Recession, after somewhat crawling back earlier this year. In the meantime, credit card balances are at all-time highs.

Take a look.

Personal savings rate going lower means consumers’ marginal ability to spend starts to fall, and it starts to show up in the spending numbers if you look deeper.

Furniture sales are falling. Wayfair’s (W) revenue fell 3% last quarter, and La-Z-Boy’s (LZB) revenue fell 20%. The whole furniture industry is down about 2%.

Plus, consumers are getting worried about the future. As credit card debt keeps rising and savings rates fall, over 75% of Americans think consumption is going to turn negative by early 2024.

When that happens, the engine of the U.S. economy is put on ice.

Currently, investors aren’t anticipating economic disruptions. Lots of experts have delayed or entirely abandoned their recession forecasts.

However, when unexpected strains arise, it could stress the economy considerably.

This may lead to credit issues for overextended consumers and for businesses unprepared for their maturing debts in the face of dwindling consumer strength.

Experts from the Federal Reserve Bank of San Francisco suggest that the surplus savings, which have assisted consumers during the recent price surge, are likely to be depleted in the ongoing quarter.

This theme of extreme spending isn’t sustainable, especially in a market with an uncertain future and a dynamic inflationary environment.

So, we suggest exercising caution as this fall in consumer spending could mean serious problems for the U.S. economy. Brace yourself for trouble and fear in the stock market.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.