In recent years, the global energy supply has exhibited volatility due to the withdrawal of Russian oil and gas from the market, resulting in the resurgence of coal. However, rating agencies are not optimistic about the coal industry, as they believe it is a dying industry. They often give reluctant ratings to coal mining companies such as Alliance Resource Partners (ARLP), which produces and markets coal to utilities and industrial users. In today’s FA Alpha Daily, we’ll examine ARLP’s credit risk profile using Uniform Accounting and discuss whether rating agencies have given the company a fair evaluation or not.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Coal is a dying industry. It’s just dying at a much slower pace than most people think.

Global coal demand peaked in 2013 and then steadily fell through 2020. Most people thought it would never recover as the world started transitioning to cleaner energy sources like natural gas, solar, and wind.

However, post-pandemic, coal prices were incredibly cheap, and other energy sources like oil and gas were not fast to recover. It took a while for drillers to start processing oil and gas again, and then prices skyrocketed around the time Russia invaded Ukraine.

That led global coal demand to hit a record high in 2022 as gas prices remained high and the European energy crisis drove up demand for fossil fuels.

The surge in coal demand last year is a clear indication of the industry’s resilience.

And sadly, as long as coal prices are somewhat competitive with other forms, it’s going to fulfill at least some of our energy needs.

Perhaps not the greatest for the environment, but it’s good news for coal companies.

Alliance Resource Partners (ARLP) is a good example of a coal company that is benefiting from this trend. The company owns and operates several underground coal mines and a coal-loading terminal.

The company invests the bare minimum to keep its operations going, not targeting high growth levels.

For that reason, its expenses are pretty modest. Moreover, the company’s ability to generate decent cash flows contributes to its clean financial record.

Nonetheless, credit rating agencies have a different viewpoint, due to their negative outlook on the coal industry.

The company earned a “B+” rating from S&P, indicating a substantial potential for default, with an estimated 24% likelihood of bankruptcy within the next five years. This assessment places the company within the category of high-risk, high-yield entities.

Alliance Resource Partners should have a significantly safer credit rating given the company’s solid financials.

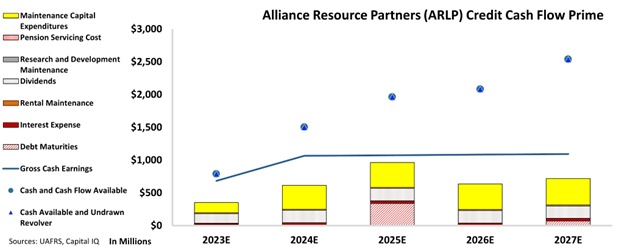

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Alliance Resource’s cash flows are more than enough to serve all its obligations going forward.

The chart suggests that the company is financially secure and is not expected to have any problems meeting its obligations over the next five years.

The company is well-positioned to weather an economic downturn thanks to its large amount of cash on hand and cash flow exceeding costs.

In addition, the expenses of the company are decently low as the coal sector does not invest heavily on capital intensive projects.

Therefore, our assessment of the Alliance Resource Partners’ financial position is that the company is unlikely to default on its debt, despite the rating agencies’ assessment.

Based on our analysis, we are assigning Alliance Resource Partners an “IG4” rating, which indicates that the company is in the safer investment-grade category and has a default probability of around 2%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Alliance Resource Partners (ARLP:USA) Tearsheet

As the Uniform Accounting tearsheet for Alliance Resource Partners (ARLP:USA) highlights, the Uniform P/E trades at 4.3x, which is below the global corporate average of 18.4x and its historical P/E of 5.5x.

Low P/Es require low EPS growth to sustain them. In the case of Alliance Resource Partners, the company has recently shown a 349% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Alliance Resource Partners’ Wall Street analyst-driven forecast is for a 23% and -1% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Alliance Resource Partners’ $19 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 3x the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 190bps above the risk-free rate.

Overall, this signals a moderate credit risk and a low dividend risk.

Lastly, Alliance Resource Partners’ Uniform earnings growth is in line with its peer averages and is trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Alliance Resource Partners (ARLP)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.