Rent payments have risen to record levels due to rising interest rates and inflation. REITs, especially residential ones, could be much more seriously affected by this than people think. In today’s FA Alpha, we learn how AvalonBay Communities (AVB) has managed its business as one of the largest residential REITs in the U.S., how its profits have been in line with its obligations and see the true risk of this business.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

2022 has been a difficult year for many asset classes with rising interest rates, geopolitical issues, supply chain problems, and inflation.

These factors affected businesses and sectors but they had a huge impact on consumers as well, as their income and purchasing power took a significant hit.

Now that both interest rates and inflation have risen to record levels in the last decade, people are concerned about their rent payments.

This situation could affect one asset class much more seriously than people think, which is REITs, especially the residential ones.

AvalonBay Communities is a great example of this as the company is among the largest residential REITs in the U.S.

The market and investors realized this risk is coming as the Dow Jones U.S. Residential REITs Index has fallen about 31% since the beginning of the year. AvalonBay stock followed the market with a 32% fall year to date.

However, credit rating agencies continue to unsee what is about to come for these businesses.

This is due to REITs’ ability to refinance their obligations as they usually have a high recovery rate. Thus, getting a pass from high credit risks.

However, these REITs saw some of the tightest cap rates they paid for some of their assets. This significantly increased their cost of debt and declined their profitability.

And Avalonbay is no different from other residential REITs that face the same problem.

In addition, with inflationary issues squeezing customers, the demand for rentals has decreased and Residential REITs may need to lower their rents to attract new tenants.

This is another factor that can put a big pressure on REITs’ profitability and it might create a much bigger weakness than rating agencies think.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand the company’s obligations matched against its cash and cash flows.

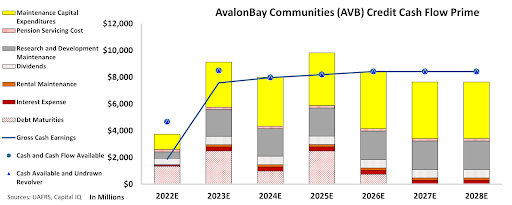

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that AvalonBay Communities’ cash flows are below its obligations going forward.

The company has near-term debt headwalls and huge maintenance capex, which cannot be covered by its cash and cash flow available.

Furthermore, if the availability in the credit markets declines, the company would have to pay much higher interest rates or they would be unable to refinance their already existing debt headwalls.

That’s certainly what Moody’s is missing. Based on its view on Avalonbay, the agency gave an A- rating for the company, which basically means no risk of bankruptcy.

However, we understand the problems that residential REITs are facing right now and gave a rating of HY1 to Avalonbay, which implies a 10.90% chance of default.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and AvalonBay Communities (AVB:USA) Tearsheet

As the Uniform Accounting tearsheet for AvalonBay Communities (AVB:USA) highlights, the Uniform P/E trades at 36.8x, which is above the global corporate average of 18.4x, but below its historical P/E of 55.1x.

High P/Es require high EPS growth to sustain them. In the case of AvalonBay, the company has recently shown a 26% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, AvalonBay’s Wall Street analyst-driven forecast is for a 222% and -42% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify AvalonBay’s $172 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2021 was below the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 110bps above the risk-free rate.

Overall, this signals a moderate credit risk and a high dividend risk.

Lastly, AvalonBay’s Uniform earnings growth is above its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of AvalonBay Communities (AVB) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.