Winter is coming and Europe is in need of cheaper alternatives from the Russian coal supply to get by the season. This gives Arch Resources (ARCH), a company that produces and sells thermal and metallurgical coal, a huge opportunity to meet the demand. In today’s FA Alpha, we look into the company’s huge potential for supply deals with Europe.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

We have been trying to move to cleaner energy sources, especially with the sustainability trends that gained more importance in the last couple of years.

Alternative energy sources like solar, wind, geothermal, and bioenergy try to take the place of coal and oil.

This shift has been gaining pace since global governments have decided to take action sooner rather than later. However, Russia’s invasion of Ukraine changed a lot of dynamics.

Russia is out of the energy market, causing a supply shock. Nearly every part of the world is experiencing price increases. But it is more severe in Europe.

The U.S. is focused on how it is going to help Europe wean off on Russian natural gas to stay clean, but that is not the only way the U.S. can help.

In the short term, coal is emerging as a cheap and fast alternative that the U.S. can supply.

These developments meant surging demand for Arch Resources (ARCH). The company produces and sells thermal and metallurgical coal from surface and underground mines. It has access to more than 700,000 acres of coal land all over the U.S.

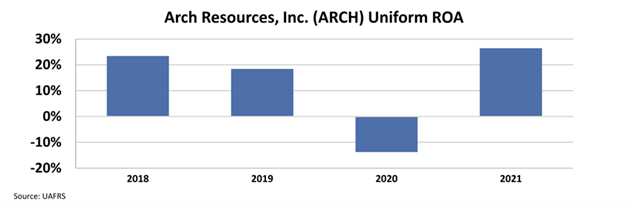

The company was already highly profitable except in 2020. Like a lot of other companies, COVID-19 affected operations negatively.

The Uniform return on assets (“ROA”) of the company dropped from 23% in 2018 to -14% in 2020 before recovering back to 26% in 2021.

The possibility of supplying coal to Europe means more customers and revenue. For shareholders of a company that is already profitable, this is amazing news.

However, we need to understand what the market thinks about the company to evaluate this as an investment opportunity. If these developments are already priced in, there would be no additional value in the share of the business.

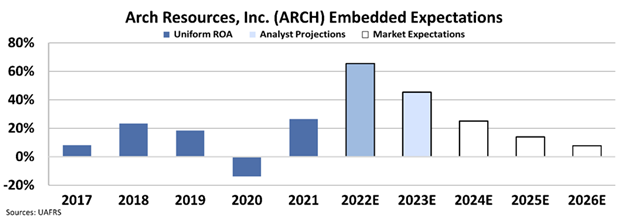

By utilizing our Embedded Expectations Analysis (“EEA”) framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow (“DCF”) model, which makes assumptions about the future and produces the “intrinsic value” of the stock.

We know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

At around $165, the market expects Arch Resources’ Uniform ROA to fall to 8%, a level not seen since 2017 except for the pandemic year. In the meantime, analysts are expecting the profitability of the company to jump to 66% in 2022 and stabilize at 45% in 2023.

Our Embedded Expectations Analysis makes it clear that there is a huge difference between the market and analyst expectations.

The market does not seem to realize the huge potential of the supply deals with Europe or understand how it would affect the business.

The high quality, impressive returns, and low valuation mean that Arch Resources is a great company to become an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

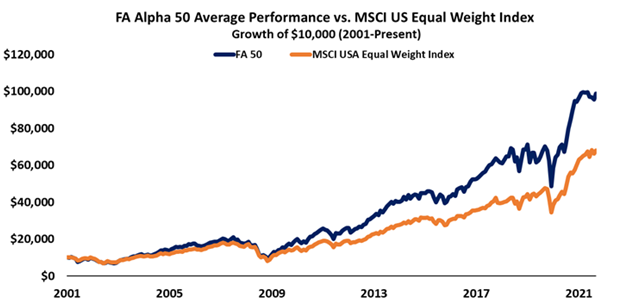

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

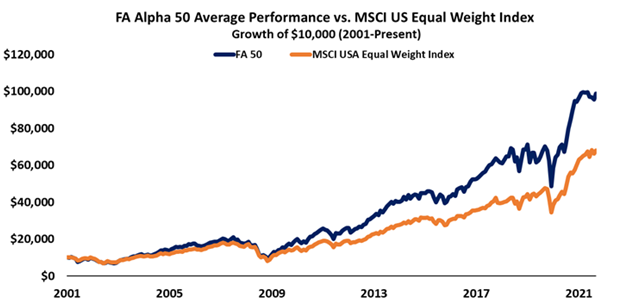

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Arch Resources (ARCH) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.