The COVID-19 pandemic created a surge in demand for healthcare supplies, propelling many businesses in the industry. However, as the pandemic subsides, a number of these healthcare supply businesses are facing financial difficulties. Credit rating agencies have downgraded some of them, including Neogen Corporation. In today’s FA Alpha Daily, we’ll examine Neogen using Uniform Accounting to see if the rating agencies are correct in their assessment of the company’s credit risk or not.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Many healthcare supply businesses rode the wave of success in recent years, thanks to the impact of the pandemic.

However, as the pandemic gradually subsides, it is becoming evident that not all of these companies are sustainable in the long run.

The market and credit rating agencies are recognizing this shift and downgrading the ratings of these businesses to reflect the current business environment.

One such company is Neogen Corporation (NEOG).

The company primarily specializes in the production of food testing equipment, which plays a crucial role in ensuring the safety and quality of our food system.

One might assume that a company in this sector would enjoy stable returns and the reliable credit risk profile it brings.

After all, food testing equipment is an essential component of maintaining public health and preventing outbreaks or contaminations.

Yet, the reality is quite different.

In order to grow the business, Neogen acquired 3M’s Food Safety business for around $4.3 billion in 2022. At the time, the deal was worth more than the company’s own market cap.

This massive acquisition significantly increased the company’s leverage. Today, it has a $550 million debt headwall coming due in 2027.

The rating agencies saw this and quickly took action. S&P opened the company’s rating at “BB+”, meaning that it belongs to the highest tranche of high-yield basket.

Today, that credit rating actually seems to make sense.

Neogen just closed the acquisition last fall, and it’s still in the process of integrating the business.

The company has not seen a lot of benefits yet, and it has a huge headwall coming in 2027. Let’s take a look at the company’s credit risk profile with the Uniform Accounting framework and see what Neogen did wrong.

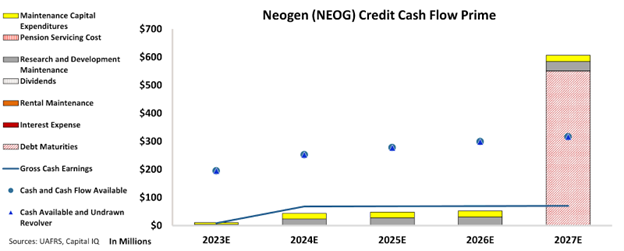

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Neogen’s cash flows are not enough to serve all its obligations going forward.

So far, it doesn’t look like the combined company will be able to generate enough cash to service the entire headwall.

That means over the next few years, it’ll have to work to integrate the acquisition, or it’ll need to refinance.

A headwall like this doesn’t completely scare us away. It still has time to figure things out. That said, we think that rating agencies are right this time as even a broken clock is right twice a day.

That is why we are rating the company “XO”. This rating places the company in a thin line between the lowest tranche of the investment grade and the highest tranche of the high-yield basket.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Neogen Corporation (NEOG:USA) Tearsheet

As the Uniform Accounting tearsheet for Neogen Corporation (NEOG:USA) highlights, the Uniform P/E trades at 196.2x, which is above the global corporate average of 18.4x and its historical P/E of 84.7x.

Low P/Es require low EPS growth to sustain them. In the case of Neogen, the company has recently shown a 14% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Neogen’s Wall Street analyst-driven forecast is for a 109% and 280% EPS shrinkage in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Neogen’s $18 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 3x the long-run corporate average. Moreover, cash flows and cash on hand 6x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 110bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, Neogen’s Uniform earnings growth is below its peer averages and is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Neogen Corporation’s (NEOG) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.